Why is Ripple’s XRP so correlated with Bitcoin? – JP Morgan report answers

“From what we can tell, Ripple has been working with banks to help them build infrastructure to make cross-border payments but few are using Ripple’s actual cryptocurrency to execute them”.

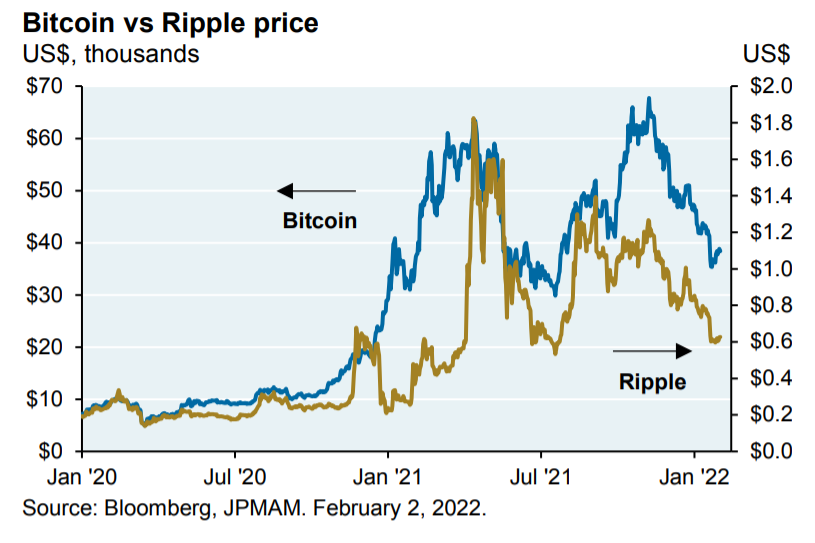

A JP Morgan report has delved into “some unanswered remittance questions”, including the Ripple effect: the blockchain specialist has connected to more and more banks but the price of XRP continues to follow BTC.

That observation remains true today as the price of Bitcoin shows signs of recovery following weeks of downward pressure. The positive mood is fueling general optimism in the cryptocurrency market, with the majority of digital assets following suit. BTC is trading at $42,700 and XRP is trading at $0.75, at the time of writing.

Few Ripple partners using XRP for cross-border payments

“Ripple reported five-fold growth in remittance transactions between 2019 and 2020. But if that’s the case, why is Ripple still trading so closely with Bitcoin, as shown below? Wouldn’t Ripple’s separate and distinct use case result in a separate and distinct return profile from Bitcoin?”, questioned Michael Cimbalest, Chairman of Market and Investment Strategy at JP Morgan Asset Management.

The answer may come as a surprise, but it seems that most financial services firms are not using Ripple’s XRP to execute cross-border payments.

“From what we can tell, Ripple has been working with banks to help them build infrastructure to make cross-border payments but few are using Ripple’s actual cryptocurrency to execute them”.

Why aren’t they powering payments with XRP?

The follow-up question is why Ripple’s network has not moved to XRP as its standard process for executing cross-border payments?

The JP Morgan report doesn’t answer that question, but there is more than one potential reason for the slow institutional adoption.

First, processing speed. The report includes an image sourced from a November 2020 document by Zorba et al, at Hacettepe University, with the capabilities of some distinguished financial infrastructures.

While Bitcoin and Ethereum execute 7 and 15 transactions per second, respectively, Ripple executes 1,500, which makes it a clear winner against, for example, EOS and its 8,000 transactions per second.

Ripple, however, still pales against established infrastructures like VISA and Paypal, according to the figures provided. VISA executes 45,000 tps and Paypal executes 56,000 tps. This only goes to show that Ripple still has many established competitors in the cross border payments technology space. Those figures, however, were obtained in November 2020. A lot has happened since then.

Another potential reason for the slow adoption by Ripple’s banking partners could be the SEC v. Ripple lawsuit. The court case has been hurting XRP holders for a long time, but Ripple has kept going and plans on doing so until the bitter end.

Throughout the lawsuit, Ripple has successfully established new partnerships and launched new products, so it is clearly being able to continue to grow its network and business. That, however, doesn’t mean that XRP is being used by Ripple partners to perform transactions.

The expansive network of Ripple partners may be waiting for the lawsuit to end in order to use XRP without any fear of regulatory issues either with the US SEC or a local regulator that chooses to follow the SEC’s footsteps.

The XRP lawsuit has most recently saw the court denying Ripple’s request to seal a few exhibits that the SEC plans to use as evidence against Ripple. Attorney John Deaton praised the return of Judge Analisa Torres and her public disclosure policy as a “good sign” for XRP holders.

The evidence against Ripple made public was analyzed by attorney Jeremy Hogan, who ironically said he hopes the SEC has better evidence than these two documents.

One of the exhibits made public is an email chain between Chris Larsen and an XRP holder about the price dynamics linked to Ripple’s expanding network. The counterpart is a Portugal national residing in Portugal, which is likely to mean this email exchange is outside the scope of the SEC even if the court found XRP was marketed as a security.