Weekly FX Recap: Run away from central pranksters

Scenarios in the foreign exchange universe tend to be quiet dynamic. However, the next one is going to be the greatest prank ever set by those called; Central Bankers.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

Scenarios in the foreign exchange universe tend to be quiet dynamic. However, the next one is going to be the greatest prank ever set by those called; Central Bankers.

If you have not heard the news, the banking industry is in for a drastic change. During the last 40 years, being a banker was the job to have. Basically it had no significant challenges as everyone wanted to build their savings account and back in those days, visiting your local branch was part of your social activities.

Bad news for you and those who still love saving every penny: The game is over. Let me explain it again; banks are done! The entire system is contaminated, and you are running out of options to protect your wealth and status.

Everything has changed so much. Do you remember the days when a savings certificate paid 12%? Some of you do, others don’t even care, which is understandable. Also, what about the latest creation from our dearest bankers…negative interest rates? Voilà! This is the one idea that customers should begin to take on board as fast as possible because it constitutes a real threat to their pocket and future.

Savers are going to be punished for years to come as we salute the new era where banks are happy to send you a notification making sure you understand that the account that is supposed to protect your wealth and help you grow will be affected by retail bank policies and soon may experience a new method which will result in the bank slowing losing your money.

Time to inform yourself about this negative rates prank (yes, it is just a bad joke). Danish, Swiss and Japanese citizens already know about it, therefore if you have a friend in these countries may be a good idea to call them to get more details.

Before jumping into the next charts, it is worth remembering one thing, that there is nothing new under the sun; we just tend to forget. So, necessity is knocking on your door; you cannot handle your hard earned money as people did back in the 50’s and maybe, just maybe Central Banks are not actually attacking us or destroying financial markets…maybe this is just a wake-up call for everyone to become more productive and efficient. Time will tell…

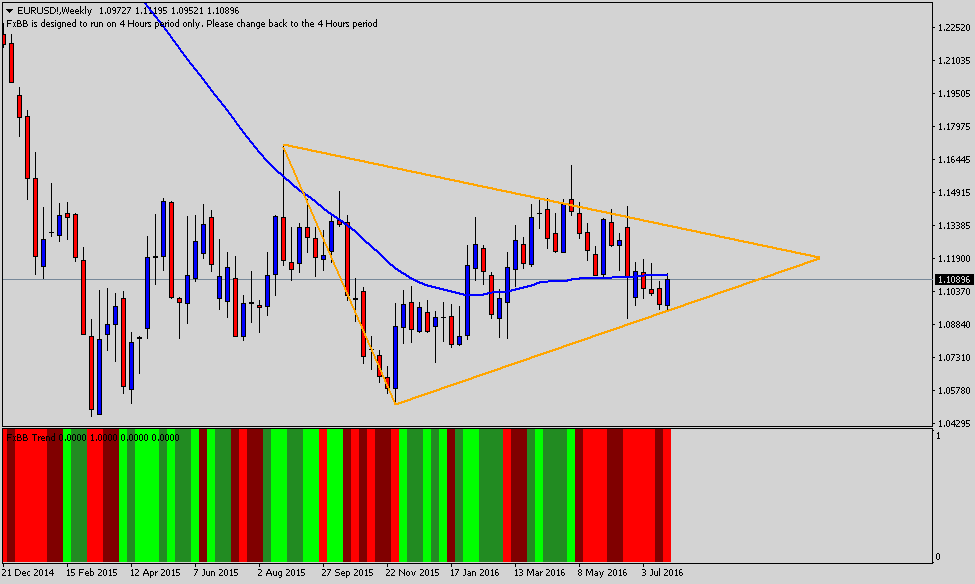

EURUSD: Guess Who’s Back?

H4 – Resistance: 1.1170 Support: 1.0950

The question of the month: How do you save the single currency? Answer: You do not.

It’s a mystery to me why Germany has been supportive of the many cases of abuse by a few members of the union. Yes, those members may have evidence to explain how things are different from their perspective, but at the end of the day, there is nothing more to do with the gargantuan debts some countries have built in the last 10 years.

On the Technical View, short-term the pair may trade above water defending its long-term support around 1.0950. However, the resistance around 1.1162 is going to be a tough one to break.

