Weekly FX Recap: Ascending the Incan Citadel; Machu Picchu

Everybody seems to live but not to accept how they go over the experience, some embrace life walking over tradition and yet, a few may excel and enjoy it.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

27 years ago looking at both in the middle of the living room, a future for us is indeed a thought worth its value in gold’s current value; a price far from our reality as tea, bread and butter cover a table for three. All we want at that moment is to survive; isn’t that what most people do? Everybody seems to live but not to accept how they go over the experience, some embrace life walking over tradition and yet, a few may excel and enjoy it.

Late has no room when you visit Lima, Peru. Among all the exotic and hectic cities in the world this one is ready to teach you a life changing lesson, not only a delicious taste in every bite but the opportunity to open your eyes, soul and heart to discover once again how much you are missing every minute just because you decide to live as a slave.

There are many positive things to mention about Peru’s vibrant and dynamic population, those characteristics Goldman Sachs noticed a long time ago as they are adding massive real estate investments to their books; what do they know or expect that you haven’t pay attention?

1,285,215.6 km2 is the country’s land extension. Not even a month serves to get to every important corner. To make it worse, your job (Just above broke) probably allows only 15 days; if you are lucky. So, quickly the adventures begin towards what 70% of visitors want to experience; the Incan Citadel.

Bus? Not an option, so you take another plane. Once in Cusco, the Rome of America, the altitude teaches you to be patient and control yourself. No rush, 3,400 meters above sea-level isn’t going to go easy on anyone. Every step shows more about a unique world not seen. It’s time to stop and meditate about your present.

At 4:00 AM ready to rock you arrive at the train station to jump on Inca Rail’s premium economy wagon. Their staff may surprise you as they are educated and always willing to make things better for you to have a flexible three hours and a 30-minute ride to Aguas Calientes which is the World’s Heritage growing touristic town.

Rural and peaceful views are all over the way, and you have no other option to enjoy them. By the time you reach the town, another 7,000 free souls are waiting for two hours to get on the bus to start their climb.

It’s noon, and the schedule no longer fit your plans. Then, walking to the entrance several tour guides approach offering stories and facts where you only need a moment to contemplate a majestic view; words are unnecessary.

Machu Picchu is indeed one of the world’s beautiful gems. It is going to teach you not to judge, not to focus on the now but to understand the past that created a now. After it, your values are stronger, and your desire to protect your identity may grow never to forget who you are.

Time to open your eyes and look up; there is so much more see and experience.

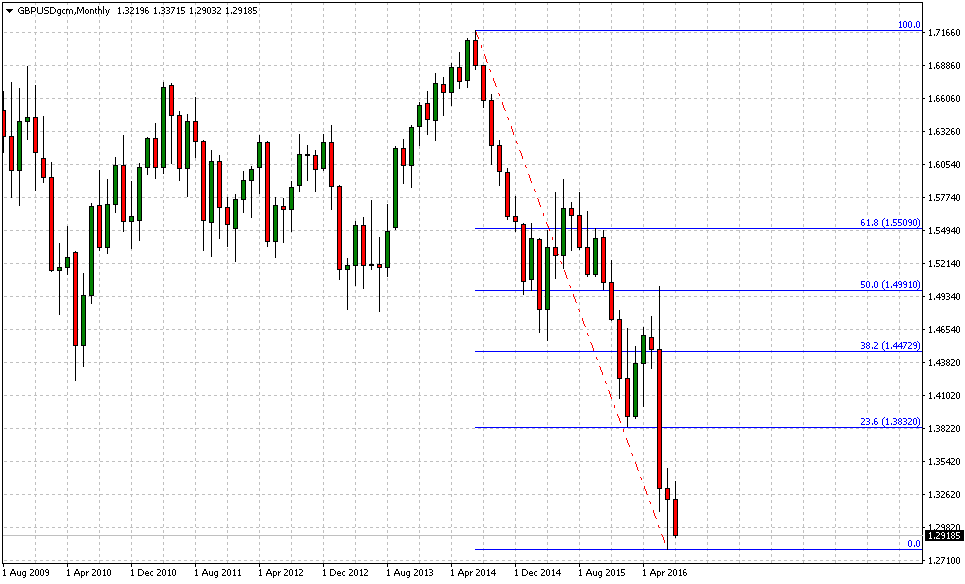

GBPUSD: Deal with it! It’s not coming back until 1.2418 or lower.

Monthly – Resistance: 1.27960 Support: 1.33715

The industrial revolution is gone, and yet we keep playing the game with some old skills that serve no purpose. Why is that? What I am betting is a consequence of a boring old school system giving points for being good boys. Pretty much, go to school, get a job and start a family. Just imagine if we all follow that model to the “T” then no Facebook, No Apple, No Uber, No Airbnb and No Forex industry.

