Vast majority of UK consumers do not know what “cryptocurrency” is, survey shows

Only 8% of all cryptocurrency owners completed ‘deep research’ before purchasing, with 16% doing no prior research.

The UK Financial Conduct Authority (FCA) has today published two pieces of research looking at UK consumer attitudes to cryptoassets. The research includes qualitative interviews with UK consumers and a national survey.

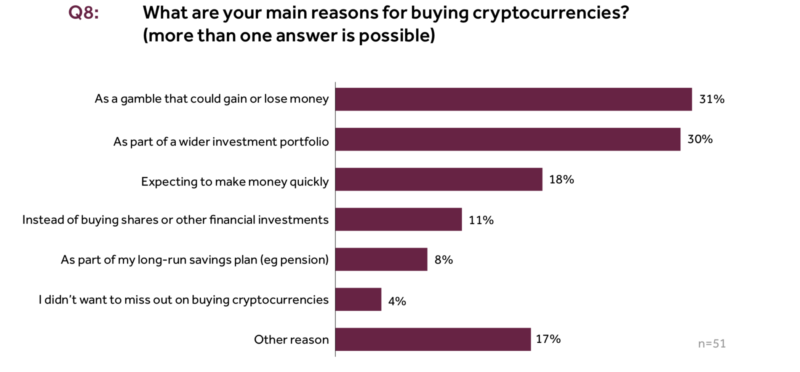

The qualitative research indicated some potential harm, including that many consumers may not fully understand what they are purchasing. Despite this lack of understanding, the cryptoasset owners interviewed were often looking for ways to ‘get rich quick’, citing friends, acquaintances and social media influencers as key motivations for buying cryptoassets.

Both the survey and qualitative research found that some cryptoasset owners made their purchases without completing any research beforehand.

Findings from the survey show 73% of UK consumers surveyed do not know what a ‘cryptocurrency’ is or are unable to define it. Those most aware of them are likely to be men aged between 20 and 44. The FCA estimates only 3% of consumers surveyed had ever bought cryptoassets. Of the small sub-sample of consumers who had bought cryptoassets, around half spent under £200 – a large majority of these said they had financed the purchases through their disposable income.

Christopher Woolard, the FCA’s Executive Director of Strategy and Competition commented:

“The results suggest that although cryptoassets may not be well understood by many consumers, the vast majority don’t buy or use them currently. Whilst the research suggests some harm to individual cryptoasset users, it does not suggest a large impact on wider society. Nevertheless, cryptoassets are complex, volatile products – consumers investing in them should be prepared to lose all of their money.”

The FCA has previously warned that cryptoassets, including Bitcoin for instance, are highly volatile and risky. Many tokens (including Bitcoin and ‘cryptocurrency’ equivalents) are not currently regulated in the UK. This means that the transfer, purchase and sale of such tokens currently fall outside our regulatory remit. Hence, it is unlikely that consumers will be entitled to make complaints to the Financial Ombudsman Service or protected by the Financial Services Compensation Scheme if things go wrong.

This consumer research is part of a series of initial pieces of work on cryptoassets, continuing the FCA’s work in this area as outlined originally by the UK Cryptoassets Taskforce. The regulator has recently published the Cryptoassets Perimeter Guidance Consultation – this consultation is open for responses until April 5, 2019.

The FCA is set to publish a consultation on a proposed ban of certain cryptoasset derivatives to retail investors later this year. HM Treasury is also exploring legislative change to potentially broaden the FCA’s regulatory remit to bring in further types of cryptoassets.