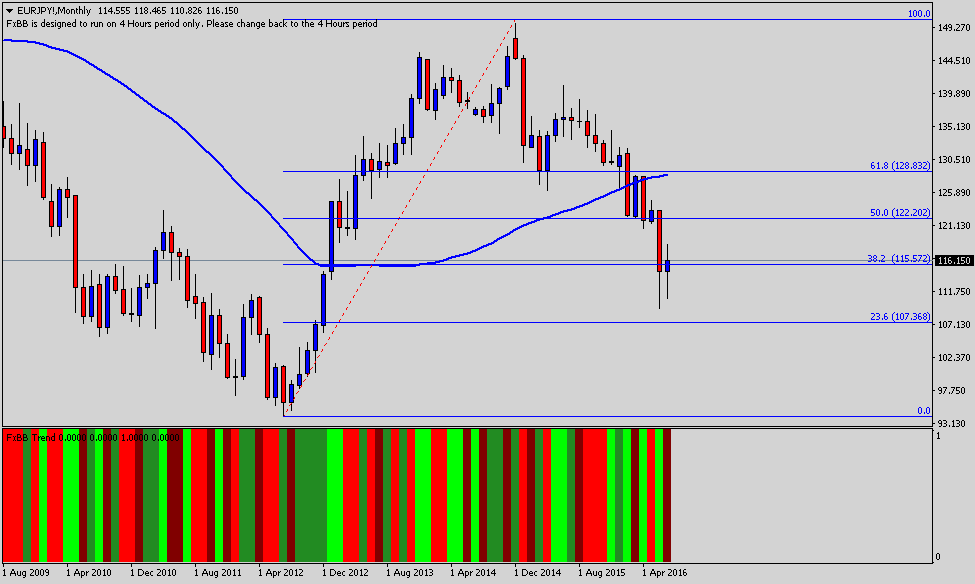

EURJPY: Cannot see the helicopter.

Monthly – Resistance: 118.52 Support: 114.55

As you can imagine, I read many publications on a daily basis to keep myself up to speed with the latest developments. According to the wire, the following banks were sending notifications to their commercial clients to make them aware of the possible implementation of negative interest rates: RBS, ABN Amro, and NatWest. Those are the ones I remember, but in Switzerland, they have been doing this for a while.

These letters are more like a warning not really a notification, and if you stay with them at least, you know now the rules of the new game. Now, just as those banks are communicating in somewhat an effective manner, our dear friends at the Bank of Japan keep having “communication” issues as no one knows what exactly is happening.

In the morning, Abe is ready, then in the afternoon there is another story. I have no doubts; currency traders have been waiting for that bazooka for so long and yet there is no evidence it may be used. If you see the helicopter let me know, I think it is time to leave this short Japanese yen trade.

On the Technical View, there is some evidence to support an extended position towards the Fibonacci level 50.0% around 121.99, however, if Japan fails to build a substantial easing package the demand for the Yen may accelerate towards 100.00, after all, institutions and commercial partners are better making 0.0001 return than nothing; right?

