Weekly FX Recap: May Savers Rest in Peace – Op Ed.

Weekly FX Recap with José Ricaurte. A look at what the FX markets have done the past week and what can be expected the coming weeks.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

Almost 9 years ago, feeling almighty, he opened his mouth expressing his views and lack of understanding when someone touched the subject. Moreover, nothing stopped him, so he kept going without saving or any savings, fast forward to his now; definitely broke.

Many years ago, it was ICQ, a yellow and straightforward interface to communicate as if you were using Skype or Facebook messenger today. It opened doors for those who lack the emotional intelligence to approach anyone, anywhere and develop an interesting conversation.

Or imagine Back to the Future III, riding horses and somewhere in the middle of nowhere a broken Ford DeLorean awaits its creator, but he does not cry or waste time for his damaged vehicle, Oh No, he embraces his now and spend no time adapting his old country boy habits.

‘Cause nothing is forever; right?” We tend to accept services and products as some evil marketing genius finds the way to convince us to move on to the new thing. Yet, you wish to meet the Marketing Head at Coca-Cola. Did they get it right, why? Because they make sure you drink, pardon, poison yourself on weekly, daily and in some instances, hourly basis with a product that has no nutritional value. But, It’s all good as long as you do not feel the immediate pain, forget about the cost, what? $2.00 for a small bottle that won’t break your pockets.

Yet, no Forex Broker is being articulated to the point that makes you understand that saving every cent under your pillow aka bank account is going to get you anywhere, especially under the current business environment. Those guys are just like you, they are funny, they love to waste millions of dollars in poor branding campaigns or high profile sponsorships to make people see their brand during a soccer game, so what? None of those has the intensity to reach the poor and outdated savers.

You find easier to drink coke from a plastic bottle than from your traditional glass. Someone walks to you to offer an account to improve your returns; you look at the guy as if the devil just called your name. And then, you still complain at the lack of returns from banks, what’s your purpose?

It’s over, It’s outdated, It’s gone; time to deal with it. Banks profit margins are shrinking, you know it, and they are not going to carry your expectations to make your savings account bigger, they are just too busy worrying about the juicy bonuses; no room for one more. It’s not about saving expecting it to grow out of a bank account, NO, it is the realization that things have changed, and there are new ways that require your attention and devoted time to making sense.

Shake your reality, join La Nueva Revolucion, where individuals are more committed and take charge of their financial future educating themselves with the latest strategies and using the best execution platforms not leaving it to an ego maniac charging 2/20 that makes it big time with your money, funny isn’t?

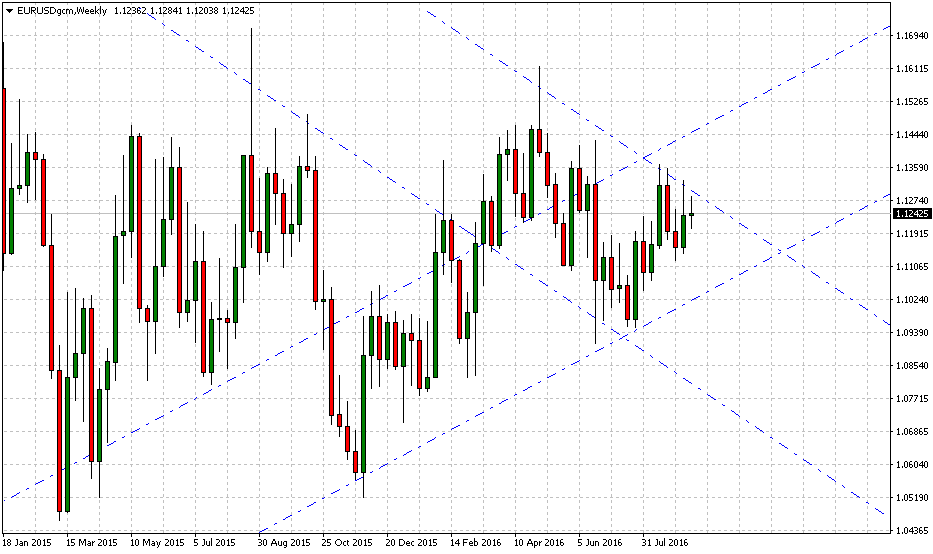

EURUSD: A new speech; Integration

Weekly – Resistance: 1.1320 Support: 1.1120 View: US$ Bearish

Is this as low as Draghi can take the single currency? 1.1200, not sure what is happening, but no doubt those fundamental junkies are losing it as I write this recap. That does make me a liar or sold out; I am just gathering the facts about the euro doomsday. After all, how it goes down is going to be fascinating, worth the years to come as a case study in Harvard Business Review.

I think I need more potassium or something, every two weeks I get confused with JP Morgan and Morgan Stanley; are they the same? Probably not, and who cares, those are legends among legends, but they do make mistakes. However, there is a paper explaining why the euro cannot go lower if you have time is worth a read. Allow me to offer a more primitive answer to the wonders of the many; euro-parity is a failed experiment. Germany cannot let it happen.

