Yen trader who “ran the biggest financial conspiracy” has his conviction upheld by court. Result: 11 years worth of porridge

City of London trader Tom Hayes has been a prominent figure among many news sources recently as a result of the controversial ruling against him in August in which he was found guilty of eight charges of conspiracy to defraud for his part in the LIBOR rate rigging scandal, consigning him to 14 years in […]

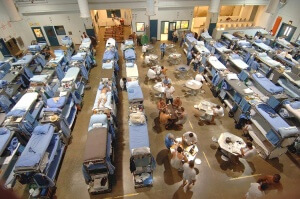

City of London trader Tom Hayes has been a prominent figure among many news sources recently as a result of the controversial ruling against him in August in which he was found guilty of eight charges of conspiracy to defraud for his part in the LIBOR rate rigging scandal, consigning him to 14 years in jail.

Despite the furore among industry professionals, some of whom include those who have personal experience of being in Mr. Hayes’ position such as former Barings trader Nick Leeson, who described the sentence as being too harsh, the Court of Appeal has upheld the conviction against Mr. Hayes, who now faces spending the next 11 years at Her Majesty’s Pleasure.

Mr. Hayes, who had worked at Citi and UBS previously as a yen derivatives trader, attended his appeal case, during which the judge concluded

“This court must make clear to all in the financial and other markets in the City of London that conduct of this type, involving fraudulent manipulation of the markets, will result in severe sentences of considerable length.”

Just three weeks ago, Mr. Hayes attended the Court of Appeal in order to attempt to have his case reviewed, leveling the accusation that he was denied a fair trial when the original 14 year sentence was handed down.

At the time of sentencing, famous ‘rogue trader’ Nick Leeson, who had brought down Barings in the early 1990s and served a jail term, his trading escapades later becoming the subject of a movie, had stated he believes Mr. Hayes’ sentence to be “too heavy.”

The barrister representing Mr. Hayes is Neil Hawes, who has stated that Judge Jeremy Cooke had prevented him from referring the jury to a prevailing culture within the banking industry between 2006 and 2010 during the judge’s closing speech at the trial.

During Mr. Hayes’ appeal hearing, Barrister Neil Hawes, acting for Mr. Hayes, said:

“The jury were entitled to take into consideration surrounding circumstances,” Hawes told the appeals court. In judging standards of reasonable and honest people, you have to have regard to the conduct of the market.”

Whilst the Court of Appeal was successful in shaving 3 years from Mr. Hayes’ jail term, the decision to uphold an 11 year final sentence sends clear messages to traders in the City that the fraudulent manipulation of markets will not be tolerated if it reaches the realms of criminal prosecutions.

The Financial Conduct Authority (FCA) may well have no teeth and act as a form of quango which does not conduct compliance inspections, and collects revenue in the form of discounted fines, however when these cases are dealt with by the British legal system, it is a different story altogether.

The judges which heard the appeal were of very high standing indeed, consisting of Lord Chief Justice John Thomas, who is Head of the Judiciary for England and Wales, and Sir Brian Leveson, who were joined by Lady Justice Gloster.