Visa and Mastercard enabling companies with malintent to take client funds – Why?

Those famous acronyms that now proliferate the compliance department of every company: KYC and AML – Know Your Client, and Anti-Money Laundering. These two procedures are two of the most scrutinized by regulatory authorities, and are at the top of the list of priorities of today’s retail FX brokerages when assessing the suitability of their […]

Those famous acronyms that now proliferate the compliance department of every company: KYC and AML – Know Your Client, and Anti-Money Laundering.

These two procedures are two of the most scrutinized by regulatory authorities, and are at the top of the list of priorities of today’s retail FX brokerages when assessing the suitability of their services to a new client, and to liquidity providers and prime brokerages when extending services to retail brokerages.

Are the funds secure? Is the client, whether a small to medium sized brokerage or a retail end user, au fait with the service that is being provided?

Very important indeed – which is why it is perhaps a paradox that whilst reputable brokerages and service providers are taking these matters very seriously indeed, merchant services providers, which are known for their stringent risk management and customer protection policies, are allowing less than reputable companies which are either unregulated, have ties to nefarious individuals, or have had their regulatory license removed, to take funds via credit card with no questions being asked.

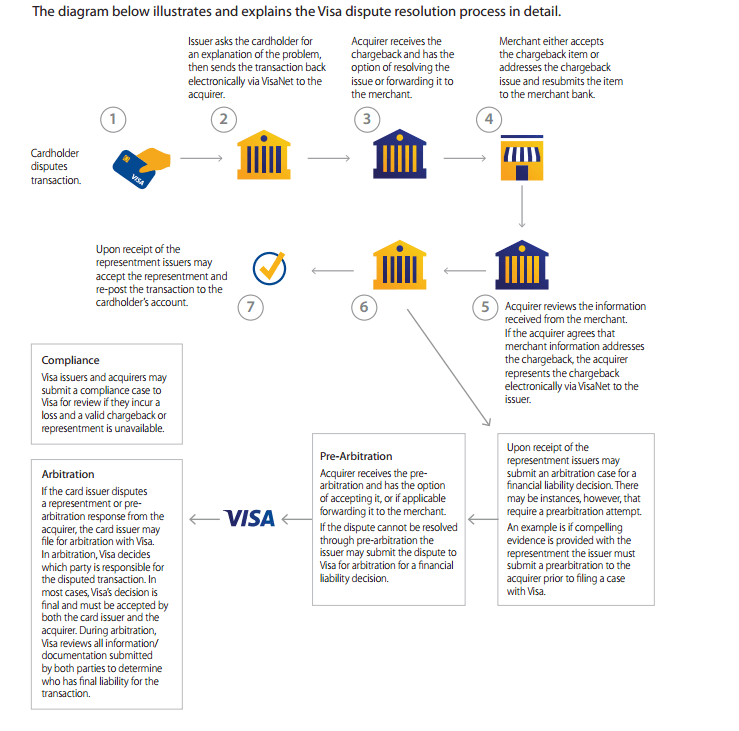

Looking at the chargeback policy which is set out by Visa, there is a very well established process which merchants must follow in the event of a customer complaint, as follows:

In the United States, the use of credit cards for funding retail trading accounts was outlawed by the National Futures Association and the Commodity Futures Trading Commission, meaning that bank transfers are the only means of funding accounts, however the authorities in the post Dodd-Frank Act US are very strict and companies must make daily reports.

Additionally, should something go awry, the US authorities make public investigations into the affairs of companies, and often subject them to very punitive litigation.

Whilst other regulators are catching up, an often overlooked point is how merchant services companies effectively enable the loss of customer money, despite very well documented customer protection policies.

When facilitating the provision of other services, Visa and Mastercard are often very quick to act. Had bad service at a hotel? Cellular company made a mistake on the invoice and is unreachable by telephone? Got caught out whilst abroad? Car dealer overcharged for a routine service? No problem – a quick call to Visa or Mastercard and all is well.

