Weekly FX Recap: As Hands of Stone; Retail FX Becomes Legendary – Op Ed.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA No one knows the exact formula or instructions to become a legend. If your background and ongoing battle with pain make the difference, then everyone at some point will be a qualified contender. However, those interested in the role may need to showcase tenacity, bravery, and […]

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

No one knows the exact formula or instructions to become a legend. If your background and ongoing battle with pain make the difference, then everyone at some point will be a qualified contender. However, those interested in the role may need to showcase tenacity, bravery, and unmatched discipline. The commitment goes above and beyond anything you ever imagined and at the same time, worth every sacrifice as the risks in the long-term are offset by prosperity and rewards.

Probably, everything started almost 20 years ago, when retail FX trading hit the books and ears of the public. At this point, sort of an unknown asset in terms of platforms and unlimited potential. Then, revolutionary technology in the tangible form of trading platforms opened the gates to a new game; attracting more than a few eyeballs.

It’s a rising start in financial markets but as the song goes “it is a long way to the top”, and you cannot expect to get anywhere without fighting a round or two to protect your reputation and assets. Retail FX had to battle even its own demons with a high guard, throwing jabs and uppers, after all, only the best of the best rises and survives over time.

The dark ages are in the past. Today’s regulated environment combined with two spoons of dedicated and experienced professionals changed the industry landscape. It was complicated to conceive segregated accounts, regulators, standards and compliance guidelines for over-the-counter assets. However, after some intense rounds, those changes built the ground towards a promising future where prime brokers, liquidity providers, banks, traders and new participants can exchange value.

Outsiders are still intrigued. They do not really know or understand “the calls to earn huge profits” that seemingly attract them via the massive marketing campaigns running 24 x 7. It is undeniable; the retail FX industry became an asset, and everyone wants a piece of the action. Then, as Hands of Stone did in the 80’s, it’s about being devoted to achieving the goal. He never cared how hard life or his opponents hit him. He kept going no matter what to reach success.

Retail FX is not going anywhere nor will it surrender. It evolves to continue its traditional path towards greatness.

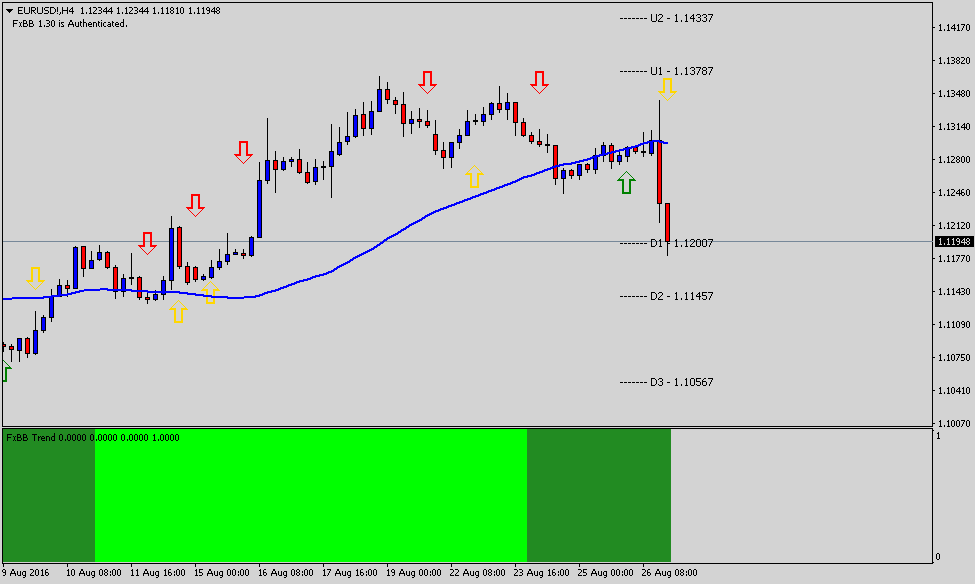

EURUSD: You weren’t expecting 1.1600; right?

H4 – Resistance: 1.1340 Support: 1.11457 View: US Dollar Bullish

Last week, going back over a few articles, it seems 1.1250 was pivotal for many analysts. I am not sure if they use more filters to share their views or was just a death wish on the US dollar. The negative sentiment around the greenback triggered a chart avalanche, and as you can guess, news sites were packed with several bullish cases.

Then, what happened? Well, the trend reversed, sort of surprising retail traders (as usual), but before doing this, it traded all the way down to 1.1250 and rushed towards 1.1340, which in fact was the 3rd lower high in one week. In addition, the price was trading below its 50 SMA on the H4 chart. Another confirmation that something was not supporting the uptrend continuation.

