YouHodler Platform Review

YouHodler is a multi-asset FinTech platform that has been operating since 2018. For four active years, it has efficiently grown into one of Europe’s top cryptocurrency wallets and financial product providers.

YouHodler is a FinTech platform focused on crypto-backed lending with fiat, crypto, and stablecoin loans crypto/fiat and crypto/crypto conversions, as well as high-yield crypto-saving accounts (crypto-rewards & staking).

The platform supports over 50 popular cryptocurrencies and tokens. User’s digital assets are safely guarded with Ledger Vault’s advanced custody and Fireblocks security options.

YouHodler is an EU and Swiss-based brand and an active member of the Blockchain Association Financial Commission. Furthemore, YouHodler SA is an active member of the Blockchain Association of Financial Commission and the Crypto Valley Association.

Licenses and Regulations

YouHodler SA is YouHodler’s registered entity in Switzerland. YouHodler SA has a Pawnbroker authorization #LEAE-PGG-EV-2020-0001 and is a member of the SRO Polyreg. YouHodler SA is affiliated with Financial Services Ombudsman FINSOM (Affiliation confirmed 14.12.2020). YouHodler SA is a registered member of the Crypto Valley Association.

YouHodler SA has successfully applied for a FINMA FinTech license and is currently waiting for processing.

Naumard LTD is YouHodlers registered entity in Cyprus. Naumard LTD’s crypto lending solutions are structured in the form of token purchase/repurchase agreements.

Trading Products

YouHodler is available on a mobile app (iOS and Android) in addition to its web app (YouHodler.com). All versions of the app enable traders to open accounts, deposit and withdraw cryptocurrency and fiat, pass KYC verification, and trade on the go.

YouHodler has two unique features that help clients trade and multiply cryptocurrency via automated lending solutions. These are Multi HODL and Turbocharge.

Multi HODL

Multi HODL is a trading tool that enables traders to multiply crypto assets using loans. Traders take the balance in their YouHodler wallet (choosing whichever currency they want) and then Multi HODL opens an initial loan in an automated chain of loans. Using the funds from the first loan, the platform then buys more crypto to use as collateral in a second loan, thus extending the chain.

This process can be repeated 2-50 times depending on which “multiplier” level the trader chooses. This process can be done in bullish or bearish markets. Multi HODL’s “up” or “down” buttons allow traders to open a long or short position depending on their market sentiment.

In addition, Multi HODL has management tools such as Take Profit, Margin Call, and Close Now. Take Profit enables traders to set a price in which their Multi HODL position closes automatically (e.g. +30% from the opening price). Margin Call is the price level in which the deal closes automatically at a loss. A margin call is set by default but traders can also control their risk by setting their Margin Call level to avoid further loss. The Close Now feature allows users to manually close the position at any time.

The combination of these three tools helps traders better manage their exit strategy when longing or shorting crypto.

Turbo Loans (Turbocharge)

YouHodler’s Turbo Loans works similarly to Multi HODL but is for when the markets are increasing and not discretion. Turbo Loans use the same “chain of loans” function as Multi HODL.

The trader clicks the “Turbocharge” button on the apps and the platform then automatically opens a loan using crypto as collateral. The borrowed fiat is then used to buy more crypto to sue as collateral for a second loan in the chain. This process can be repeated 3 – 15 times depending on the trader’s setting.

Turbo Loans allow traders to buy more crypto with borrowed funds, hence using loans as leverage to multiply their crypto portfolio. To receive the total amount of crypto, the trader must pay off the entire loan first. This can be advantageous during bull markets as the profit from newly acquired crypto – which rose in value –can offset the expenses from the loan.

Trading Fees

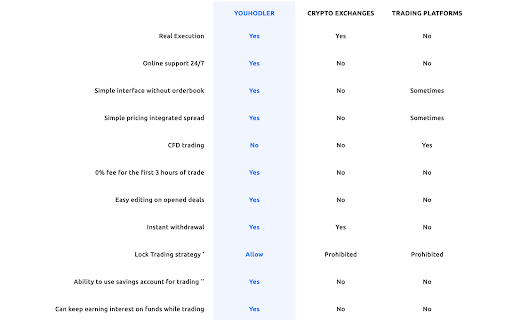

In terms of trading fees, YouHodler does not have any hidden fees, rollover fees, or any fees at all for the first three hours of trading. There are some fees, however, they are competitive with the top exchanges on the crypto market (e.g. FTX for example). Furthermore, traders can practice lock trading (opening up multiple positions at once) via Multi HODL, a technique that is not possible on other trading platforms.

In addition, YouHodler does not have any active sales managers that push its clients to trade. This is common practice on other trading platforms. Another convenience is that YouHodler never locks funds on the platform and withdrawals are incredibly fast. This means traders have constant access to liquid funds without a problem. There’s no need to verify your withdrawal with sales managers like on other platforms.

Additional Products

YouHodler provides an impressive product catalog that includes over 50 cryptocurrencies, fiat currencies, and stablecoins. Unlike some of its competitors, YouHodler has full support for all listed currencies across the platform’s core features.

Overall, the following core features present a balanced mix, offering clients varying levels of risk, security, and in-depth cross-asset diversification.

