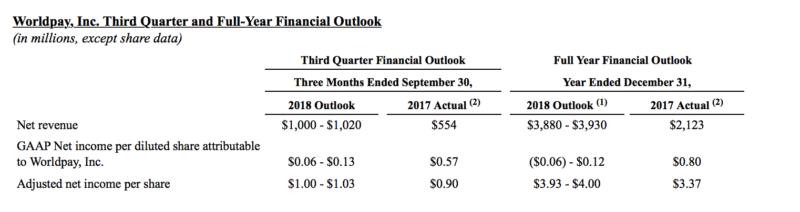

Worldpay raises revenue guidance range for FY 2018

The company is increasing its organic revenue growth expectations by one point for the full year with a partial offset due to currency.

Payments technology company Worldpay Inc (LON:WPY), which was formed in January this year through Vantiv, Inc.’s acquisition of Worldpay Group plc, has just posted its financial results for the second quarter of 2018, with the company also revising its revenues and earnings outlook for the full year.

In its filing with the London Stock Exchange, Worldpay said it was increasing its financial guidance.

“We are raising our net revenue and adjusted earnings guidance ranges for the full year 2018,” said Stephanie Ferris, chief financial officer at Worldpay. “We expect the accelerating organic growth trends that we achieved during the second quarter to continue for the rest of the year, and we are increasing our organic revenue growth expectations by one point for the full year with a partial offset due to currency. In addition, we continue to carefully manage expenses, resulting in further earnings accretion.”

Regarding the financial metrics for the quarter to June 30, 2018, the company said its net revenue increased 90% to $1.0 billion as compared to $530.0 million in Vantiv Inc.’s prior year period. Had the Vantiv Inc./Worldpay Group plc transaction closed on January 1, 2017, net revenue would have increased by 11% on a pro forma basis and by 9% on a pro forma constant currency basis as compared to the prior year period.

On a GAAP basis, net income per diluted share attributable to Worldpay, Inc. decreased 102% to $(0.01) as compared to $0.42 in the prior year period. The GAAP loss was attributed to transition, acquisition and integration costs and intangible amortization incurred in connection with the Vantiv, Inc./Worldpay Group plc transaction.

Adjusted net income per share increased 25% to $1.04 as compared to $0.83 in the prior year period.

“Just two quarters after closing the Worldpay transaction, our combination is already delivering superior results through accelerating organic revenue growth and significant earnings accretion,” said Charles Drucker, chairman and co-chief executive officer and Philip Jansen, co-chief executive officer at Worldpay. “With our leading global ecommerce and integrated payments capabilities, we are uniquely positioned to capitalize on the most significant areas of secular growth across the payments industry.”

Adjusted EBITDA was $492.9 million or 49.0% of net revenue in the second quarter of 2018, representing 70 basis points of margin expansion as compared to Vantiv, Inc. results on a stand-alone basis in the prior year period. Had the Vantiv, Inc./Worldpay Group plc transaction closed on January 1, 2017, Adjusted EBITDA margins would have expanded by 160 basis points on a pro forma basis over the prior year period.

The merger of Worldpay Group PLC with Vantiv and Bidco (a subsidiary of Vantiv) became effective in January this year. The deal was agreed in August 2017. Under the terms of the deal, Worldpay Shareholders receive approximately 420 pence per Worldpay Share.