This Week’s Five Main Economic Calendar Events – Guest Editorial

Market analysis Ramy Abouzaid provides his overview of this week’s trading environment and news announcements

By Ramy Abouzaid, Head of Research, ATFX, UAE

Italian elections and the talks of increasing oil production are the main market-moving items earlier this week. The bank holidays in the UK (Spring Bank) and the US (Memorial Day) on Monday were most likely the reason for the main moves at the start of the trading session yesterday.

Political tensions are rising in Italy after its president refused to join the Minister of Finance – who is known for his rejection of the policies of the European Union – to the coalition government that was in formation, result was announced withdrawal of the Socialist Party and the Five-Star movement, and the announcement of fresh elections likeliest to be held in September.

The euro was pumped up in the beginning of the trading session, only to turn back to hit fresh lows unseen in 27 weeks, combined with a drop in Italy’s stock exchange FTSE MIB by -2.08% and Italy’s 10-Year bond yields rising 2.8% on Monday.

On the other hand, Oil prices fell sharply yesterday with market expectations that OPEC and its partners agreed to increase oil production during the meeting scheduled in Vienna next month, this increased market speculation after comments by Russia’s Energy Minister that his country is open to discuss the return to production levels that was in November of 2016. Russia’s oil production was near the levels of 11.5 million barrels per day this was a shock to the oil market, this increased the current production by about 300,000 barrels per day as per OPEC’s monthly report.

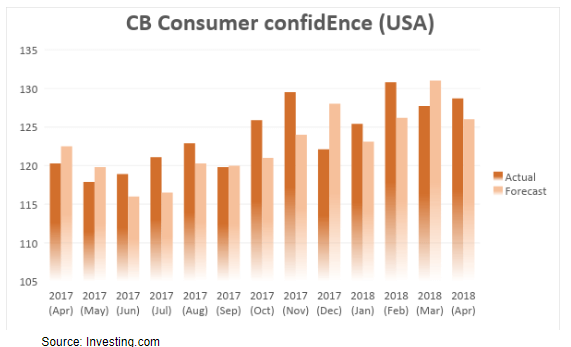

Tuesday, May 29. US CB consumer confidence:

Markets will wait for CB’s Consumer Confidence Index to be released on Tuesday, and the index is at its best levels in over three years after recording 128.7 in April. Furthermore, consumers spending rose in the first quarter of 2018 to 12066.82 USD Billion, its highest level since July 2015, but markets expect this month’s reading of consumer confidence to decrease by about 0.5 points below last month’s reading.

It will be surprising if the index manages to post higher than expected reading, which will likely strengthen the US dollar as an immediate reaction.

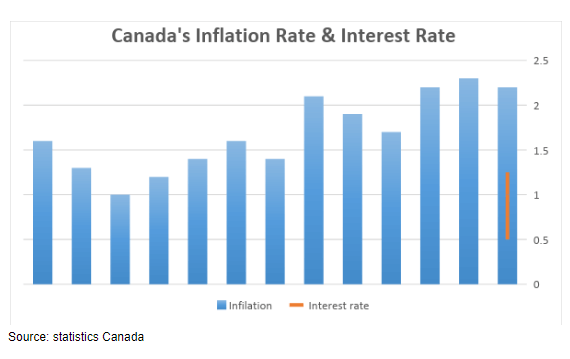

Wednesday, May 30. BoC Interest Rate Decision, likely to remain unchanged:

There are no expectations in the market that the Bank of Canada will raise interest rates on Wednesday’s meeting, and it is understandable why is the most likely scenario, as the real estate market in Canada is experiencing sharp price rises, particularly in areas such as Toronto, even after the application of new credit rules for mortgages, which tighten both the individual and institutional mortgage systems.

It is however better for the Bank of Canada to maintain current inflation and interest rates, since its former rates are the closest among the G8 central banks to US Fed interest rates and would not shock the real estate market in the North American country.

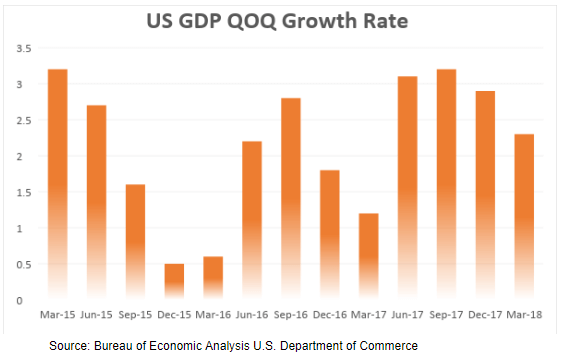

Wednesday, May 30. GDP Growth Rate QoQ 2nd Est Q1:

Markets expect the second estimated reading of the quarterly GDP growth to stabilize at 2.3%, this may come after the decline in GDP growth over the past two quarters.

However, this reading would be a pleasant surprise for the dollar if the previous reading is revised favorably, suggesting a more rapid growth of GDP. A negative revision of that reading could help reduce the dollar’s current upward momentum.

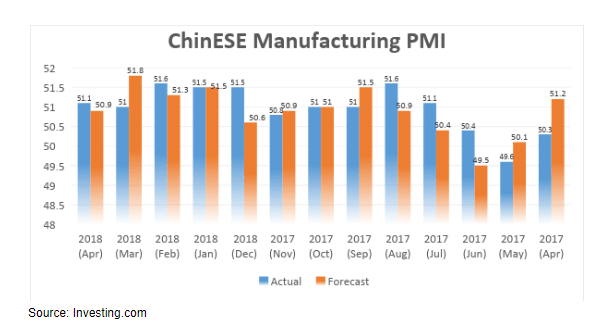

Wednesday, May 30. Chinese Manufacturing PMI:

The market have been witnessing China’s manufacturing PMI below expectations for the past two months, the market hope to get a better reading this month similar to last month’s 51.1. If that reading were to beat expectations, this will help the markets to be optimistic and it may support the Australian dollar a little, which has been under continuous pressure for the past few weeks.

- Friday, June 1. US labor market data:

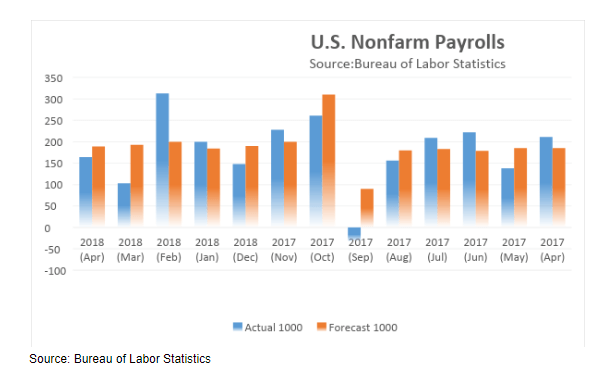

US Non-farm payrolls increased by 164K in April 2018 it is better than market expectations, following an upwardly revised 135K for March 2018 that was below market expectations of 192K. At the same time, Job gains occurred in professional and business services, manufacturing, health care, and mining. In April 2018, employment in professional and business services increased by 54,000, whereas over the past 12 months the industry has added 518,000 jobs.

Now the markets are generally comfortable with the labor market and its impact on the Fed’s decisions, but the Average Hourly Earnings remains the most important figure, which may be reflected in optimism on the market outlook for inflation if it shows an improvement.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.