Some join the industry because we pay well even ordinary individuals and poor structure FX Brokers make more than two pennies. However, there is a group of devoted, smart and hardworking units pulling towards something more than just the disgusting paycheck.

We can argue all day long about these ideas, but I just prefer to elaborate on why the British Pound may crash some more and you should not be surprising because all you need to understand its pattern behaviors is common sense.

Since 2009 on the monthly chart, you can see how it crashes and retraces, it tends to let go something around +2500 pips from the top to its next historical low. This time is not going to be different, similar to the EUR/USD +18 months’ range, you can expect the Pound to trade all the way to 1.2418 that’s why the “Big Money” pushed prices close to 1.5000 before Brexit, to avoid a one-way trip to 1.2000 which is precisely where the exchange rate should be right now.

This bearish range may last at least 2 years giving enough time for the UK authorities to negotiate better deals or cut a few; it’s time to work with the best partners. In addition, data may be optimistic giving a break to the Bank of England, and if things work as expected, they will be the first Central Bank in start normalizing interest rates.

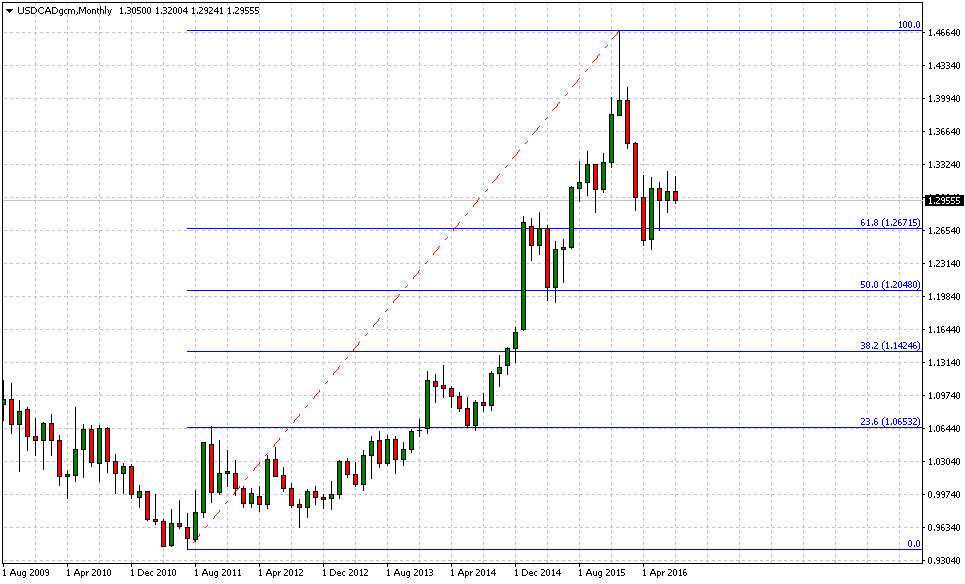

USDCAD: Oil above $50.00?

Monthly – Resistance: 1.32593 Support: 1.24620

Long-term we must put on the table a tough question: Who needs oil at $100.00 a barrel? As I have mentioned before, demand and supply play a role in this structure. When you mix high yield bonds and massive debt to boost any particular industry you have to expect chaos because players overspend, overuse, and excess in everything you can imagine, to picture a more than profitable outcome.

Sometimes, it seems it is never going to end; but it does. On one hand, interest rate hikes promised based on reliable unemployment figures, later we understand is not that easy even with average data. Also, short-term debt refinance and black accounting to help troubled drilling firms shine like gold.

Again, what for? Without a core change or real adjustment to the new growth models, saving mediocre companies and organizations is a waste of time.

USDCAD may bounce short-term in a bullish range from 1.26661 to 1.33240; that should be enough bait to capture technical traders into a bullish setup which eventually fails, and the exchange rate collapses towards 1.24346 and trades all the way to 1.20436.