Have you seen his face lately? It does not look like he rests well. Also, do not fool yourself, even if they do not have a more eligible debt to purchase, there are plenty securities and corporate bonds, make no mistake, Moodys and Standard and Poors ain’t going to hesitate to label those as the ECB may need.

On the Technical View, someone is broadcasting a strong message; leave the EUR/USD above 1.1200, therefore, as it is the currency pair requires a close and open above 1.1290 to continue its bullish trend that began in 2015. Of course, we cannot be blind, there are plenty fundamental catalysts to hit the current exchange value and see it crashing towards 1.1060, but again, if Italy’s dementia does not hit it now, what could? Expect some sellers pushing the price lower around 1.0976, at that point, some serious buyers will jump in.

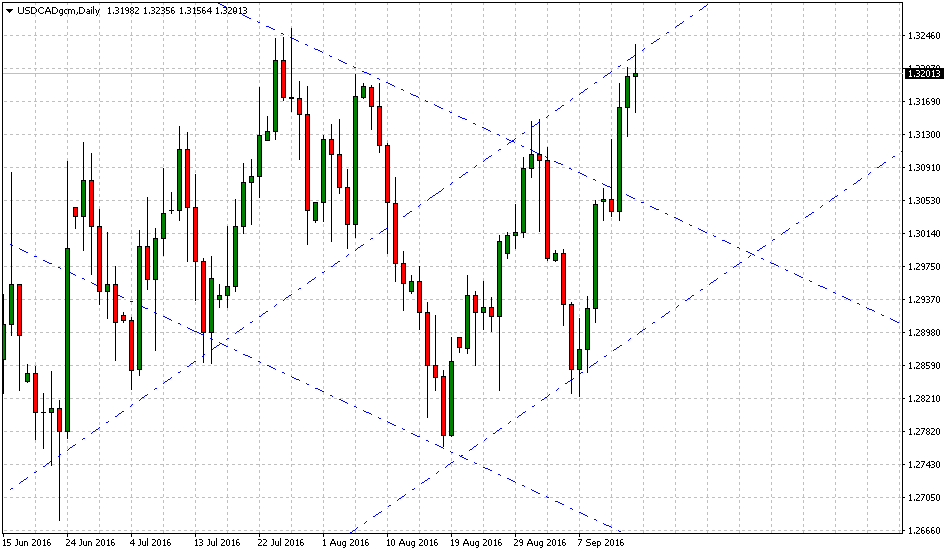

USDCAD: So far, Predictable and Profitable

Daily – Resistance: 1.3254 Support: 1.3028 View: CA$ Bullish

What happens when you do not follow instructions? Yes, you received a memo or in my case a $1,180.00 loss, that’s disgusting I can tell you. No shame in sharing, I rather keep it clean and honest. Believe it or not, it seems our culture finds pleasure when others fail to reach profitability, and by culture, I meant the FX industry, sort of the traders within our universe.

If I take out the first six weeks of the year, which represents a significant bearish trend from 1.4600 to 1.2470, there are just something I can express about this pair; stupid Joy! It has been nothing more than a natural process to identify the resistance and support on the daily chart to maximize the pair’s price action. Still, I am positive many retail traders made it all the way to zero in their trading accounts. As I mentioned the other day: “not an inch of progress.”

On the Technical View, a daily chart, for some reason I think oil is doable at current levels, and it makes CA$ vulnerable to the smallest and thinnest positive outlook for the US$, however, a strong, tough and rough greenback makes the day to a few, I bet Vladimir Putin is going to find the way to freezing production and post on headlines “cooperation.”

The abundant evidence we have, to allocate more risk towards 1.3245, that in essence should attract eyeballs making them think that 1.3800 is wide open. However, don’t be a fool, just this week the BoE whispered the magic words “possible cut,” Is Yellen so hateful that she does not care about her buddies? Let’s stay tuned. To keep this bullish trend alive prices should not break to the downside below 1.3016 if they do, then a retest towards 1.2400 and lower is granted.

