Web3 startup PIP integrates with Binance ecosystem

Web3 payment provider PIP has announced integration with the Binance ecosystem, which allows the firm to vastly develop and propose needed products and improvements that are worthy of competing with others chains.

This milestone involves support of Binance Coin (BNB) and Binance USD (BUSD) stablecoin-based transactions for Binance Smart Chain (BSC) users. PIP will also benefit from access to Binance’s sizable existing audience of cryptocurrency users.

Moreover, the combination of the PIP browser-based extension with the Binance ecosystem brings another extremely important advantage, lower gas fees. The extreme rise of Ethereum network gas fees is pricing out some of our most valuable Web3 applications.

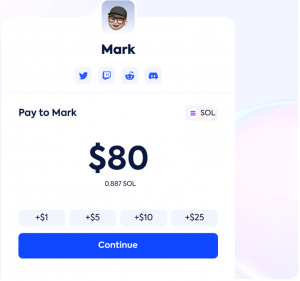

Built on Solana, PIP connects scalable crypto-protocols with common social platforms like Twitter and Facebook. Creators and service owners can seamlessly transact value through integrating the PIP button into their website and unlock an extra revenue stream. The process can be also done without a single party’s permission or a high intermediary fee.

With extension, the BSC integration will help empower the vision of microeconomy by breaking down economic barriers between billions of social media users through its inclusive financial services.

The platform’s PIP Extension product will also provide the advanced service that bridges the Web3 ecosystem between a range of connected Web2 social media platforms.

According to PIP’s CEO and Co-Founder, Jeff Baek: “We believe that PIP will help $17 billion BUSD to expand beyond a trading pair to become a means of global payment, flouring micropayment economy.”

PIP is the developer of the PIP Button, a startup that acts as a Web 3.0 bridge connecting the blockchain world to the web 2.0 platforms. More importantly, Pip offers a neutral platform that allows interoperability among social platforms like Twitter, Reddit, Discord and Twitch when it comes to crypto activities.

Eventually, the support for BNB and BUSD tokens will be extended to PIP.ME and PIP Button. PIP.ME is a customizable Web3 profile link that can be shared to accept payments, display or market user-owned NFTs, and also share content.

Since closing a seed-round investment from Alameda Research, Coinbase Ventures, CMS Holdings, Galaxy Digital Hong Kong, and Genesis Block Ventures, PIP has initiated further plans to add other consumer-focused Web3 services to its lineup. Moreover, PIP intends to add support for other blockchains, tokens, and social media platforms as part of its roadmap over the forthcoming quarters.