Weekly FX Recap: Take, Reduce, Eliminate…Understanding the FX Universe à la Charles Darwin – Op Ed.

Outside the box behavior and mantra suggest one theory to solve this dilemma; Darwin’s evolution theory. That’s right.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

Many keep thinking is just about repeating the same old technique or strategy over and over again, but believe it or not, structures, products, assets and relationships including yourself may evolve even if you do not accept all tangible evidence. There is a compelling theory about the evolution process that seems to apply to everything we do and yet after all these decades nobody appears to thank the man behind it; Charles Darwin.

Have you thought about the immense value the FX market offers? Perhaps the asset implied volatility is too high or the life expectancy of your account set at less than six months are the issue; who shall we blame? Literally, outside the box behavior and mantra suggest one theory to solve this dilemma; Darwin’s evolution theory. That’s right.

See, the brainwashing process is so efficient (after 40 decades listening to the same tape: save, work hard, buy a house and other) so individuals accept all facts, statistics and foggy arguments about what they should expect versus exploring on their own terms. Therefore, no one seems willing to TAKE risks, please do not jump from the cliff, far from the truth; measured and intelligent risks are healthy choices.

Changes scare everyone, so it delays the inevitable and individuals tend to find no reason to REDUCE their excess in other areas (talk about life areas, useless friends, comatose investments or anything distracting you from your designed life) you see no interest to evolve and how could you if it ain’t broken…

But when things go wrong at the last minute, then and only at that last moment you are going to start asking questions, by that time is too late. You carefully missed your chance to ELIMINATE waste, and now there is no room to improve; sad.

How difficult can it be? Veterans called it “industry” when “Universe” seems more appropriate. It might be just the circumstances. However, there is no escape from the evolution process; you should meditate on it.

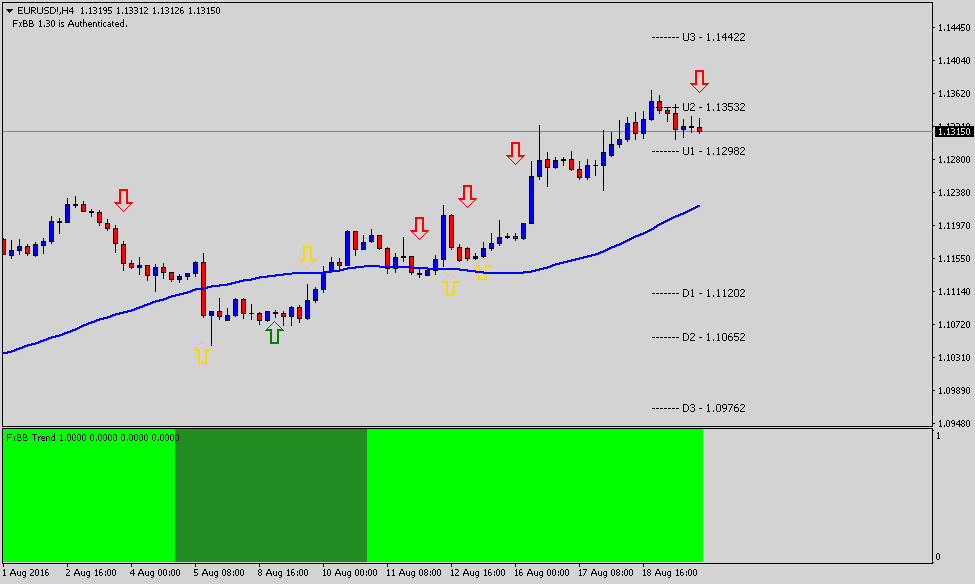

EURUSD: Another death cat bounce!

H4 – Resistance: 1.14422 Support: 1.09762

According to the definition when applying “Reversion to the Mean” (valid trading strategy utilised by Mutual and Hedge fund managers) indicates that price disruption high/low tend to be for a temporary time, then it goes back to the average range.

Now, would you like to explain why the EURUSD is trading at 1.13230 (Friday’s closing price)? Let’s quickly go over a few ideas:

- There is no value to keep long positions since the single currency provides no actual swap.

- It should not be called European Community; someone jumped ship.

- Isn’t Italy still a member? If YES, get ready the last chapter in this ongoing drama is about to begin.

If you want to TAKE risk probably going long crude suits you better, at least some stats mentioned how U.S. crude oil inventories dropped 1 million barrels which can be translated into a bullish sign. But, where is that positive tick for the euro? If you have it, feel free to share it in the comments section as I might be blind and deaf, I haven’t received the memo.