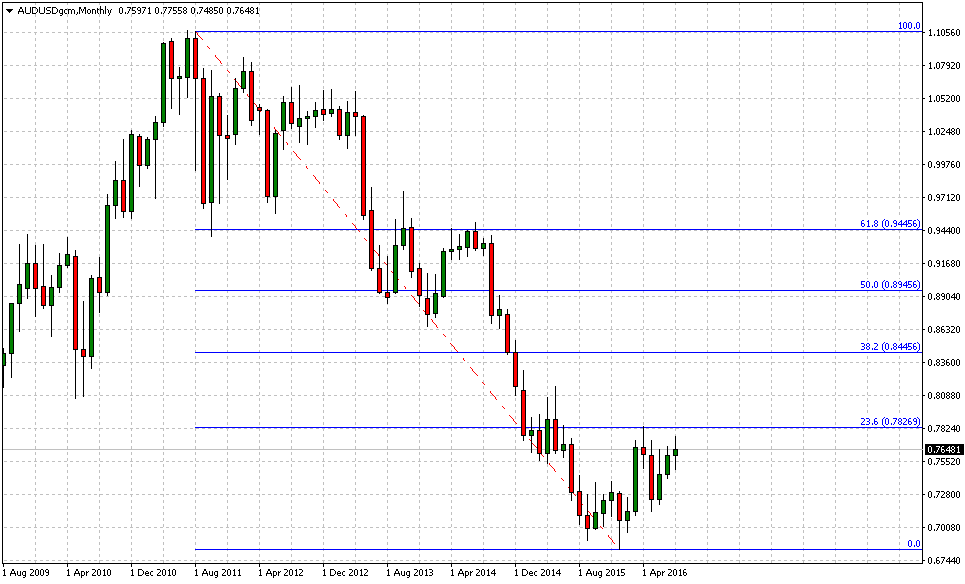

AUDUSD: 181 pips before hitting the fan.

Monthly – Resistance: 0.78344 Support: 0.71450

On the Technical View, it’s evident we are in a bullish channel with healthy retracements. However, this party is almost over for the bulls. But! There are some considerations to keep in mind:

- Australia is not doing that bad; China has been behaving to avoid market chaos.

- Forget about interest rate hikes in the US at least until 2017. They may come out with a joke before then end of 2016, but it’s unlikely.

- China is not going to stop the yuan’s devaluation process, and that’s the real threat to the Aussie.

Outside these factors, chances to see the AUDUSD exchange rate trading around 0.80 cents are slim. If we were in the expansion cycle, yes, but we are not…we are just surviving and adjusting to the downside.

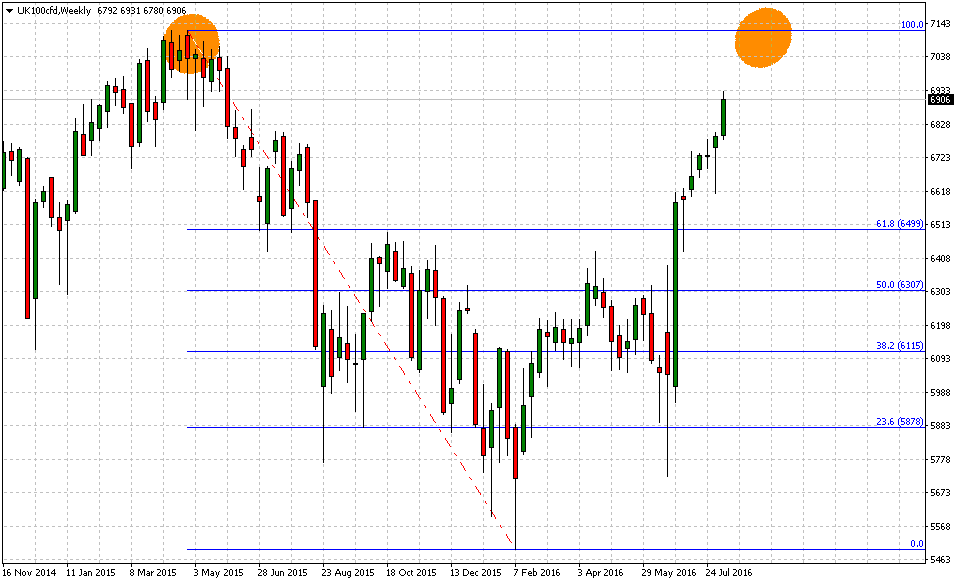

FTSE 100: Seems closer to the edge.

Weekly – Resistance: 7122.00 Support: 6611.00

On the Technical View, on the weekly chart, there is an inverted “Head and Shoulders” pattern which seems to end around 7140.

If we go back to the trading weeks between May and June 2015, you may notice it took 10 full weeks for the market to break to the downside. Remember “the market has memory” and I expect the same behavior one more time but to the upside.

6618.00 to 6513.00 are supporting zones where we can expect more buyers to guard the index price.

How long does the FTSE 100 may keep trading higher? Well, there is no doubt the BoE is happy to pay the price to let the music play as long as it is necessary, so expect by next summer prices trading above 7100 including +300 points corrections. The higher it goes just as ascending Machu Picchu, the altitude forces you to go back to your average levels, expect the same scenario for overpriced securities and wicked indexes.

Happy days for dedicated FX Brokers, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.