Out of the list of strategists and analysts in our industry, only one guy had an idea and suggested smooth action; Steen Jakobsen. If I were you, I would start reading a bit more of his work. It’s worth your time and account equity.

Sadly, I am still not buying this “2 Hikes” before the end of 2016 because Italy’s banking chaos is around the corner. There are some talks about Portugal not behaving too well either, but I have my ears ready to pick any alert or noise from Greece.

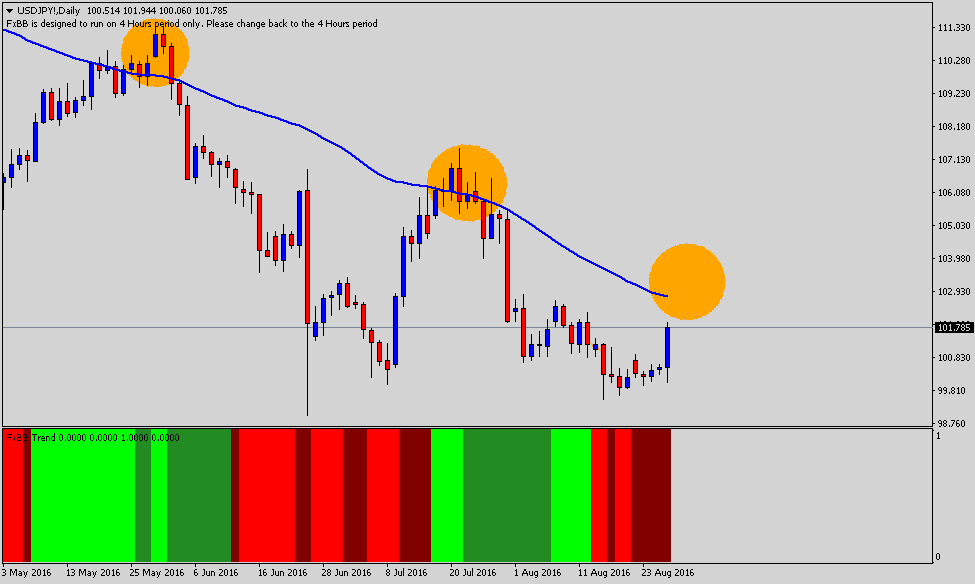

USDJPY: Run Yen, Run!

Daily – Resistance: 102.389 Support: 100.060 View: US Dollar Bullish

Do you believe in team work? I do. Finally, we do have some serious evidence to build more the linked economy argument. This is the first time I see two central bankers work in close cooperation to keep things going as if a secular government was keeping the lights on for the ghetto. Make no mistake, Yellen and Kuroda do know how to drive like real gangsters.

Although funny at times, it provides a frame as what to expect next in terms of economic policies, comments and any sort of quantitative easing package the Bank of Japan structures in the short and medium-term.

As we all know, Friday opens Tier 1 data with Non-farm payrolls (NFP), boy this one is going to be the best in a while; why? Quite simple! If the outcome comes a close or little bit above consensus which is something around 164K, then those US dollar bears are going to get suffocated like everyone felt thanks to the heat wave in Europe last week.

On the Technical View, prepare your ammo to buy dips into support where 100.50 to 100.10 represents a decent demand zone. Also, do not forget the long-term bearish trend in place. This is not difficult to appreciate on the daily chart. Nevertheless, I am betting on strong trend reversal IF indeed the Fed delivers a rate hike in September. In other words, I wait to witness the unexpected; you should do the same by protecting profits and keeping your stops in place.

