Volatile market conditions drive TP ICAP’s revenues higher in Q1 2020

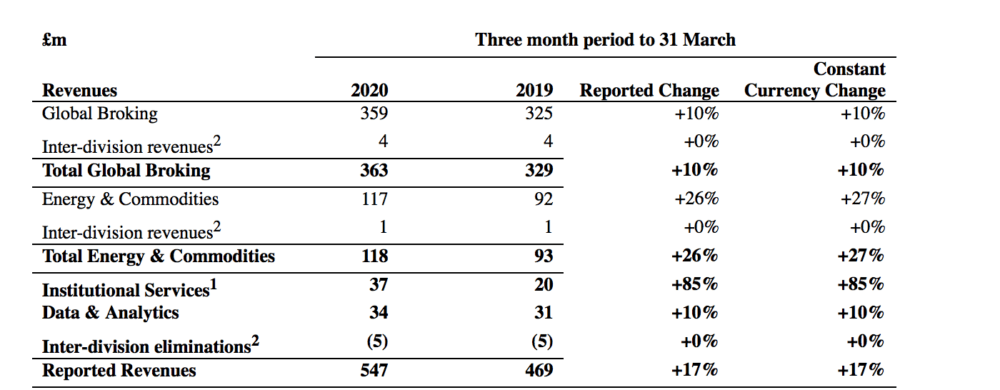

Revenue in the first quarter of 2020 was £547 million, up 17% from the year-ago quarter.

TP ICAP PLC (LON:TCAP) today issued a trading update in relation to the first three months of 2020. Despite a very challenging macroeconomic backdrop, the Group has reacted quickly to protect the interests of all stakeholders and has delivered robust financial performance.

Revenue in the first quarter of 2020 amounted to £547 million, up 17% from the equivalent period last year. The company attributed the revenue growth to higher client volumes due to the volatile market conditions caused by the COVID-19 pandemic at the end of the period.

Global Broking revenue grew 10% in the first quarter of 2020 from the corresponding period last year on a reported basis (10% on a constant currency basis) with all asset classes demonstrating strong revenue growth. Rates and equities showed particular strength capitalising on higher volatility and volumes.

Energy & Commodities revenue grew 26% in the first three months of 2020 relative to the equivalent period last year on a reported basis (27% on a constant currency basis) as a result of favourable macro conditions amidst increased volatility.

Institutional Services revenue jumped 85% year-on-year in the first quarter of 2020 on a reported basis (85% on a constant currency basis) as it benefited from new hires, on-boarding new clients and increased client appetite.

Data & Analytics revenue grew 10% in the first quarter of 2020 on a reported basis (10% on a constant currency basis) against a strong prior year comparative period as the business continues to benefit from strategic initiatives to launch new products and deepen its client relationships.

TP ICAP notes that it regularly assesses the strength of its financial position and liquidity under different market scenarios and stress scenarios. These assessments have been updated to include both current market conditions caused by COVID-19 and further extreme stress scenarios.

The Group believes that it has a strong balance sheet, sufficient cash resources and access to incremental liquidity under the various adverse scenarios assessed.

As at the end of the first quarter of 2020, £250 million of the Group’s Revolving Credit Facility, which matures in December 2022, remains undrawn. This facility remains available to meet the Group’s liquidity needs and this can be used for general corporate purposes.

The Group has no bond maturities until 2024.