Why does Apple win?

Apple’s stock has been correcting and moving sideways since the start of the year. In the past couple of months, it was under pressure just as the other tech stocks. However, traders believe that unlike other large companies, Apple will be able to emerge victorious from the current pullback. Today, FBS analysts analyze how Apple is doing and outline the most likely scenarios for this company in the future.

Influence of Chinese Covid restrictions

Apple faces some challenges when it comes to iPhone production. The company’s biggest problem is manufacturing of its flagship product in China.

While most countries have eased pandemic restrictions, China is still trying to hold to the zero-tolerance policy and, hence, is imposing lockdowns. The resulting protests across the country have led to production problems at Foxconn’s Zhengzhou, where Apple makes its iPhones. The Foxconn factory employs more than 200,000 people and provides 70% of the world’s iPhone shipments. Reports say there may be a six million iPhone Pro units’ shortage due to ongoing issues. The news sent Apple’s stock down on fears of declining profits.

To strengthen its position, Apple has already started moving production to India. The tech giant understands that worsening relations between China and the US create risks for its business. Analysts report that by the end of 2022, Apple will move about 5% of its global iPhone production to India. According to forecasts, Apple will make 25% of all iPhones in 2025. Let’s see how it turns out. For now, though, Apple is still heavily dependent on China.

Ambitious plans delay

Due to production constraints and potential profit cuts, Apple put off ambitious plans for its electric vehicle and postponed its target launch by about a year to 2026.

The car project, Titan, has been in limbo over the past few months as Apple executives grapple with the reality that their vision of a fully autonomous vehicle — without a steering wheel or pedals — is not feasible with today’s technology.

With a significant shift for the project, the company is now planning a less ambitious design that will include a steering wheel and pedals and only support fully autonomous capabilities on motorways, said the people, who asked not to be identified as the information is confidential.

Strong Apple community

Still, one of the Apple’s strongest sides is the iPhone users. The company’s efforts to consistently provide an integrated ecosystem of hardware, software, and services that delight customers has helped the company not only sell products but also build a loyal customer base across many actively used devices (over 1.8 billion as of the latest date).

Apple combines the base of active devices with the growing services business (selling both its own and third-party apps, cloud storage, AppleCare, and similar offerings). This combo acts like an engine for the firm’s development. The active, loyal subscriber base, which hit an all-time high in the company’s most recent reporting quarter, represents a monetization opportunity as Apple works to increase customer engagement over time.

Stock price is doing well

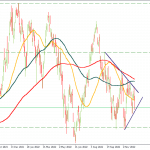

Despite many obstacles and world crises, Apple stock is doing great. Since August, the price has been staying above $135. Now the 100-period and 200-period MAs are coming closer to each other, and the price has formed a sort of wedge. Most likely, the price will continue to squeeze and then break out. If the price crosses the resistance trendline, the closest target can be $153. In case of the support trendline breakout, the price might head to $135, but not lower.

Conclusion

FBS analysts believe that compared to other tech giants, Apple doesn’t rush and thoughtfully makes new steps. The company understands that sometimes you must wait and see, and adaptations to a new reality are necessary. It seems like the company will overcome all the difficulties on its way.