What’s the cost? FX dealing desks are outmoded. Full report from Moscow

Inside view from Moscow: A new platform to advance the cause of order execution

For those who have spent any length of their career within a retail FX brokerage, it is likely that when asked which particular position within a company is not only the most cognitively strenuous, but also which carries the most risk and responsibility, the heavily burdened team in the dealing room come to mind.

Ever since the dawn of MetaTrader 4 in 2004, the ease of access into a global electronic trading market by a vast array of companies whose executives do not necessarily hail from the vast, well backed safe havens of the institutional financial technology or interbank dealing sectors in London, New York or Chicago, operating a risk model and dealing desk has been a very difficult department to operate. Indeed, maintaining a career as Chief Dealer is a commendable one indeed, as it can in many cases be akin to fighting several fires from several directions.

Having to manage the different relationships between the banks, non-bank liquidity providers, prime of primes, internal sales staff and of course the traders themselves is tricky enough, however there are continued requirements to analyze data and make sure all execution and risk management has been conducted not only in accordance with company requirements – the fate of electronic trading companies lies almost completely in the hands of the dealers – but also in accordance with regulatory requirements.

Such a tremendous amount of critical activity often comes all at once, and dealers often find themselves having to not only balance several thought processes and execution related activites in a very short time, but also rely on somewhat antiquated systems for reporting and decision making, leading to all kinds of potential loopholes for arbitrage, abusive trading, execution and price anomalies and regulatory recourse.

Isn’t it time that the dealer became the person in control of all sets of responsibilities from a proactive rather than reactive position?

Last week, FinanceFeeds met with a team of institutional financial technology developers with over 15 years of experience in developing IT systems for hedge funds and banking institutions globally in order to look at a solution to this matter in great detail.

The developers were led to design an all-encompassing retail solution by ideological founders Peter Tatarnikov, Chairman of dispute arbitration body The Financial Commission, who spent several years as Chief Dealer at Forex Club, Russia’s largest retail FX brokerage, along with colleague Alexey Pavlenko, in order to develop this particular enterprise solution which provides a comprehensive set of real time analytics for brokerages.

Whilst Mssrs Tatarnikov and Pavlenko have extensive and illustrious careers in the retail FX industry, the development of the Broker Pilot system was conducted by five institutional technologists under the direction of IndigoSoft, a dedicated financial software firm based in the Russian capital city of Moscow.

Meeting with IndigoSoft CEO Valery Dolgov last week, FinanceFeeds gained a very concise understanding of the new Broker Pilot system which intends to solve a very important issue for retail brokers.

“We began the development of Broker Pilot 3 years ago, at which time we created IndigoSoft. It was the start of us working together, and at that point we formed the team consisting of myself, my twin brother Yury Dolgov, Andrew Grekov who is our frontend developer, Valery Soroka our backend developer, user interface tester Stanislav Petkevich and systems administrator Andrew Pominov” explained Mr Dolgov.

“Whilst the company is new, this particular team was created 15 years ago, at which time we created software in 2002 for our own support systems for institutional business, created support for hedge funds, and whilst these are protected by a non-disclosure agreement preventing us from stating which hedge funds have our IT system, it has become a very b\ig business for us with the owners of the funds not only based in Russia, but in western countries too” said Mr Dolgov.

Russia is a breeding ground for high technology. Always has been. The land that led the world into space in 1961 and has a long history of advanced military and civilian technological large scale projects is now home to professional gamers, system developers and incubators for tomorrow’s high end financial services software. During our meeting, we were even apprehended by two professional XBox gaming developers who were zealous enthusiasts wanting as many monitors as they could find, including ours!

The Broker Pilot system was released approximately one year ago, and is now sufficiently tested, according to Mr Dolgov, to be brought into the mainstream FX brokerage industry, thus refining the operations of brokerage dealing and execution operations.

“When we established IndigoSoft three years ago, we knew that there was a distinct need for retail brokers to have totally new software. IndigoSoft was then created by us to create this type of sustem based on our experience in the institutional sector for retail brokers as we identified a need for complete granular transparency in the retail OTC derivatives market that can benefit brokers (from a longevity of traders perspective) and traders (ability to trust price feeds and execution quality from brokerages)” said Mr Dolgov.

