Which region tops illicit Bitcoin activity? Yes, it’s Europe – by FAR

Roughly a quarter of all incoming transactions went into Europe in 2015 and 2016, but 38 percent and 57 percent of all illicit transactions, respectively, went to European services during those years. Thus, Europe hosted a disproportionate amount of illicit activity compared to any other region of the world

The association of peer-to-peer cash settlement systems being abused for the purposes of fraud, money laundering and attempts to circumvent the bona fide financial system with regions of the world that are unaligned with established financial markets centers, or home to a large percentage of the general public with no access to a bank account is a common one.

It is, however, misguided when considering recent research by a non-government think tank, the Center on Sanctions & Illicit Finance into the unlawful activities committed by users of digital assets.

The research, which has been conducted over a number of months this year, of which FinanceFeeds has a complete hard copy, made an analysis of illicit flows into digital currency services, looking at how criminals – often early adopters of new technologies – quickly appreciated that Bitcoin has unique properties that could potentially serve their interest in evading law enforcement. Users of Bitcoin employ pseudonyms rather than real names (think back to Dread Pirate Roberts aka Ross Ulbricht, one of the first notorious Bitcoin criminals) and it can be transferred without intermediaries and across international borders as easily as sending an email.

However, what we know about Bitcoin’s illicit use is mainly based on anecdotal evidence, usually without supporting data, analysis of how it is used across geographical regions, or trends over time. While it is impossible to quantify exactly how much bitcoin is used illicitly, analyzing the laundering of bitcoins (where it can be identified) gives insight into criminals’ methods for hiding their illicit proceeds.

Indeed, various criminal cases have materialized in South East Asia and the Middle East, Russia and by former residents of the United States who realized that their activites would not be welcome in the most civilized and well organized nation on earth, thus operating from offshore bases before being reeled in by the law enforcement agencies. Silk Road’s demise several years ago is a prime example.

This is all very self-explanatory, however the research conducted by the Center on Sanctions & Illicit Finance has unearthed some very interesting statistics which demonstrate that it is not just offshore chancers with a stealthy profile, or South East Asian upstarts with unscrupulous short term business plans that are responsible for fraud fueled by the use of peer to peer digital currency.

To provide a more rigorous assessment of Bitcoin and its use in illicit finance, the Center on Sanctions and Illicit Finance, a program at the Foundation for Defense of Democracies, teamed up with Elliptic, a cryptocurrency analytics provider, to study Bitcoin blockchain data and illicit inflows into digital currency services.

The study provides insights for policymakers and financial industry leaders who want to better understand illicit finance risks arising from Bitcoin and formulate ways to enhance Anti-Money Laundering and Combating the Financing

of Terrorism (AML/CFT) compliance among cryptocurrency businesses, hence is credible and intended for use by government officials and financial services executives when defining commercial and national policy.

Through extensive analysis of a narrow data sample of Bitcoin transactions between 2013 and 2016, this study identifies trends in the flow of bitcoins from clearly identified illicit activity to various digital currency conversion services.

Here is the shock – Europe receives greatest share of illicit Bitcoins

Europe, a traditional and bureaucratic, highly established region of the world whose population is absolutely aligned with the banking system, and is subject to stringent identification and money laundering regulations, inhabited by generally speaking, a population of law-abiding citizens with traditional jobs, is the region with the highest flow of illegal Bitcoin activity.

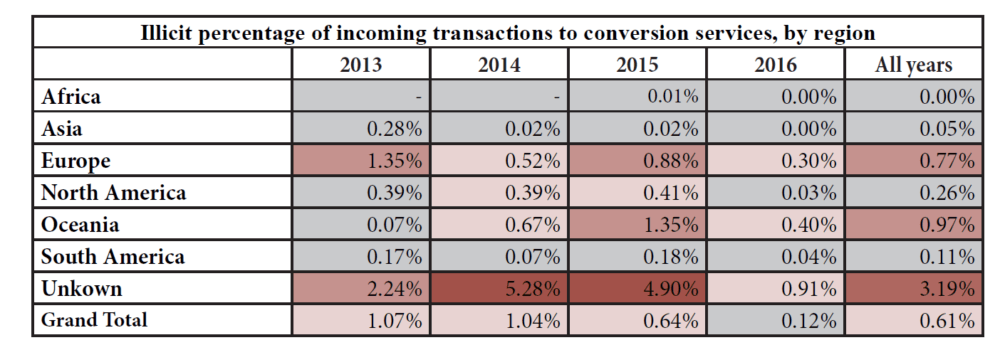

Looking at geographic patterns, conversion services based in Europe received the greatest share of illicit bitcoins out of identifiable regions, more than five times as much as North American services. And while Asian conversion services processed the highest share of all incoming Bitcoin transactions in 2015 and 2016, they accounted for a disproportionately small share of Bitcoin laundering during those years. Lastly, a large percentage of conversion services that receive illicit bitcoins appear to conceal their country of operations, making it a challenge to identify the legal jurisdictions responsible for their AML enforcement.

