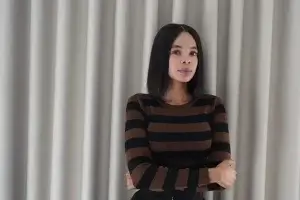

XS.com hires Chanelle Tsoka to head South Africa operations

XS.com, the multi-regulated financial services provider, has appointed Chanelle Tsoka as its new country director in South Africa.

Chanelle has accumulated more than 10 years of experience in the FinTech and online trading industries, having held senior roles at several FX brokers in the country. Through her diverse background, she worked as General Manager at AvaTrade. Most recently, Chanelle ended a short stint as Head of Sales- South Africa at Scope Markets.

In her new role, Chanelle will be tasked with overseeing the company’s regional operations and will be responsible for many functions including business development, customer service, and marketing affairs.

“We are excited about this new chapter for the XS.com Group. I cannot think of anyone more suitable than Chanelle to join us on this next step in our journey to become the leading, global online trading brokerage.” said Mohamad Ibrahim, Group Chief Executive Officer (CEO) at XS.com about the firm’s new hire.

He continued: “Chanelle will be responsible for overseeing all aspects of our operations for this important part of the world, including developing and executing our strategic plan for South Africa – ensuring it is in line with XS Group’s overall objectives. She will be in charge of identifying new business opportunities, building relationships with local partners and stakeholders, as well as ensuring that XS.com’s products and services meet the needs of the local market.”

Chanelle Tsoka XS.com’s new South Africa Country Director commented on her joining the firm:

“I am delighted to be joining XS.com as the brokerages new South Africa Country Director. This is an exciting time for the country and the XS Group as South Africa is a large and growing market with the most developed economy on the African continent and a population of over 60 million people. As the new Country Director I will be ensuring that XS.com provides excellent customer service and trading support to our clients in South Africa and across the continent.”

She continued: “I’m excited to be leading our local team and monitoring our local metrics to ensure we deliver our services effectively and efficiently to suit our growing regional client base.”

XS Group is a multinational fintech and financial services provider with entities authorized in various jurisdictions around the globe.

Founded in 2020, XS.com was originally founded in Australia before relocating its headquarters to Cyprus. The broker is authorized in Seychelles while its institutional arm, XS Prime Ltd, is regulated by the Australian Securities and Investments Commission (ASIC).

Forex brokers in South Africa are overseen by the financial sector conduct authority, FSCA, which approves the platforms that can operate within the jurisdiction. The powerful watchdog handles the issuance of licenses and can sanction companies that violate guidelines of the nation’s dual regulation system.

South Africa enjoys a strong and well-organized financial market and therefore has become a popular destination for brokers looking to expand. It is one of the world’s top ten capital markets and boasts thousands of investors. The country itself is a diverse market that is largely devoid of the market saturation seen in other jurisdictions such as Europe.

The country’s resource-rich economy is heavily reliant on financial services and its appeal as a business hub only increases as there are almost no competing financial centers in the south part of the black continent.