Vantage partners with FinaCom for external dispute resolution and up to €20,000 protection per client

Vantage has joined the Financial Commission (FinaCom) as a member, thus gaining access to the external dispute resolution body’s range of services and membership benefits, including the unbiased resolution process facilitated by FinaCom, and the protection of up to €20,000 per client, covered by the FinaCom’s compensation fund.

The international multi-asset broker offers up to 500:1 leverage on a wide range of CFDs on Forex, Commodities, Indices, and Shares via its proprietary Vantage app, MT4, MT5, ProTrader, and WebTrader.

Users also have access to a social trading offering that is comprised of ZuluTrade, MyFXBook Autotrade, DupliTrade, and its proprietary Vantage Social Trading.

FinaCom helps FX and Crypto brokers and their clients with disputes

FinaCom is an independent self-regulatory organisation and an external dispute resolution body for businesses operating in the forex and contracts for difference (CFD) markets.

In case a user enters into a dispute with Vantage, the partnership with FinaCom will improve the experience for both parties by ensuring an unbiased resolution and protection of up to €20,000 per client.

Marc Despallieres, Chief Strategy & Trading Officer at Vantage, said: “We’re extremely delighted to have partnered with the Financial Commission. We value our clients’ feedback and their trading experience with us, and we are pleased to have the support from a highly regarded external dispute resolution organisation like Finacom. At Vantage, we take pride in building a business that is committed to doing what’s right, and being a trusted, regulated organisation that our clients and staff can be proud to be a part of.”

Financial Commission reported record number of complaints in Q1 2022

The Financial Commission started out by providing a new approach for traders and brokers alike to resolve any disputes which arise in the course of trading electronic markets such as Foreign Exchange, and then expanded into CFDs and related derivatives. Now, FinaCom also certifies technology platforms used for trading.

FinaCom has recently approved several new broker members, including TMGM, Pepperstone, Fullerton Markets, Bold Prime, Axiory, DegerFX, Inveslo, and IC Markets.

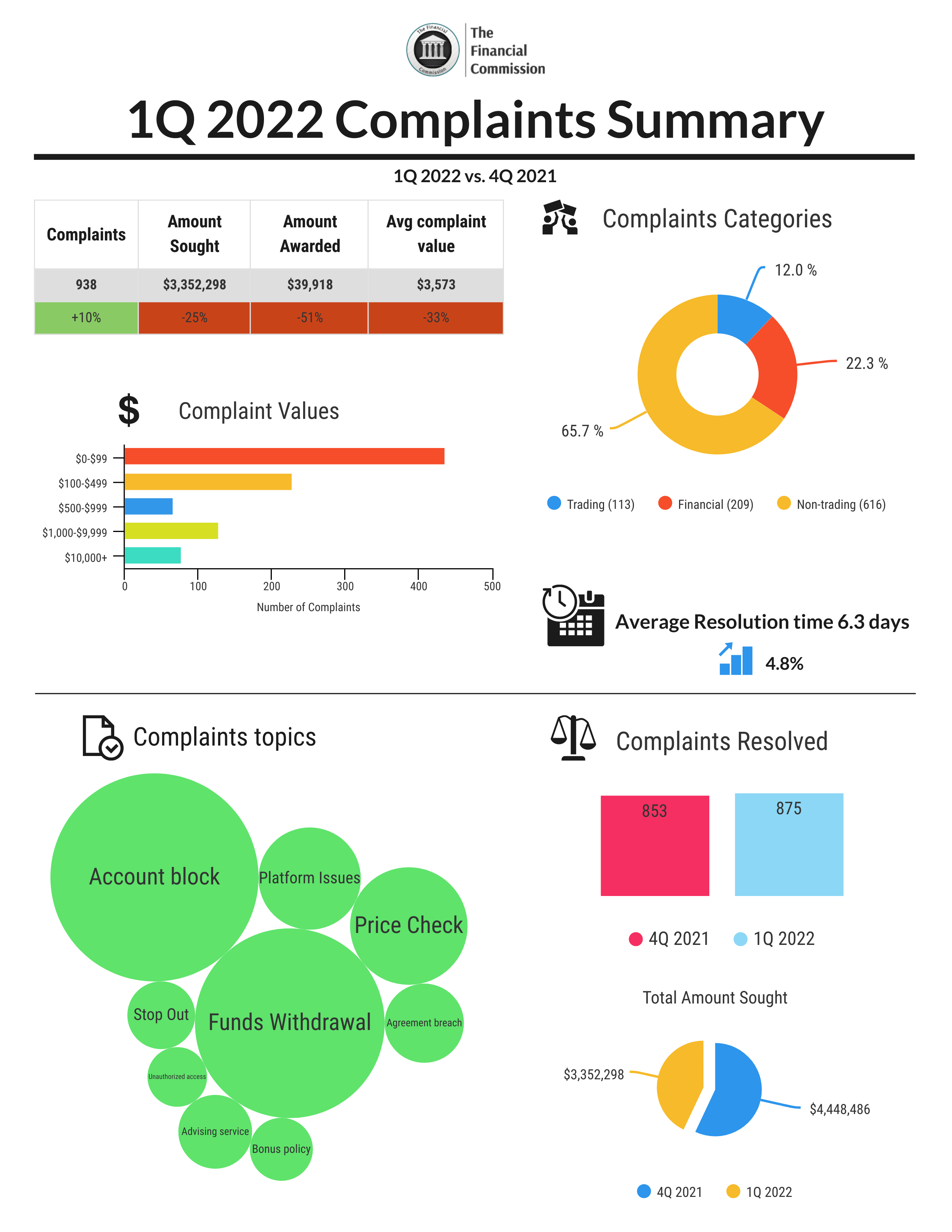

In April, the Financial Commission reported a record of 938 complaints in the first quarter of 2022, an increase of 10% QoQ as compensation sought from broker members rose 57 percent to $3.35 million.

The enforcement report revealed that the majority of complaints were related to non-trading issues ,with 65 percent of the total, while trading related disputes accounted for 12 percent and financial claims were 209 or 22 percent. The most popular topics for complaints dealt with funds withdrawal agreement breach, price check and account blocking.

Other highlights show the amount of total compensations awarded to broker member clients in the first quarter decreased to $39.918. Further, the value of the average complaint dropped 33 percent to $3,573.