Often, Visa or Mastercard will remove the merchant services terminal from small companies that have reached a certain number of chargebacks.

This is not the case for retail FX firms though.

The litany of complaints from retail customers that proliferate the internet forums complaining about withdrawals amounting tens of thousands of dollars and high profile news published about specific companies has not provoked any action from the merchant services firms.

Indeed, services are still being provided to unregulated brokerages in offshore jurisdictions such as the British Virgin Islands and the Seychelles, where unsuspecting customers can easily send funds. The merchant services firms do not check the operating model of any of the brokerages that they supply to and it is not part of the standard procedure.

Does the company using merchant services operate on a profit and loss model, effectively making its revenues from the losses of customers?

Does the company using merchant services have sufficient capital to pay withdrawals should customers wish to take funds from their trading accounts?

These are two questions that are omitted from the merchant services firms’ checklist.

Due to the very generic nature of merchant services provision, the entire system is not geared toward the electronic trading industry at all.

Some recent examples include Aviv Talmor’s arrest in Israel in connection with a $12 million dollar fraud with unregulated brokerage UTRADE, and the high profile media campaign that centers around introducing brokers and retail clients of IronFX.

Indeed, the clients of IronFX which are based in China have little recourse because UnionPay operates on completely different parameters and theoretically it is against Chinese rulings to send funds outside China, however the recent concerns with regard to IronFX’s operations in other jurisdictions, is a case in point.

In that particular circumstance, senior government officials in Cyprus are now calling for action, but the merchant services companies remain silent.

Currently, customers remain out of pocket, with the merchant services firms having not intervened and cut their provisioning when this began to come to light.

FinanceFeeds was contacted today by a client of a small brokerage in Cyprus which had its license suspended by CySec recently.

“In around October 2015, I was cold called and had an account with the company in question, and invested around $40,000 which was at one point $85,000 due to profit I had made” explained the client.

“This remained until I mentioned withdrawal and within a 3 week period there were losses recorded of $43,000 on wheat and gold, which broke down as $21,000 ,Gold $17,000, and $18,000 loss on Euro/Dollar along with a few other losses around the $3000 to $6000 mark needless to say when I was all maxed out on my credit cards had no more margin/leverage money to throw at the losing trades the account burnt out and I was left with nothing but a big headache that has not left me to this day.”

The trader continued to explain “I had used Visa to pay the brokerage so I went to Visa and explained how they had done this from the initial cold call to the persistent phone calls all day and night demanding more funds for my account when it was in free fall, until they just blew it all.”

“Two days ago the $16,500 that Visa returned to me was redebited from my account” he said.

“So I am back in the same mess as I was in January 2016, over $40,000 out of pocket and on the verge of losing my business” said the trader.

Raising the point about merchant services companies, the trader explained “I don’t know why Visa does not see that there is huge fraud being committed by these companies. It is staring them in the face as there are pages and pages of individuals on review sites who have had there savings wiped out by companies with malintent.”

“All or at least half of customers have used Visa or Mastercard to fund their accounts, therefore why don’t the credit card companies see that too and the connection to complaints and refund requests? Everyone cannot be wrong. Can we all be wrong and companies like the one I used working in the best interests of their clients be right?” asked the trader.

In conclusion, whilst the vast majority of bona fide companies are very cautious when it comes to ensuring that their clients are suited to the services being provided, and vice versa, and the vast majority conduct their compliance adherence with aplomb, those which do not are able to benefit from this massive loophole.

It is a loophole that is overlooked because many do not consider the merchant services provider to be a part of the process, rather a vehicle to deposit to a company which should be responsible for its own actions and accountable should something go wrong.

Action by merchant services companies in this direction would not only reimburse thousands to customers that have fallen foul of nefarious entities, but would also put a stop to their very existence because the merchant accounts would be closed.

This would benefit the entire retail FX industry and help the great many good companies to uphold their own well-deserved good reputation and make their ability to bring on board new clients much easier as customer confidence would be so much higher without the small minority of bad apples making it difficult for the good people of this fine industry.