Virtu estimates net trading income to be $460-$474m in two months to end-May 2020

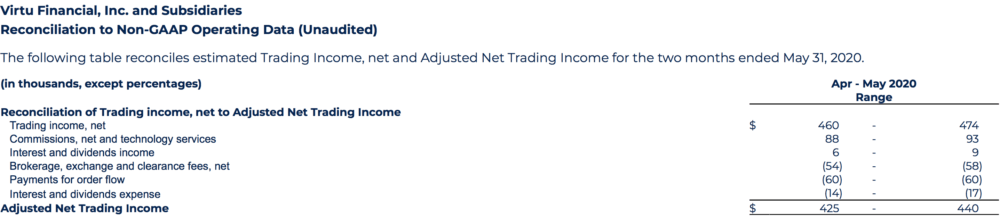

Adjusted Net Trading Income for the first two months of the second quarter of 2020 is expected to be between $425 million and $440 million.

Virtu Financial Inc (NASDAQ:VIRT) today announced preliminary estimates of its top line results for second quarter to date through May 31, 2020.

On a preliminary estimated basis, Virtu expects its results of operations for the two months ended May 31, 2020 to reflect:

- Trading Income, net between $460 million and $474 million; Adjusted Net Trading Income between $425 million and $440 million;

- Average Daily Adjusted Net Trading Income between $10.37 million and $10.73 million per day.

Let’s recall that Virtu marked a steep rise in revenues in the first quarter of 2020. Total revenues for the first quarter of 2020 increased 176.6% from a year ago to $1,004.1 million on the back of heightened levels of volatility, bid-ask spreads and trading volumes across global markets and asset classes due to the COVID-19 pandemic.

Trading income, net, increased 211.6% to $802.5 million for the first quarter fo 2020, compared to $257.5 million for the same period in 2019. Net income totaled $388.2 million for the first quarter of 2020, compared to a net loss of $13.6 million in the prior year quarter, which included costs related to the ITG acquisition.

Basic and diluted earnings per share amounted to $1.80 in the first quarter of 2020, compared to a loss per share of $0.07 for the same period in 2019.