Weekly FX Recap: Predictions, Profitability, Probabilities – Op Ed.

If the industry success were based on waves, Fibonacci levels, overbought stochastics or outrageous predictions; The Louvre may be easily packed with thousands of charts which inspiration may be understood only by their creative authors.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

In the beginning, you prepare yourself to navigate in the trading world, not only FX; rapidly, you find one too many participants that dedicate their time to forecast different scenarios like bullish, bearish and the infamous neutral trend outcome. To communicate these ideas, all sort of technical analysis approaches can be applied:

- Elliot Wave from ABC to ZYX. This one is like surfing, but with your money.

- Harmonic Patters from Bullish Butterfly to Bearish Bat. Mother nature trades too.

- Overbought and Oversold Indicators; even planetary location if Jupiter moves an inch closer to Saturn. If it is overbought; why it keeps going up? Then, you have the astrologist applying moon cycles to finance; what’s next?

Financial markets are not efficient; that’s the main advantage and opportunity to generate a profit in the long-term. But, when it comes to drawing charts and predict, the chances tend to match the 50/50 ratio. Their work is to provide no more than guidance and spark curiosity to perform a more extensive research on the matter. Lately, technology offered the opportunity to the masses to work on those predictions which do not equal profitability. It’s the perfect scenario to witness the birth of the next Picasso or Monet.

Success equals the sum of all needed variables to make it happen, for example, a reliable FX broker, decent execution, good pricing and the strategy that meets your risk profile. You can count on one thing; none of them have anything to do with predicting or drawing charts.

On the other hand, the probability science, that’s a different ball game. You move away from judging trend lines and hidden patterns to set expectations based on benchmarks and statistics. Suddenly, you find yourself understanding expectancy, standard deviation, drawdowns and win ratio.

The FX industry is no different from other businesses, the product reached maturity in developed countries and still, the conversations seem to bring memories back from the early 2000s; Why? Probably is the human fascination to see what they want, when the only path to greatness is based on black and white performance.

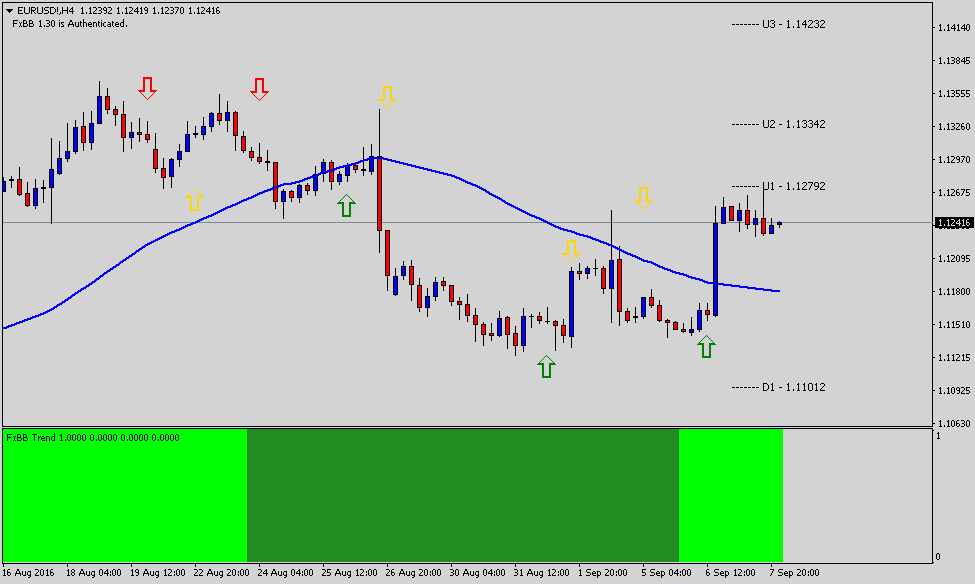

EURUSD: What would you do if you were Draghi?

H4 – Resistance: 1.14232 Support: 1.11012 View: US Dollar Bullish

Being a central banker must have a detailed and juicy compensation package behind the pool of terrible, sort of impossible, decisions they have to execute. It seems a job where chaos has more appearances than interest rates cuts or hikes. And still, those organizations keep finding a well-rounded victim to be the face to recall every time the economy dives, missing direction between deflation or recession.

I have explained theses scenarios a couple times. However, individuals tend to follow logic structures to solve the never ending puzzle to pick the best solution in a desperate attempt to deliver what no financial entity may achieve; save us all from a monetary oblivion.

Doomed or not, the single currency is facing challenging times. Nevertheless, there are two vivid chapters we may experience next:

- ECB does nothing which can lead to some positive outcome, if and only “if” the Federal Reserve does not hike interest rates this year.