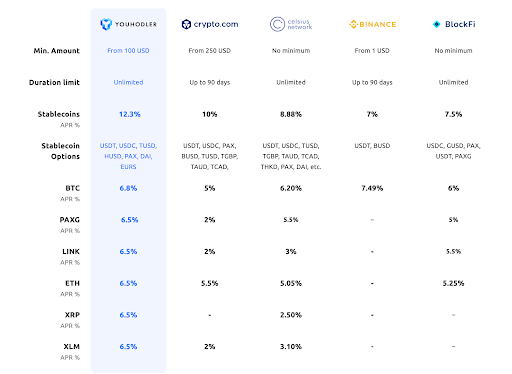

- Savings Accounts: Clients can earn up to 12.3% APR plus compounding interest on various cryptocurrencies and stablecoins. Interest payments are calculated every four hours and automatic payments occur weekly. Interest payments are automatically deposited into the client’s YouHodler wallet. YouHodler Savings Accounts are fee-free.

- Crypto-backed loans: Clients can use the top 50 cryptocurrencies as collateral for an instant loan of up to €30,000 with the highest loan to value ratio (90%). Clients can receive loans in EUR, USD, CHF, GBP, BTC, or stablecoins. Withdrawals can go directly to bank cards and bank accounts.

- Exchange: Clients can exchange cryptocurrency, fiat, and stablecoins with real-time execution and low fees. Universal conversion allows clients to exchange any currency pairs on the platform in addition to buying crypto with a credit card (Visa, Mastercard) and a SEPA bank account.

- Multi HODL: Use the power of crypto lending to long and short the market with multiplier levels up to x50.

- Turbocharge: Open a chain of loans to buy more crypto with less initial capital and multiply your portfolio up to x30.

Resources and Education

YouHodler offers high-quality, in-house resources for clients of all experience levels. The YouHodler official website offers an extensive help desk featuring video tutorials and hundreds of articles related to all elements of the platform. The YouHodler blog also produces weekly content about trading strategies, market news, YouHodler news, and financial thought-pieces All of the above is available online for free.

YouHodler welcomes novice cryptocurrency traders to the platform. YouHodlers 24/7 support offers conversations with real support agents and not bots. This allows them to get appropriate education and have their questions answered by industry professionals.

YouHodler offers support in multiple languages, 24 hours a day Monday – Friday. The majority of customer support at YouHodler takes place on its client portal in addition to the Help Desk FAQs, Telegram channels, and social media.

Promotions and Bonuses

YouHodler offers regular promotions, bonuses, and contests where clients can earn rewards like electric vehicles, cryptocurrency, discounts on financial services, and more. These are all announced in advance on YouHodler social media channels and blogs.

Opening an Account

Opening a trading account at YouHoder is a user-friendly and straightforward process. Any client can register quickly with some personal information and a valid email address. However, as a regulated platform, account verification at YouHodler is a mandatory final step. YouHodler complies with all AML/KYC regulations and users simply need to send a selfie and active ID to complete the process. It typically takes five minutes and customer support is always there if clients need help.

Deposits and Withdrawals

For funding methods, YouHodler has a variety of convenient options. To deposit fiat currencies with the bank wire option, clients must first verify their address. There is no commission for incoming bank wire transfers except for USD ($25) and GBP (20 GBP). The sender of the bank wire must be a verified YouHodler client. Bank Wire processing times vary from 1 to 5 days depending on the currency.

YouHodler clients can also deposit fiat funds with a bank card via AdvCash. This option and the bank wire option are available on the client’s fiat wallet. They can click “deposit”, choose a bank wire or bank card and follow the simple instructions.

Bank card deposits can take from a few minutes to a few hours depending on the bank provider’s processing speed and the verification process.

For fiat withdrawals, the same options are available (bank wire, bank card).

As for crypto deposits and withdrawals, clients navigate to any crypto wallet on YouHodler and click “deposit” or “withdraw.” Then, the client needs to follow the instructions. YouHodler does not charge any fee for crypto deposits or withdrawals. However, clients should be aware that every blockchain charges a blockchain fee to process and verify transactions. This is out of YouHoder’s control.

These fees vary from network to network and can also change from day to day. Hence, it’s advised clients take note of these fees before making transactions to avoid surprises.

Verdict

With a variety of innovative features that help crypto traders and HODLers use their crypto in new ways, YouHodler is a great fit for people of all financial backgrounds. For beginners, YouHodler’s educational resources are fantastic for learning the platform and the basics of the crypto market. For advanced traders, YouHodler has a plethora of features on tools like Multi HODL and Turbocharge that will help them efficiently take advantage of crypto market volatility.

In terms of trading costs, YouHodler does not have any hidden fees, rollover fees, or any fees at all for the first three hours of trading. While the other fees such as lending interest rates are not the lowest on the market, they are competitive. Additionally, the fact that there are no pushy sales managers constantly asking clients to trade is a nice bonus.

YouHodler’s savings accounts are some of the most stable in the market. While other competitors frequently alter interest rates, YouHodler’s famous 12% APR on stablecoins has remained that way since its inception. This allows traders to keep the majority of their portfolio in safe, stable savings accounts while simultaneously taking a smaller portion of that portfolio for riskier and potentially more profitable trading maneuvers.

Consistency, transparency, and efficiency are staples of the YouHodler culture, and they back those values up with results.