This finding was concluded by looking at platforms where users convert bitcoin to fiat currency (a bitcoin exchange) or another cryptocurrency (a crypto-exchange) or move the bitcoins to another Bitcoin address accessible to the user. This results in a flow of funds that cannot be viewed or traced directly on the public blockchain.

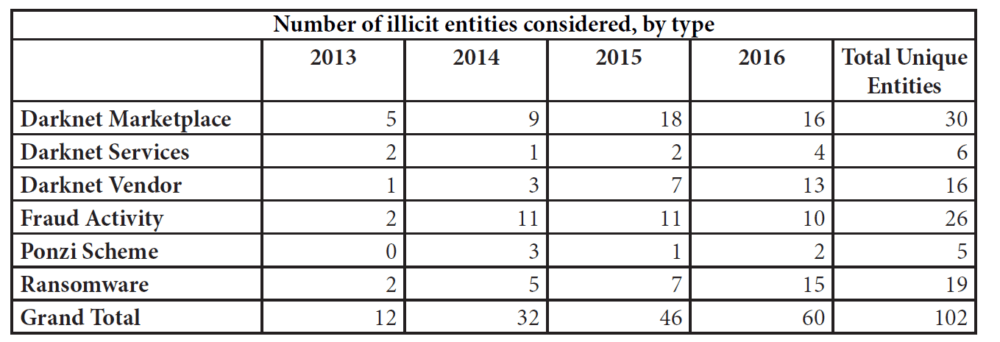

Illicit activity originated overwhelmingly from darknet marketplaces. Examples of darknet marketplaces, which became popular sites to buy and sell illegal drugs and a multitude of other illicit items and services, are Silk Road, shut down in 2013, and AlphaBay, shut down in July 2017.11 In 2016, a rise in bitcoins laundered from ransom and Ponzi schemes came from the Locky RansomWare attack and the OneCoin scheme, respectively, signaling an increase in this type of activity that continued into 2017.

According to the study, the total percentage of identified “dirty bitcoins” going into conversion services was relatively small.

Only 0.61 percent of the money entering conversion services during the four years analyzed were verifiably from illicit sources, with the highest proportion (1.07 percent) seen in 2013. The 0.61 percent figure should be considered a lower-bound estimate, as we are unlikely to have identified all illicit activity in Bitcoin. The true percentage of Bitcoin laundering is likely to be higher.

Bitcoin exchanges receive 75% of incoming fraudulent Bitcoin transactions globally

Bitcoin exchange services received roughly 75 percent of all incoming (licit and illicit) Bitcoin entering conversion services in our study. Although mixers account for a small amount of Bitcoin transactions, they have a higher propensity to being used for laundering bitcoins. From 2013-15, over 20 percent of mixers’ incoming transactions came directly from illicit sources, with a sharp drop in 2016 that mirrored an across-the-board decline in the proportion of illicit transactions in the study. It is likely that illicit bitcoins fell as a percentage of total volume entering conversion services due to the cryptocurrency’s increasing popularity as a speculative investment as well as new laundering techniques. The drop may also reflect better AML/CFT compliance by conversion services, including the use of blockchain analysis services to determine customers’ source of funds.

Europe by FAR the center for crypto fraud

By comparing the percentage of all transactions versus the percentage of illicit transactions going through services on each continent, we can get a sense of where there may be an outsized proportion of illicit activity.

Asia dominates the conversion service usage in 2015-16 (with over half of our transactions going through conversion services in Asia in those years). The domination of usage plus lower fraud figure could be due to Japan’s pragmatic approach to the regulation of digital currency and its structured business environment.

However, only 1.61 percent and 1.21 percent of all laundering went through Asia in those years. Thus, though most bitcoins were entering Asian conversion services (within which, China dominates) in those years, only a very small proportion of illicit bitcoins appears to have been laundered there.

One plausible explanation for this may be that capital controls in China, in particular, restrict the ability to move fiat currency out of the country, making Chinese conversion services less attractive for transferring illicit funds.

The same cannot be said of Europe. Roughly a quarter of all incoming transactions went into Europe in 2015 and 2016, but 38 percent and 57 percent of all illicit transactions, respectively, went to European services during those years. Thus, Europe hosted a disproportionate amount of illicit activity.

who would have thought it?