Worried about MiFID and Dodd-Frank, or an international OTC crackdown? Try hosting your FX firm on the moon

We take a look at how a new initiative by a space start up could open up huge business opportunities and disrupt the current ‘global’ commercial environment for electronic trading firms who could literally avoid all bureaucracy by hosting on the moon

Ever since the ability to operate an entire online business and all its integrated components without having physical infrastructure on site has existed, the world’s national boundaries have become less relevant and the world has got exponentially smaller from an economic and commercial perspective.

In 1991, when my career began as an intern/apprentice systems engineer at the institutional FX and electronic trading infrastructure company that is now BT Radianz, the IBM Middleware servers were as large as the entire office of many brokerages of today, yet had less capacity and lower performance than a modern iPad.

Data was transmitted via BNC connectors at just 10 megabytes per second, used now long-defunct baseband signalling, and had a maximum segment length of around 185 meters.

Infrastructure of this gargantuan physical size, that produces so little, so slowly, is anathema to today’s world of cloud hosting and lightning fast data transmission.

In retail FX, it is entirely possible, via specialist integration solutions from dedicated companies Gold-i, PrimeXM and oneZero, for brokerages to manage their order flow, determining which orders to send to liquidity providers and which to conduct internal risk management, with absolute millisecond-specific precision, all by connecting a MetaTrader platform via a single API and without a visit from any hardware engineers.

This applies to hosting, payment solutions provision, back office and CRM systems, and of course the trading platforms themselves.

Whilst the reduction in use to almost complete obsolescence of physical and localized infrastructure has created a very practical means for brokerages to operate extremely efficiently and scale their businesses internationally across several, very different regions – including mainland China with its own internal internet system – all of which have very different consumer requirements and regulatory remits, recent motives by regulatory authorities that are now very much au fait with the electronic nature of the financial markets have demonstrated that whilst the FX and multi-asset trading business has globalized, borderless capacity, so do the powers that be.

The imminent introduction of MiFID II, a Europe-wide directive that will address every aspect of the infrastructure around which brokerages MTFs and listed derivatives venues are based, the seven-year old Dodd Frank Wall Street Reform Act in North America, and several Memoranda of Understanding (MoU) between governments and financial markets regulators from Hong Kong and Singapore to Canada and Australia with the main British, American and Japanese establishment that overseas the vast majority of retail OTC and listed order flow, now shows that quite simply, a ‘one-world’ approach is in place.

This is all very well, and FinanceFeeds is absolutely in favor of stringent regulation relating to technological infrastructure and how it is used in order to provide high quality execution and thus future-proof the retail FX industry as a long-standing and respectable global business led by very astute and experienced leaders that continue to strive for excellence, however in a perfect world, where competition views the OTC retail electronic trading business as an equal to the decades-established listed derivatives venues, all would be well indeed.

With lobbyists in Chicago and London continuing to bear down on the regulators, creating some very difficult proposed conditions for core business aspects of very widely renowned companies, a prime example being the proposed CFD reforms by Britain’s Financial Conduct Authority (FCA), which is clearly an attempt by the exchanges to onboard as many retail clients as possible, something that they would not be able to do on their own merit, due to the far greater aplomb displayed over the past 30 years in innovation and market dominance by the far more attractive domestic OTC companies.

FinanceFeeds has investigated that dynamic in great detail and the continued interest in chipping away at the OTC market by exchanges makes the giants’ intentions clear.

The question is, with the world now completely sewn up by globalized regulators, lobbyists and directives, where is there left to go?

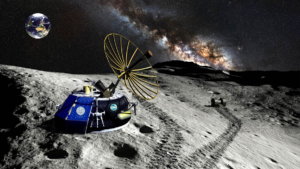

The moon – that’s where!

It may appear banal, and, if you’ll excuse the pun, other-wordly, but indeed it is just that.