- Draghi jumps rapidly adding random equity purchases since his team cannot keep expanding the bank balance sheet, due investment grade paper scarcity. Yes indeed, another “too fast and too furious” study case.

On the Technical View, there is evidence to add short positions close or above the 1.1250 resistance level. However, to avoid any surprises, a better approach may be to wait until Friday. When the dust settles, it easier to set a direction for your trading. Keep an eye on 1.1120; this support played many sellers a week ago.

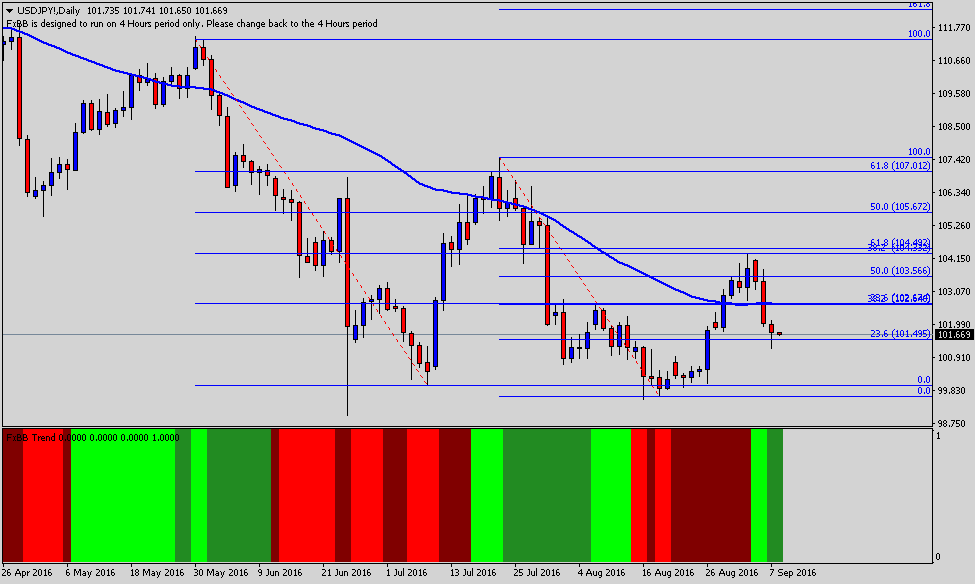

USDJPY: It’s now or never!

Daily – Resistance: 104.35 Support: 100.26 View: US Dollar Bullish

Two weeks ago, I experienced joy when the market traded as low as 99.523, and as you can imagine I had my stop placed at 99.513; can’t believe me? I could not be at the beginning, but then I realized the spread played a fascinating role in my lucky seven. I just do not feel Abe’s team has the same star; perhaps it is a Japanese thing; who knows and who cares!

There are some similarities to the euro scenario:

- No US hikes, goodbye USD/JPY, the next trade may be filled at 96.90 or 90.20 both unthinkable situations; for now.

- Out of the blue, the Fed shows up with a hike in the next FOMC get together. Some analysts, like KVP from Saxo Bank, do have a list of valid reasons to expect at least a September hike. If it takes place.

On the Technical View, a daily chart, explains things better. For some reason, the market tends to extend its rally towards the 61.8% Fibonacci level. After trading a high close to 104.40, once again the reversal takes place, slowly killing any bullish hope in the short-term. Nevertheless, around the 102.20 handle, we may witness a case of resistance turned into support, and that can be a compelling case to attract buyers.