On the Technical View, the currency pair just entered in the short-term a price range between 1.13532 to 1.12982. There is, in fact, a sell signal from the Forex Black Book, but one cannot avoid having doubts from previous entries. If this is the week when things turn around, 1.11202 seems the obvious target for short sellers. On the other hand, if William’s words are empty 1.12982 can be another break for bulls to add more long positions towards 1.14422, no matter what happen next the only reason why the EURUSD is moving higher is due Yellen’s lack of action; don’t talk to me about euro strength ‘cause there is no evidence whatsoever to support it. (if you do have it let me have your comments)

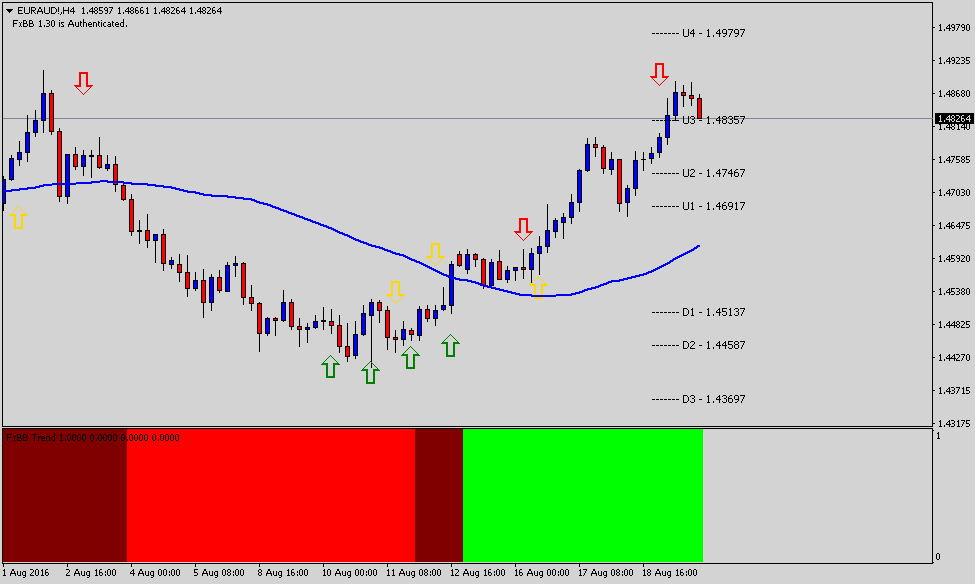

EURAUD: Why is anybody still long this cross?

H4 – Resistance: 1.49797 Support: 1.43697

On the Technical View, there is a “double top formation” in place close to the resistance zone. However, 1.49797 seems the better entry to add massive short positions if you are expecting the downtrend continuation.

When trading this currency cross, as any volatile cross, I always make sure to REDUCE the trade size to have a decent stop no matter what direction I may pick.

The way it looks so far the market is attracting liquidity to start its next leg lower. Medium-term we cannot discount prices trading close to 1.5000, but as I mentioned the Long-term outlook empowers the Australian Dollar because no matter what happens next, It is better to hold a currency at 1.50% than one with zero rates.