In North America, for example, it is illegal for firms based outside the National Futures Association’s federal United States jurisdiction to approach and onboard citizens of the United States as retail customers, however the remit states “world”, meaning that if a firm approaches the same customers from outside this particular planet, where does the law stand?

The same applies to all of the other global infrastructure directives , FX codes and lobby attempts by governments.

Global means global – not intergalactic.

This week, from the nation which put the very first man on the moon in 1969, progress has been made by a company with its operations on NASA’s doorstep at Cape Canaveral, Florida, to place commercial infrastructure on the moon.

Next year, a startup called Moon Express, which currently has 30 employees, aims to be the first private entity to put a small robotic lander on the moon. It is investing at least $1.85 million to renovate decades-old buildings at Cape Canaveral, and is transforming a parking lot into a miniature moonscape, and will also set up an engineering laboratory, a mission operations room and a test stand for spacecraft engine firings.

That may appear very kitch and a somewhat naff attempt at gaining attention, and yes, it would be if it were not that the company has already developed systems that will be able to operate commercial infrastructure from 120,000 miles away.

Unlike other banal ventures which these days are the darling of ICO fraudsters and disingenuous ‘inventors’ with a product which resembles the Emperor’s new clothes, this particular system is a topic of research and discussion among very senior academics at some of the world’s most distinguished universities.

“Before it was something really, really hypothetical,” said Fabio Tronchetti, a law professor at Harbin Institute of Technology in China. “But now there are groups that are really serious. It changes everything.”

Robert D. Richards, Moon Express’s chief executive — whose business plan is “to expand Earth’s economic sphere to the moon and beyond” — is far from the only entrepreneur looking for business opportunities beyond our planet.

Elon Musk, the billionaire founder of SpaceX, boldly proclaims that his company will begin sending colonists to Mars in a decade. Jeffrey P. Bezos, the founder of Amazon, is using part of his fortune to finance his rocket company Blue Origin, and predicts millions of people will be living and working in space.

As these companies go where no businesses have gone before, they raise questions only fuzzily addressed by the Outer Space Treaty: What are private companies allowed to do in space? Can a company mine the moon or an asteroid and then sell what it has pulled out? How are countries to regulate these businesses?

Internationally, countries have been discussing how to answer these questions. In the United States, Congress has begun tackling regulatory issues. Some warn that if the United States does not set up business-friendly policies, then the start-ups could move elsewhere — including such seemingly unlikely places as Luxembourg.

This highlights the exact advantage, that being that nobody ‘owns’ or has colonized the moon. No nations exist and no man-made boundaries and legal jurisdiction exists. If the government of a major country attempts to legislate, it will not be able to do so, because the moon is not under any jurisdiction and it would take conquering, colonization and legislature to be able to do so, all of which is virtually impossible in an environment completely unsuitable for human habitation.

Moon Express ran into a bureaucratic wall initially, because the treaty declares that activities of nongovernmental entities — a classification that includes commercial companies — “require authorization and continuing supervision” of the government. The United States had insisted on the clause, rejecting the Soviet view that space exploration should be limited to governments.

“We had a mission planned, we had investors invested, but didn’t have a way forward at the end of 2015,” Dr. Richards testified during a Senate committee hearing in May. “There wasn’t anybody that didn’t want to say yes. There was just no mechanism to do so.”

The Federal Aviation Administration licenses rocket launches and re-entry of commercial spacecraft from orbit in order to ensure the safety of people on the ground. The Federal Communications Commission regulates communications satellites, and the Department of Commerce regulates commercial remote sensing satellites.

For those with a very good business ethic, who wish to avoid the closing of opportunities or being bullied by the establishment, this is perhaps a small glimpse into the future.

The Germans laughed when America began developing electric cars. “Milk floats!” they jeered. With Tesla producing 700 bhp performance cars that are ultra modern and can outpace most of the traditional products whilst using no fuel whatsoever, it is no longer funny in Stuttgart or Munich.

This could well be the case if infrastructural innovation goes stratospheric in the financial sector – literally!