Video economic calendar run by TV expert becomes retention and engagement tool – We meet with its creator

Customer engagement is a primary consideration for many FX brokerages. What if there was a video economic calendar, created by an expert in commercial television production. Now there is, we meet its creator

Innovative new entrants to the ancillary service provision sector of the retail FX industry are often welcomed by brokerages for whom the conundrum of ensuring longer customer lifetime value, greater retention and customer engagement and thus lowering the cost of acquisition and getting more of a return on initial outlay is a vitally important facet of every day business.

Whether educational tools, signals or methods of facilitating interaction between traders, the support industry that provides such services has become a vital one.

Now a further take on this ethos has entered the arena, that being Upsell Media, a firm based in Cyprus and operated by Danish partners, led by Christian Jensen.

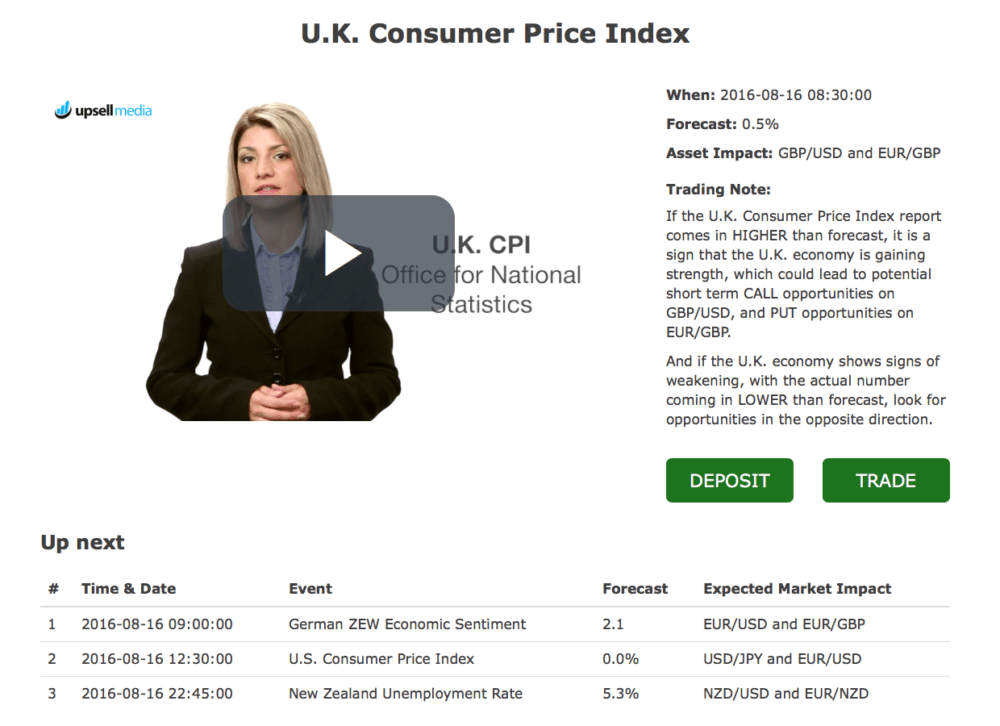

The company provides an economic calendar in the form of a video which aims to boost deposits and trading volumes of retail customers. It began by providing service to binary options firms, however the company is now preparing to enter the retail FX business by providing its video economic calendar to FX brokerages.

Today, FinanceFeeds spoke to Christian Jensen, the company’s CEO, who spent 12 years in televised journalism and has now brought this audio visual expertise to the trading business.

What is special about offering video analysis for FX and upon its launch, how will it differentiate the way that users look at these services as it is 3 dimensional?

If you’ve been in the industry for a while, you may have forgotten quite how daunting FX is for a newcomer. New clients are bombarded with masses of information, trading bonuses they don’t quite understand, e-books, strange terminology, and all the while their broker is emailing and calling, trying to get them to deposit and trade their hard earned money.

The fact that they signed up for an account is evidence enough that they are ready to take action. They just need the answers to three questions: What asset should I trade? When should I trade it? Is this asset’s price likely to go up or down?

Video is the fastest way to convey that information. It’s now the go-to medium for self-study. If you want to clear the RAM on your phone, learn how to start a fire using just a couple of sticks, in fact anything that requires more than a two or three sentence explanation, you are going to look for the answer on YouTube or some other video source.

Upsell Media produces thoroughly-researched, well-scripted video tutorials that answer these core questions, and automatically presents the answers at the exact moment a client is ready to take action on a forex trading platform.

How will the service be capitalized?

Myself and my partner decided from the outset that the best way to grow our business was to help the brokers grow theirs first.

We didn’t want to bundle 10 or 15 languages together, and ask that everybody pays a flat fee. That didn’t make sense to us. If you are a start-up broker with sales and customer support in English and Italian, why should you have to pay for a retention tool in Chinese?

So we set up Upsell Media to work on a very simple subscription model. If you can only service English and Italian clients, just subscribe for those two languages. If you are thinking about expanding into Germany, give us a call and we’ll set up a one-month free trial of the German language service.

You can add or remove languages whenever you want, and are only billed for what you use. We don’t want to lock anyone into paying for a service they don’t need.

Brokerages need to consider lifetime value of clients these days, as acquisition costs are at an all-time high. You have pioneered this in the Binary industry where client lifetime value is very short indeed. How will this transfer to the FX industry as a valuable retention tool?

You are exactly right. Most FX and binary brokers are locked into a dangerous cycle of overpaying for media and IBs, while at the same time doing very little to maximise the LTV of their existing clients.

Our FX product, just like the one we made for binary options, is all about transitioning enthusiastic newcomers into confident investors who can identify profitable trading opportunities and take positions on their brokers’ platforms.

To do this we had to move away from the existing models. They are either too vague – educational videos about investing in general, or too specific – daily or weekly bulletins that presume too much of a new trader.

So we made a video economic calendar that always gives FX and binary options investors easy-to-understand, actionable trading information about every major economic event, delivered as they happen.

It’s a win-win for everybody. The FX client’s progression from interested newcomer to confident solo trader is expedited, the broker quickly gains engaged customers who deposit more, trade more, stick around for longer, and require less costly servicing from retention teams.

New media such as video, geotargeting and apps has taken other online industries by storm. Why has it been so slow in this business despite the level of technological advancement in our industry.

It has been slow, but right now we are seeing a lot of new technology companies and innovative platform providers stepping into the industry.

I have had a lot of conversations with key people in many binary and forex brokerages and they all say the same thing – the cost of acquisition is now approaching a tipping point, and they are pushed to fundamentally change the way they do retention.

The most cost-effective form of retention is with automated solutions, and that’s what is driving technological advancement in FX today.

Where will you innovate the videos further as FX continues to evolve

I think the very nature of our product is already geared for the medium to long-term future of the industry. In binary, the clampdown on hard sales is already driving the brokers to automated retention tools like ours. Will the same happen with retail forex? It is certainly a possibility.

Even if the status quo is maintained, FX brokers are already pushed to rethink their acquisition and retention strategies. High CPAs, low LTVs, and short client lifecycles are not the recipe for long-term growth in any industry, and these diminishing margins will inevitably lead to leaner, more automated operations in the future.

Christian Jensen is the CEO of Upsell Media, a technology company that produces a video economic calendar for the electronic trading industry.

Christian has managed television production and technology companies since 2004.