Wikipedia ‘moderators’ interfering with facts about FXCM are blocked as editors – FinanceFeeds research

Wikipedia blocks paid moderators who are actively working for FXCM to adapt facts in impartial online encyclopedia

It has been quite some time since regulatory authoriites in the United States embarked upon an activity that would change the face of the entire retail FX business in North America, that being the ban which was imposed on FXCM and its senior executives, removing what was one of the world’s largest and most widely renowned retail electronic brokerages from its home market.

Today, FXCM is not much more than a shell, its metamporphosis into Global Brokerage Inc having decimated its standing everywhere in the world, with the exception of mainland China, where FXCM is still a major retail FX tour de force.

FinanceFeeds has, during the course of the chain of events that ensued, documented the litigation, corporate direction and series of occurrances that have formed the vast and detailed aftermath of the dismantling of the firm in its original format, and today, further aspects of interest have arisen.

These days, corporate image via online visibility is a very considerable factor for business across all sectors, especially for those with an international audience and a product which is provided and serviced online.

Today, FinanceFeeds spoke to a Wikipedia editor in Europe, who provided full details of his pseudonym and professional remit within Wikipedia’s moderation team.

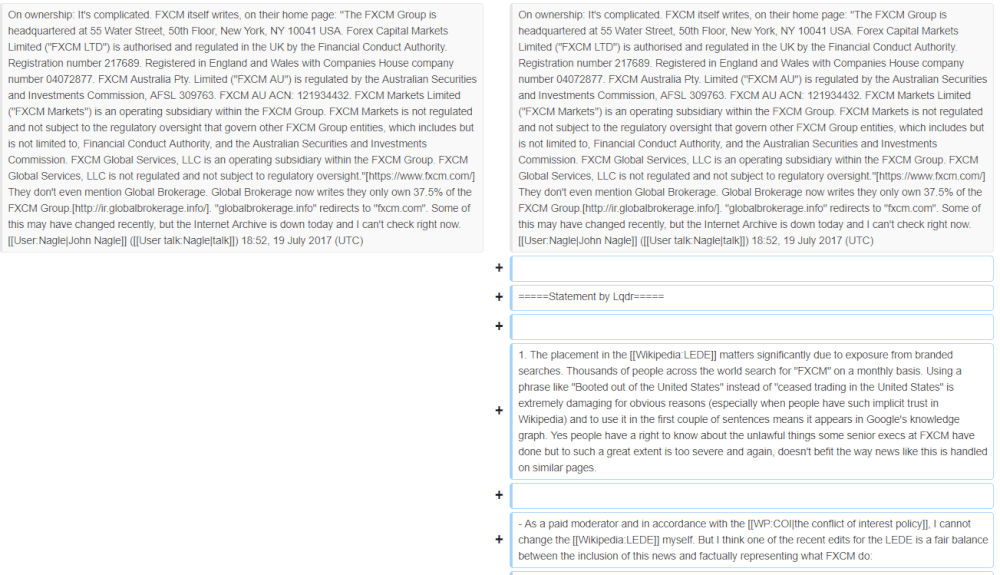

This particular editor explained that according to his findings during his daily duties, “Multiple editors from FXCM have been editing the Wikipedia article (about FXCM – Ed) and making both hidden and open denials of the facts or more usually just spinning the facts”.

The Wikipedia editor continued “They’ve been caught red handed breaking our rules and 4 of them including somebody who declared that they were a PR agent working for FXCM have been blocked from editing the site.”

According to sources within Wikipedia, one especially interesting statement from the declared PR agent, who was also a paid Wikipedia moderator at the time, is that “Thousands of people across the world search for “FXCM” on a monthly basis. Using a phrase like “Booted out of the United States” instead of “ceased trading in the United States” is extremely damaging for obvious reasons, and to use it in the first couple of sentences means it appears in Google’s knowledge graph.”

Wikipedia, according to its own records, has taken action against this and blocked certain moderators.

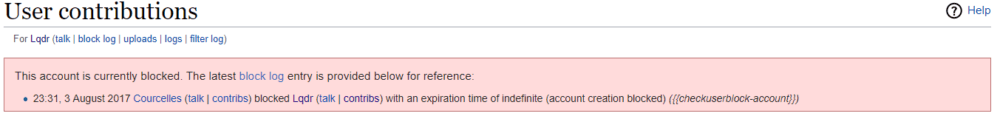

Wikipedia then put up a notice stating that the moderator in question, Lqdr, in accordance with the Wikimedia Foundation’s Terms of Use, discloses that they have been paid by Independent PR Consultant on behalf of FXCM for their contributions to Wikipedia.

“I am an independent PR consultant who is working with FXCM Incorporated on numerous freelance projects. I am interested in understanding more about Wikipedia and the governance of the WP:Policies_and_guidelines that help shape the community. Please feel free to direct message me for more information about my professional affiliation” says the statement.

When searching for the user credentials of Lqdr, Wikipedia displays a landing page denoting that the user is now blocked.

The differences between the two versions are listed here , on Wikipedia’s dispute resolution board, and indeed whilst Wikipedia has been relatively exhaustive in its procedure in dealing with this matter, it is clear that the practice is one which has prevailed.