“One of the disruptive factors that brokerages face these days is an increasing number of advanced traders who know how to outpace their brokerage and create toxic order flow. Arbitrage trading is a very modern trend, and we have skills in this area” said Mr Dolgov. “I think it is important to note that brokerages need a to make use of the growing hierarchy of ancillary software that is now available to check exeution” said Mr Dolgov.

“We are not sales people or marketers, we are IT programmers with a very lengthy experience in creating institutional software, however we know that many retail trading firms are not equipped to safeguard themselves against the market” he said.

Trading at major brokerages, and being invited to build their systems

Mr Dolgov deviated from software development over a decade ago to gain knowledge of the retail business by actually trading with some retail brokers.

“I did trade with FXCM back in 2004 and was successful, and this led to seven years of trading. I made $300,000 within various companies during that period, having had some additional success with GFT, Saxo Bank, and Alpari. Around ten years ago, I visited Saxo Bank’s head office in Copenhagen and spent more than a week there and saw the brokerage from the inside. Their highly knowledgeable management asked me a lot of questions about trading and showed all their state of the art systems. It was a very good experience for me and helped see what is needed to create our own software for brokers” – Valery Dolgov, CEO, IndigoSoft

Taking our own development plan, and having gained a very useful insight as to what is important for brokers, especially from one of the very highly organized and well developed firms that is Saxo Bank, we looked at what would be needed to build a full suite that automates all data for all aspects of trade execution for retail brokers.

“I found this area of development very interesting especially with regard to risk management” said Mr Dolgov. “Saxo Bank had at the time a very interesting STP model where they can get risk on only 3% of all volumes.”

“The firm had a long history of collaboration with Deutsche Bank as a prime broker and was handling billions of dollars of volumes of their clients, I saw calls from their customers. When I was in the office, a very large client from Eastern Europe asked to buy options on a very large volume and an account manager actually physically called the bank to ask the bank’s prime brokerage desk via a voice call how much they could get right now for that trade. They then disbursed the volume between several Tier 1 banks. This was great, howver they asked by using the phone. This made me think that if large brokers are using phones, they need to use very specialist software for derivatives products such as futures and options they have had to create their own software solutions and this is a very complex story for all brokers. They have to create their own systems and Saxo is a good example to see because they really are a high tech firm” – Valery Dolgov, CEO, IndigoSoft

“Developers are working and taking systems in various countries within various hedge funds rather than brokers. We have a very experienced background to enable the development of software which comes from a much larger execution style than that within retail brokers. Yury, for example, is experienced in developing trading systems directly connected to gateways to exchanges” said Mr Dolgov.

“He was a very successful competitor for HFT companies using automated trading robots located directly on exchanges. His trading systems were successful for several years and modern versions of the same systems are still in use today” he explained.

One of the key factors that causes smaller brokerages not to be able to manage their execution as well as could be the case is that many, especially those using completely outsourced technology including the MetaTrader platform, is that many brokerages have been established and operated over recent years by individuals or entities that do not come from a technological background, yet this is a highly technology reliant business.

The instant availability of MetaTrader 4 which by default ensures that many white label brokerages have no intrinsic value due to their entire set of intellectual property being on MetaQuotes’ system rather than theirs, creating a gulf between sales and marketing divisions, and the off-site technology.

“Very few brokers want to invest in technology, as many come from affiliate marketing or sales backgrounds rather than financial services” said Mr Dolgov.

“Traders these days are not the same novices that they were in 2004 when MetaTrader gave rise to an entirely different market and brought in people who would never have traded before. MetaTrader 4 remains the most simple platform for starting to trade and MetaQuotes develops very good instruments for traders. They concentrated on a community for traders, but they are not developing enough tools for brokers such as risk management, collecting data from trading servers and even trading platforms” said Mr Dolgov.

“At this point, we support MetaTrader 4 and MetaTrader 5, and it is not important for us how many trading servers are at a broker, as we can connect Broker Pilot to any number of MT4 / MT5 servers and collate data into one big picture” he explained.

“Now we have plans to use smart technologies that are available in Broker Pilot to detect various cheaters and dangerous situations for brokers. This is very important for them as many do not understand how to create their technical topography. They know alot about how to get leads, how to sell and conduct retention marketing or branding, and many firms have very good CRM systems, lead generators, and back offices, and thus these are the most developed technical aspects in the industry and all of them relate to sales and customer service related efficiency, but there are very few highly developed systems to provide analytical info about traders and execution” he said.

