XTB acquires FSCA license to operate in South Africa

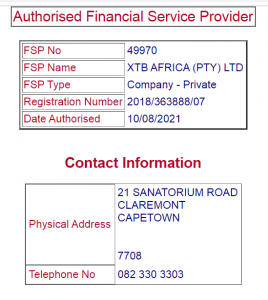

Polish FX brokerage, XTB has acquired an FSCA license in South Africa and is now authorized as a Financial Service Provider locally.

The addition of this coveted license extends the group’s regulatory arsenal to include regulated companies authorised by CySEC in Cyprus, KNF in Poland, the DFSA in Dubai and FCA in the United Kingdom.

Registration with the regulatory body will allow ‘XTB Africa (Pty) Ltd’ to operate as a financial service provider in the country, which the company cited as an important region for strategic expansion.

XTB has recently announced plans to expand its brokerage business to meet its growth targets for 2021. The publicly-listed broker wants to onboard an average of 30,000 new customers in each quarter in 2021. The average number of active clients on the platform was 40,623 as of Q2 2021, well below the 67,231 clients it onboarded in the previous quarter, or 40 percent QoQ.

XTB’s subsidiary in South Africa has been in the licensing process for more than two years. The new license will allow XTB to provide its range of FX and CFDs products to retail and professional clients not only from the South Africa but also to expand the offering to the other African countries.

Forex brokers in South Africa are overseen by the financial sector conduct authority, FSCA, which approves the platforms that can operate within the jurisdiction. The powerful watchdog handles the issuance of licenses and can sanction companies that violate guidelines of the nation’s dual regulation system.

Earlier this month, XTB reported its final results for Q2 2021 ending June 30, 2021. Compared to a solid performance during the first quarter, where the industry players broadly saw another boom in retail trading due to coronavirus, XTB revealed a drop in trading activity on the back of less volatile financial markets.

During Q2 of 2021, XTB disclosed a total operating revenue of PLN 55.1 million ($14.3 million), which dropped against the PLN 188 million it reported in the first quarter. Taking a half-year perspective, XTB revenue nearly halved in the six month through June 2021, coming in at PLN 241 million relative to PLN 518 million in the same period a year earlier.