Worldpay to end referral arrangement with RBS

Under the arrangement, RBS exclusively refers potential clients to Worldpay UK, and Worldpay UK sells Worldpay-branded merchant acquiring and related services to these referred clients.

Payments technology company Worldpay Inc (LON:WPY) is about to end a referral arrangement with The Royal Bank of Scotland (RBS). In a filing with the London Stock Exchange, Worldpay announces that Worldpay (UK) Limited and RBS have agreed to terminate their referral arrangement during 2019.

Under the arrangement, RBS exclusively refers potential clients to Worldpay UK, and Worldpay UK sells Worldpay-branded merchant acquiring and related services to these referred clients. Following the conclusion of the arrangement, Worldpay UK will continue to own the merchant acquiring relationships for its existing portfolio of clients that were previously referred by RBS.

Worldpay expects this agreement to have an immaterial impact on its operational and financial results. Worldpay operates multiple direct and referral-based distribution channels within the United Kingdom (U.K.) as well as globally. In 2017, RBS provided referrals that generated approximately $4.8 million in annualized net revenue from new sales or approximately 0.1% of Worldpay’s annualized total company net revenue.

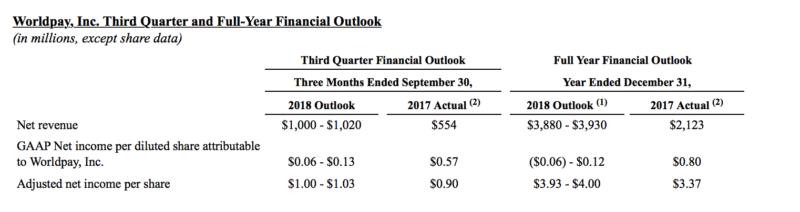

Worldpay expects its previously provided 2018 net revenue guidance to be unaffected by this announcement and for the impact on future revenue expectations to be immaterial.

Let’s recall that, in August this year, the company revised its revenues and earnings outlook for the full year. Back then, Worldpay said it was increasing its financial guidance.

“We are raising our net revenue and adjusted earnings guidance ranges for the full year 2018,” said Stephanie Ferris, chief financial officer at Worldpay. “We expect the accelerating organic growth trends that we achieved during the second quarter to continue for the rest of the year, and we are increasing our organic revenue growth expectations by one point for the full year with a partial offset due to currency. In addition, we continue to carefully manage expenses, resulting in further earnings accretion.”