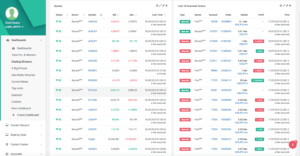

Dealers can now be supervisors rather than constantly having to react to often conflicting circumstances. “We can show full P&L in all categories, with a fully visible chart for each category of traders, those being automated robot, direct clients clients, different regions, account groups, and symbol groups on MetaTrader 4 and 5 platforms” explained Mr Dolgov.

“With our system, you see a real time picture, a genuine current situation that a dealer in a brokerage can see on a real time basis. Dealers can see any dangerous things that can happen right now, and act appropriately” he explained. Our system shows a list with the instruments and open trades with the biggest exposure to the broker listed at the top of the list, and also dealers can look at a per-customer breakdown or aggregated exposure for a particular instrument so it saves a huge amount of time for each dealer” he said.

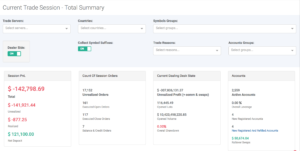

P&L trade session history

“Broker Pilot displays the trade history for any particular account including net volumes, created data of margin requirements, actual leverage ratios and a dealer can make a decision to hedge the account on A book within an instant. I hope that in future we can develop some smart tools to make this happen automatically to take action on behalf of the dealer. In most cases, the dealer wants to see these issues and react manually – we now give them the opportunity by being able to see cheaters, scallpers or toxic HFT traders. Broker Pilot also shows invalid balances, and breaks this down into absolute granular data for last 20 dealing issues which the system picks up, and last 20 robot actions which the system flags up on a per-server basis” he said.

“Leverage control can be automated, and this can be automated for part of accounts, and part of some larger accounts can be controlled manually. This allows real time control of trading and real time alerts. If, for example, I see no order execution for 2 minutes, it means that the execution feed is not functioning and you have to ask your LP about it and get it repaired immediately” explained Mr Dolgov.

“We also we have the Broker Pilot API so that all this data can be used for additional systems for brokers if they need the data on their own system, then brokers can use the Broker Pilot API. This provides information on volume sentiment which collated from all servers at all brokers using MT4/5 to show who is doing what over a long time across the entire retail FX business an multiple brokerages” he said.

“Some larger brokerages have asked us if they can obtain this information for data centers. They usually buy analytical systems to analyze their big data. We can now give access to real time data to analyze it, and to use to decide whether to hedge accounts. This way, brokerages do not need to ask their own IT department to change something in the system as they would only need a UI to change any setting on the system. Brokers can pull and drag along the bar (see chart) and it automatically sets the new parameters across all trading servers” said Mr Dolgov.

“This means that brokers do not need to concern themselves with the dealing platform’s operational functionality and limitations. They just need to implement a few simple rules. Dealers are not programmers, thus ergonomics is the key to their own efficiency, therefore they just need to use this API to connect” he said.

Weeding out the disruptions and HFT toxic flow

“The same applies to the monitoring of scalpers and HFT activity. Broker Pilot flags up any cheating. For example, during the news, when spreads widen, if a client has a standard account and wishes to use that opportunity to cheat, the system will notify the dealer immediately. If something untoward happens in the market, the software automatically notifies what it is- for example no liquidity on EURUSD. Dealers can see this on a fully comprehensive menu.”

“Brokers can check any trade on history data. If you want to search block trading on accounts, you can check the history to show you when it occurred, and from where, from all trading servers and all customers, can then find out if there is a specitic trader who is making arbitrage and not trading ethically, it will display the actual trader who is doing so and will display the order number of each HFT order” he said.

“Our platform stands between IT and dealers which is why it is very easy to customize by dealers. Dealers do not need to know specific data about MT4. If you see a MT4 manager or administrator, they have specific methods of creating new account groups, or trading conditions. This is standardized in Broker Pilot. Many firms did not see the inherent instability in many of their trades before using Broker Pilot. A big surprise for one of our clients was when we noticed a difference of a very significant amount of margin deposited with a broker which is a business critical error” explained Mr Dolgov.