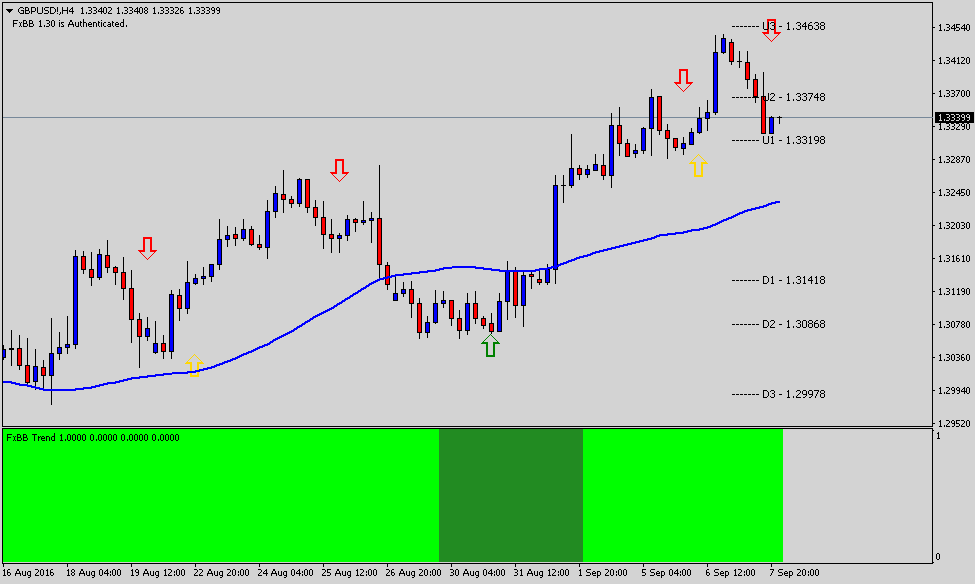

GBPUSD: God Saved the Queen; right…!

H4 – Resistance: 1.34806 Support: 1.31281 View: US Dollar Bullish, Short-term

Post-Brexit data released keep shocking the markets to the upside. It pictures a “too good to be true” landscape but who is going to stop this celebration party.

Yesterday’s UK inflation hearings were suspicious. Not entirely boring, especially when Dr. Carney, answered as a genuine professional. However, I think I heard another girl talking about buying corporate bonds from XYZ entities. I beg you pardon; what?

“Hello, Darkness, my old friend. I come to see you again…” that was exactly the track my brain played as soon as I hear that. I do not want to continue because I am building a doomsday scenario, one-day central bankers and the next morning; Hedge Fund Managers?

On the Technical View, prices are trending higher. However, within every single bullish impulse, you may experience healthy retracements. It’s key to understand “how” the market operates, liquidity is essential, then it must attract multiple players to make its next move. There is no doubt at 1.3455, all eyes are focused on the next resistance level around 1.3539, but to hit that objective, the pound needs large buyers.

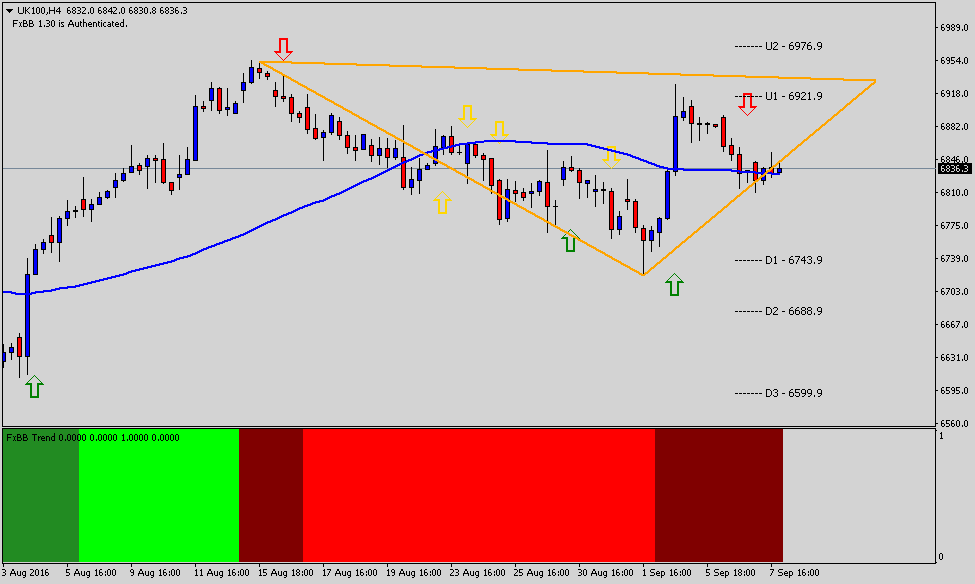

FTSE 100: Who is going to keep buying at these levels?

Daily – Resistance: 6976.9 Support: 6688.9 View: Bearish Medium-term

According to Dr. Carney, you must be prepared to play both possible outcomes at any time. That’s a phenomenal answer to building the rate cut case. The BoE just aligned it’s war horses in the most strategic corners. No one is blind here to accept that it worked better than expected; short-term fix or long lasting change?

Honestly, after all, the hearings, positive data releases, and positive stories; I do not trust happy faces. There is something wrong here. If we do not experience a correction during this quarter, in 2017, the shock is going to be extremely painful.

On the Technical View, the index is finding support around its 50 SMA. God only knows who keeps buying at these levels, but as long as the party keeps going there is no reason to stop; right? In the medium-term, we can see 6599 playing its role as support when prices trade close to it, the double bottom pattern is confirmed or is it a hidden head and shoulders? Go figure…

Happy days for Post-Brexit Bulls, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.