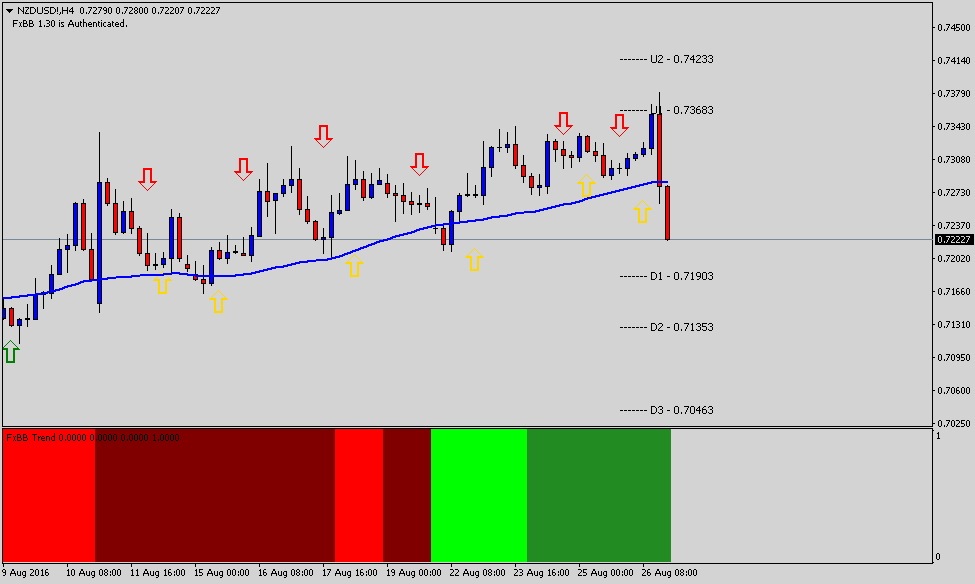

NZDUSD: Wheeler is losing it.

H4 – Resistance: 0.73683 Support: 0.70463 View: NZ$ Overpriced

Had a great chat with Tom Constable from Two Blokes Trading, their podcast is a must if you are starting your journey in FX trading; worth your time and energy. We talked about our industry, trading perspectives and believe it or not; I mentioned the New Zealand Dollar for a few seconds.

A short lesson on Forex, not all pairs, and crosses move at the same time. On Friday, once again, I experienced this trading fact. While the Single Currency traded a two-week low at 1.1231, I rushed to open an H4 chart on the NZDUSD to find its bid at 0.7319; then I had the opportunity to sell based on the bearish pattern. A few minutes later, the sell-off begins crushing any hopes for Kiwi buyers; down it goes like a hot potato.

Always keep in mind: There is no reason to chase the market; let it come to you. The execution is not that easy as our nature tends to play a trick on us. What’s my approach this week? I am more interested in selling pullbacks into resistance; targeting 0.71010 and lower. Unless something really strange happens (We all know it can)there are some serious challenges this currency pair could not overcome in the short-term; trading above 0.7310 isn’t happening for now.

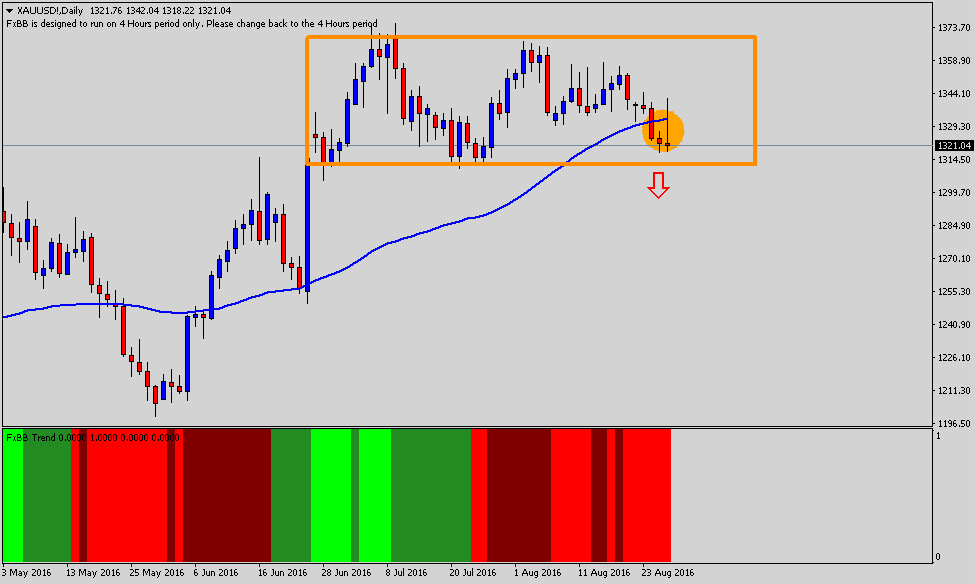

XAUUSD: Not even close the bottom.

Daily – Resistance: 1344.10 Support: 1230.50 View: Bearish Medium-term

Another interesting week for gold bugs. I am just wondering the word count and endless – keep calm – messages the masters of “Gold is Money” are going to send to their clients to keep their mood up. If they have a ten-year outlook on the funds allocate into gold, then I have no problem with the position.

Jim Rogers shared his views couple weeks ago on this matter. He mentioned how gold made a quick move the upside while the US dollar did not appreciate much during the last market storm. When it comes commodities I think we should pay attention to that man; his track record during his tenure at the Quantum Fund made him a living legend.

On the Technical View, there is more evidence to allocate short positions not denying some support at 1310.40, where demand is steady since June. Price trades below its 50 SMA on the daily chart, definitely a bearish signal, technical analysis 101 dictates we should expect more downside in the short and medium-term.

Happy days for US Dollar Bulls, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.