FinanceFeeds at that point posed the question that if dealers are doing their job more efficeintly, what will prime of prime brokers do? Will they reject orders?

Mr Dolgov replied “Right now we cannot control what happens with aggregated liquidity provided to a retail broker. We have to use practical solutions with each prime of prime. This is a very complex issue and in our plans is creating an additional product with which we can control all flow of execution and toxic traffic, we can then stop the traders engaging in toxic traffic automatically. We have to built filters for toxic traffic. Prime of primes should be happy that this is being used to refine execution practices within retail brokerages which in turn should improve their relationship between broker and prime and prime.”

“Many B book brokers should get more relationships with prime of primes” said Mr Dolgov. “This way, they can offer properly managed liquidity to clients. Banks want to use technical data from Broker Pilot about toxic trafiic. If for example, I am a broker who is using an A book method only for specific accoints, then this is not a main core business for banks. We can build a very smart solution for them in this area. We have to change the conditions of it. For example, I want to analyze total trading volumes including money flow in P&L, I then have to separate buy and sell toxic volumes on the different hedge accounts. We have to change our approach. If we can build a system that makes money based on our own trade anchor, then that is ideal” – Valery Dolgov, CEO, IndigoSoft

“We are currently creating a neutral network and want to work with that network toward providing information on the behavior of cheaters, arbitrage traders, traders taking bonds from one account to another, operators of pump and dump schemes. It is a very interesting task for us as IT specialists in this area as we are creating an AI solution to detect a very complex behaviroal patterns of traders it is the higher level of dealng control in the brokerage buisness” enthused Mr Dolgov.

“I recently had conversation with the chief dealer of a large well known brokerage. Right now they are evaluating the demo system and we will look to implement Broker Pilot across all systems. This is a very good proof of the system’s functionality for us. Previously, if I had to be a proactive dealer, I would have had to go through my own thoughts and several processes to find these trades. Now I can just wait for issues from the software and adjust to accomodate, and it sets this across all servers. Dealers can see all the last dealing issues and robot actions, any warnings and alerts with full details next to them” he said.

“Within 10 seconds, a broker can see every exposure, every winner/loser biggest winner/bigget loser, all unrealized profit, all net volume, and there is no need to analyze huge reports. It is important to have a very quick view for all of this information, because without it dealers have to waste a lot of time getting reports which takes several minutes by which time traders have taken more advantage.”

“We have been asked to make a custom setting by one broker on dangerous clients who will try ot use partner programs. I know of one broker which had this system not developed correctly, and in the partner program a lot of volumes were generated with no profit for the company. Most brokers have to wait far too long to analyze – monthly reports, it can be hundreds of thousands of dollars or more. Partner program can be misused – One firm in the US had experienced a lot of cheaters that try to built very big networks in affiliate programs, and a broker cannot realize it immediately. You have to detect unusual behavior and usually affiliate networks are left alone to generate revenues. It then gets looked at on the system and brokers see volumes being traded, but abusers can exist in large networks and often look toward affiliate programs to do en masse abuse. Brokers dont notice it – they see volumes mounting up from it, but then because of large scale abuse, no profitability can be gained from these groups” said Mr Dolgov.

“Stakeholders can get all their information from one central platform They can come to a meeting with their laptop and get all the metrics in one go with Broker Pilot installed can monitor the broker remotely in a very granular fashion” said Mr Dolgov.

“We held a presentation of the Pilot Broker in two state regulators with the very good feedback. We continue a dialogue with them on the implementation of the system from the side of the reporting. On one hand, this is a software for brokers, however regulators can use a system of this nature, because brokers need to have certain systems to make reports to the central bank if they want to be regulated” said Mr Dolgov.

“Any regulator or central bank can get their own version of Broker Pilot to be able to automatically see parameters. Without Broker Pilot it is very hard for the regulator to obtain certain parameters about broker and trading activity. This can be piloted by any regulator in any region and then rolled out in other regions such as Europe where reporting to regulators is a very important part of the FX industry’s daily remit” said Mr Dolgov.

Indeed, we are only aware of one other regulatory authority which has a fully comprehensive trade analysis and real time surveillance system from a specialist software provider, and that is the highly well regarded Australian Securities and Investments Commission (ASIC) with their First Derivatives system.

QED.