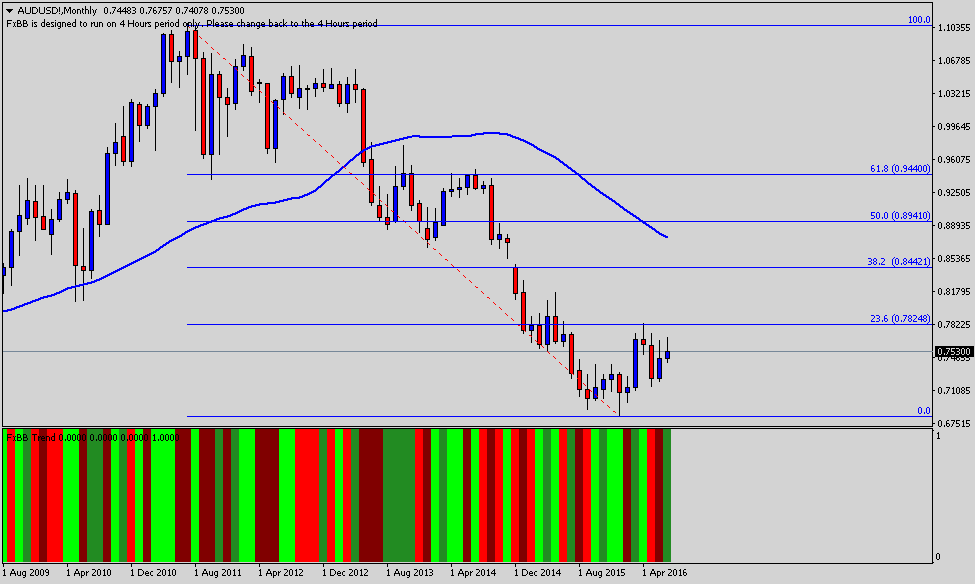

AUDUSD: Saxo Bank’s Parity Call

Monthly – Resistance: 0.7706 Support: 0.7218

Yes, I may understand the reasoning behind this call by Saxo Bank’s Chief Economist. Think about it, besides the Australian Dollar, we have the New Zealand to capture some positive long-term carry trade. Yellen seems to be just a figure, and that’s about it; there is not much she can do to save us as Ben Bernanke did it all.

But, if you have institutions including Central Pranksters buying debt and the debt available with positive yield is now very much limited, then What are retail traders and investors buying? Answer: nada.

As the masses starve for positive yields, the long AUD/USD is an attractive proposition to run away from negative interest rates.

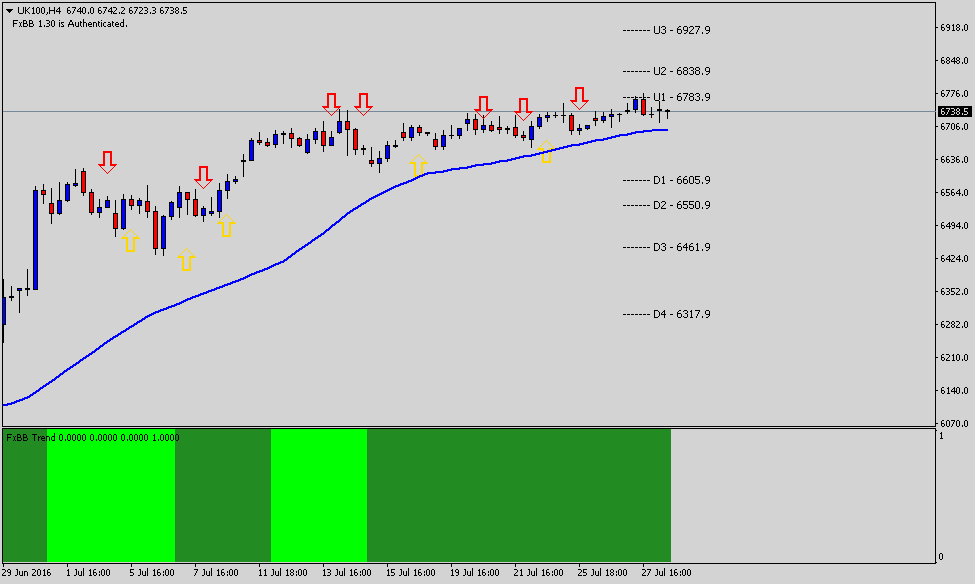

FTSE 100: Chronics of a future crash.

H4 – Resistance: 6927.9 Support: 6550.9

It seems everyone is waiting for the BoE rate cut in August. Where is the evidence to support it? As you understand rate cuts serve to take equity indexes higher via “free money” which will be the most probable outcome. However, isn’t better to cut rates when things aren’t going so well?

Moreover, when banks report their earnings and those numbers don’t add, the sell-off can take the FTSE 100 to a more attractive buy zone. And Yes, stocks can always go higher from here, I am just not interested in overpriced empty vessels. (talking about value and growth)

On the Technical View, expect a pullback towards D3 (6461.9), the Italy debt bomb is around the corner ready to explode, and there is no way it will not have a domino effect around the globe. The most important piece of evidence will be close and open below the 50 SMA that may serve as a confirmation to trade a new trend.

Happy days for Carry Traders, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.