World first: Integrated one-touch market scanner for MetaTrader revolutionizes the entire trading experience

Copy and follow trading was a Godsend to Forex brokers when first introduced because it solved two massive pains – it got investors to fund their accounts due to some misplaced trust that somebody else knew how to trade, and, it got investors active in the market almost instantaneously. Although it took them a […]

Copy and follow trading was a Godsend to Forex brokers when first introduced because it solved two massive pains – it got investors to fund their accounts due to some misplaced trust that somebody else knew how to trade, and, it got investors active in the market almost instantaneously.

Although it took them a while, regulators did finally come through to protect retail traders from these platforms. To make matters even worse for Copy/Follow platforms, MetaQuotes put the nail in the coffin by releasing their own signal center.

This turn of events has left a gap in the market for a technology that can try and fulfil this need that is no longer filled by Copy/Follow.

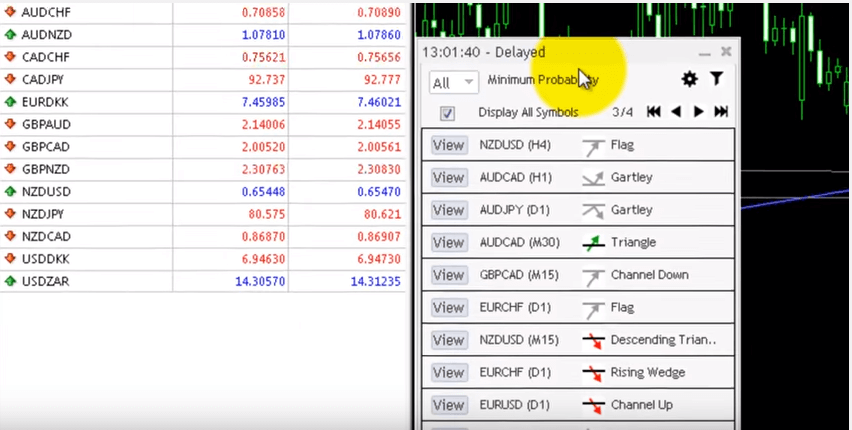

In this article, we break the news of a new technology, to be released to the public this week that aims to fill this void. In fact this exact solution comes from Autochartist.com that is about to release the world’s first market scanner embedded into the MetaTrader platform.

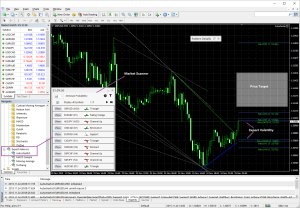

The tool comes in a form of a window, embedded into MetaTrader, that shows trading opportunities across all currency pairs and time intervals. No external websites, no DLLs. Just one Expert Advisor.

Let’s forget about the technobabble for a moment and look at the value-proposition: Any MetaTrader broker can now provide trading opportunities to their retail customers by simply dragging and dropping an EA onto a chart. From the retail traders perspective: they are getting trade setups from a well trusted brand, and from the broker’s perspective, the trader is getting notified of multiple trading opportunities directly inside their execution platform – which should dramatically reduce the analysis-to-execution cycle.

With customer retention being a somewhat double-edged sword these days in that novice traders which do not succeed within their first few months of trading tend to exit the market altogether, and retail FX brokerages continue to experience ever-increasing customer acquisition and retention costs, thus no entity wins, it becomes imperative for brokers to provide high quality and effective tools which not only bring simplicity to a new trader’s operating environment whilst assisting their success.

This is probably the most innovative and useful piece of technology I have seen in years.