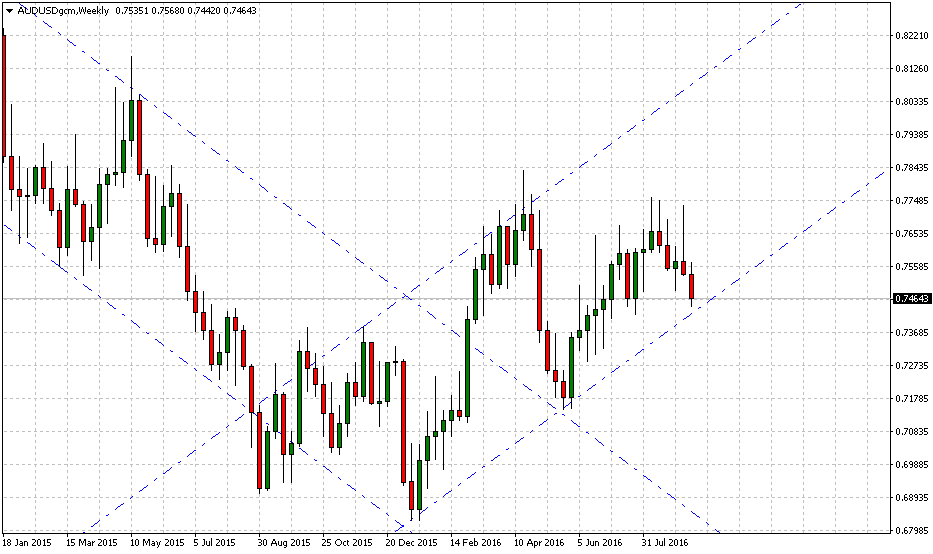

AUDUSD: Seekers, Hunters or Yield Eaters? Just Load the Boat

Weekly – Resistance: 0.7830 Support: 0.7284 View: US$ Bearish

Mixed data was released this week. China apparently is doing good (sarcasm) Australia has not experienced the overheated pill, so it seems its economy is strong, then you have New Zealand, that cares less about borders and campaigns announcing to the world that they real estate is very expensive; thanks to foreigners.

I cannot tell you how happy I feel right now for our Asian friends. Should you and I pack our bags and move all assets to their grounds? It’s not so easy George, the dynamics change from country to country same for exchanges. They key here is the yield, nothing more, any of these days the chinese swing at the bat and devaluate more than needed and chaos is upon all the financial markets. Because everything is linked, like the matrix, we are all plugged since day one without questions or the opportunity to opt-out.

On the Technical View, on a weekly chart, there is no room to deny the awful truth, this currency pair experiences a bullish trend. Now, the higher you want to go, the more liquidity you need to bring in (aka more losers) and this is where you need to watch out because between some mix data and Fed hopes, things can be confusing or blurry. They are not, and the pairs already tested the bottom/support of this ascendant channel around 0.7425, which means there is plenty upside available, all the way targeting its previous resistance at 0.7830 and why not; 0.80 cents.

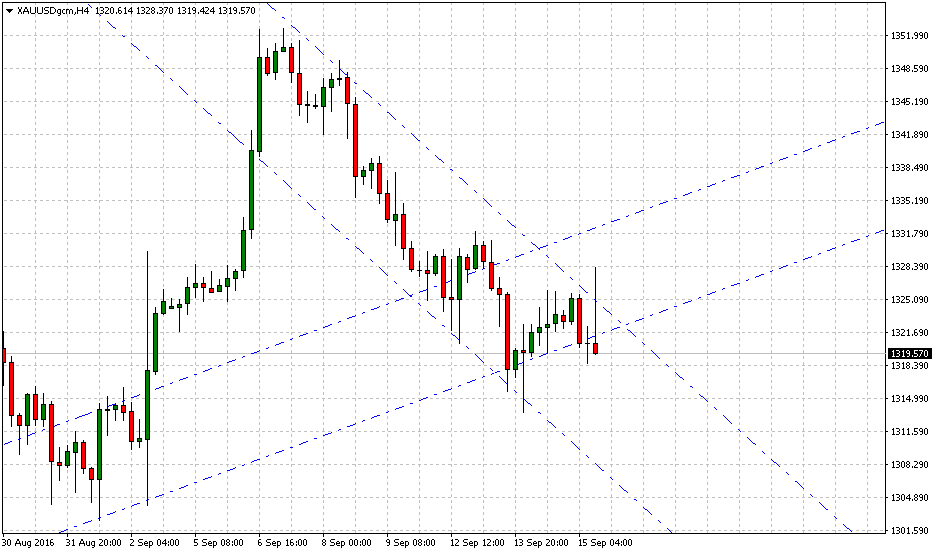

XAUUSD: Is not Black and White; Central Banks do have Power

H4 – Resistance: 1351.04 Support: 1304.20 View: Bearish Medium-term

On the Technical View, on H4, end of the line for gold bugs. The support is evident at 1304.00 if we witness a break and open below this price we are in for a ride down the toilet and lots of grown-ups are going to start crying as they stacked their bunkers with gold, silver, and God knows what other precious metal.

Long-term I keep my stand to use gold coins and bars as a method to transfer wealth, but now, right now! You and I have to work for income. Excuse me, are you 65 ready to retire? If things played as you expected, I am glad, but don’t fool yourself for a minute gold is not the answer to our Monetary System.

Short-term, there is room to trade as low as 1197.80 (don’t laugh) once prices settle, I am sure everyone will start drawing “double bottoms” and that can be enough to publish a new research on gold based on both view; technical and fundamental…what a team.

Happy days for Technical Analysts, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.

Featured image by JMortonPhoto.com & OtoGodfrey.com, CC BY-SA 4.0, Wikipedia