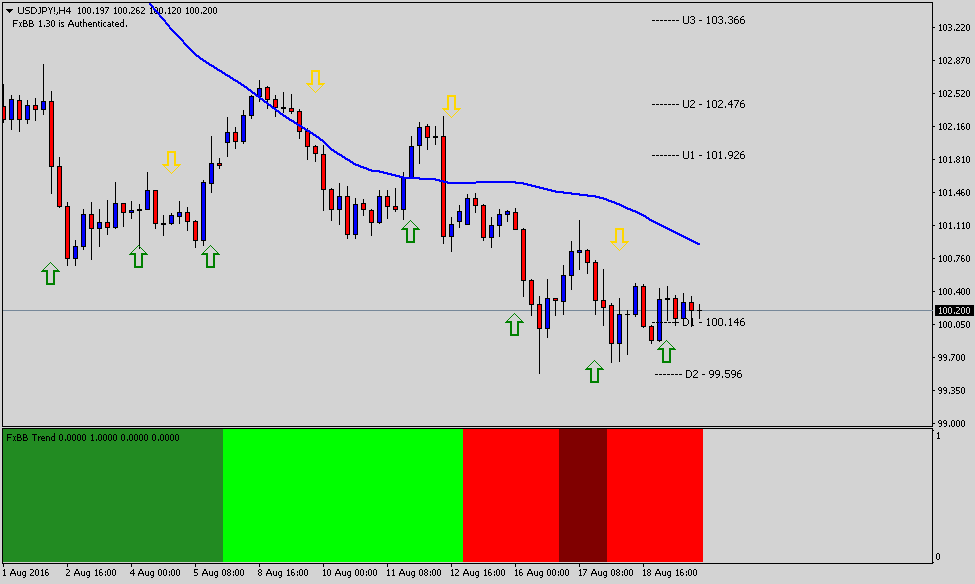

USDJPY

H4 – Resistance: 103.366 Support: 99.596

Today, some retail traders are expecting a gap to the upside, and I wonder why? Well, because they think there is an imminent action from the Bank of Japan as the Japanese Yen trades in the critical territory at 100.15.

No doubt, you can always see the BoJ coming out their way with some random action, but long-term what’s really happening behind the curtains?

On the Technical View, reports and Elliot Wave traders (which all of them should be rich by now; of course, not the case) have the last leg going deep into 97.50 I do have to share that I still have my stop at 99.513 so now you know.

If indeed the pair recovers, then it may move as high as 103.229 where it is going to find lots of sellers selling the level as it is going to challenge its 50 SMA on a longer timeframe. Short-term this currency walks over a fragile scenario just be ready for everything.

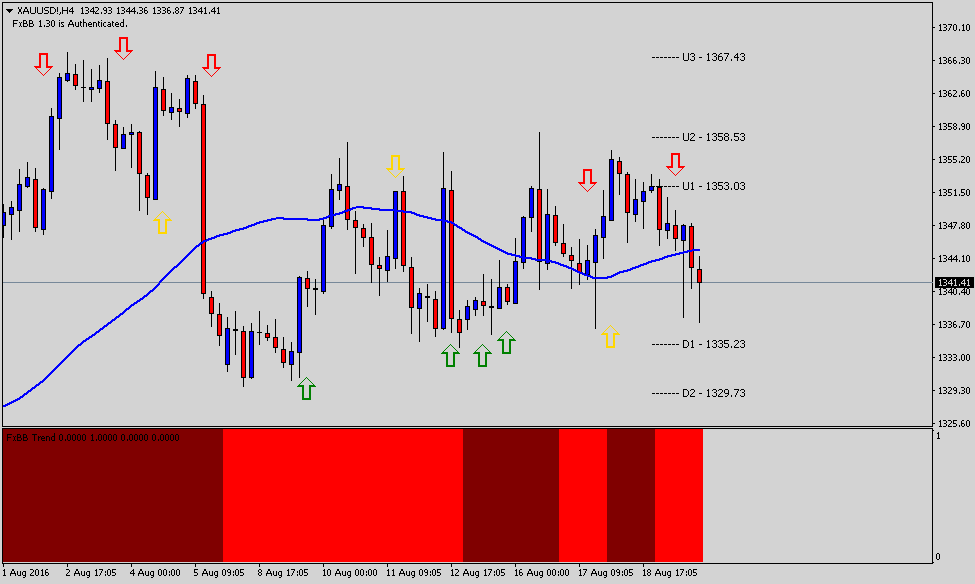

XAUUSD: sideways, but it’s not your fault.

H4 – Resistance: 1367.43 Support: 1329.73

Thinking it is Credit Suisse or UBS that have a research team coming out with $1475.00 target price later this year for Gold. How many overpriced analysts do you need to get that number?

You may dislike my analysis, or you may just read it for fun, but I am going to repeat it again, short-term Gold is in a bearish trend. The only way I believe Gold provides value is if you buy the physical. That’s it. In the event that you want to hedge your wealth, I strongly suggest you focus on quality real estate with no leverage or financing in the location.

Short-term, Yes, I have no issues trading the electronic quote. Now, you can ask me: Jose; Why is that? Sure, no problem I have an answer. Think about this for a minute, how bright are you if it is trading at 1341.41 (at least this is what my online broker is quoting me) and you are calling a Year End price of $1,475.00 that’s only +130.00 to the upside and your risk goes all the way down to $1,000.00 do the math, I am positive your calculator works as good as mine…What’s the risk/reward ratio?

I rest my case. And please, remember I am not saying it is a bad investment, if you think about it Gold is not even an investment is just a must because the undeniable truth; it ELIMINATES all wealth worries for future generations.

Happy days for risk-off forex traders, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.