$10 Million via Copy Trading? Easy!

cTrader Copy Strategy Beats World Copy Trading Record

We all know that copy trading is becoming more and more popular in the new era, but a truly one-of-a-kind event for cTrader Copy and the copy trading world generally, has taken place several days back. Just one single copy strategy has seen $10 million in investment! Let’s dive deeper into the story and find out what happened.

Back to Basics – What is Copy Trading?

Copy Trading basically allows investors to copy strategies of other traders worldwide, as well as enables them to become strategy providers themselves and help other traders out for a fee. This way, a less experienced investor can take advantage of a professional one’s expertise, while the latter can share their knowledge and make a profit from it. Not only does copy trading hold profit potential for both - followers and providers, it’s also an opportunity for many to up their trading knowledge and skill long-term, through strategy observation.

The $10 Million Copy Case

We at cTrader have picked up on this very unusual case that caused a wave of discussion in the cTrader community and set out to figure out what happened…

A user has created a copy strategy named Relax over a year ago, having invested only $15 as a starting balance. All year long the user was trading with an average return of 200% per month. Throughout this very successful year, the strategy has attracted $10 million in investment, making followers money and giving the provider around $1 million of additional income through performance fees (very impressive, given the initial investment of $15).

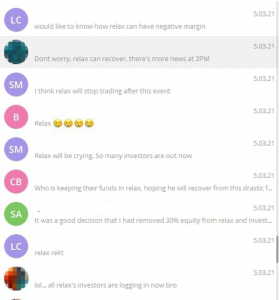

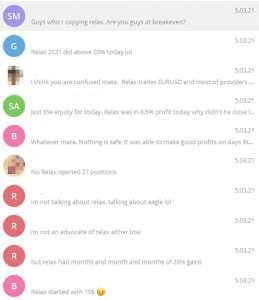

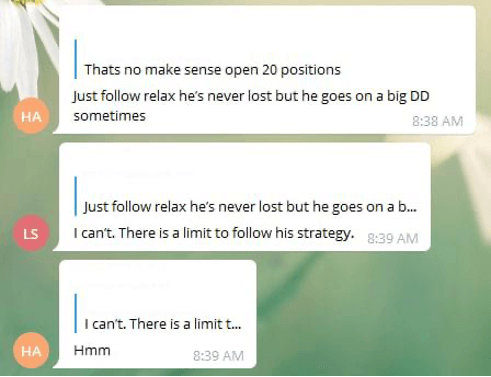

On the 5th of March 2021, as the NFP figures were about to hit, our developers identified unusual activity on the cTrader Copy service. Users were actually queueing up due to follower amount limitations, eager to invest in the Relax strategy, which has reached $10 million of following capital! This was the mood in the chatroom before the NFP:

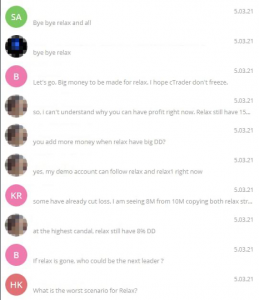

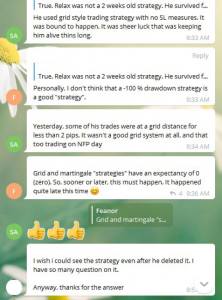

The defining hour of the NFP report was coming up and things were getting heated. The strategy was entering a massive drawdown but was still trading in the same manner as it did for the last 18 months. Building a position through a grid approach and betting on a rebound. Unfortunately for both – the provider and his followers, the outcome was not what one expected. NFP numbers were surprisingly good, and the market moved in the opposite direction than anticipated, causing the strategy to be stopped out to 0.

Needless to say, many were distraught following NFP report results. Some users were even having trouble logging in – that’s how overloaded the system was with users eager to check their investment (an issue Spotware has, however, dealt with in a timely manner).

Spotware’s Head of Community Management – Panagiotis Charalambous commented as follows: “There has been substantial volatility today and the specific strategies traded huge volumes for their followers. Many orders were rejected by brokers due to a lack of liquidity. There is not much one can do about these cases, but our team has done the difficult job of keeping servers running and addressing all user concerns.”

Officials have stated that this has been the largest investment via cTrader Copy so far, and the world copy trading record has been beaten as $10+ million have been invested to just one provider.

What does this teach us?

This proves that copy trading is indeed a way of making money, but caution is advised, as financial markets are volatile and your risk management should always be a priority.

For Providers: How to Get More Investors in Copy?

- Choose Platform with a Cross Broker Feature

- Be the Best to Get in the Top List

- Write an Engaging Strategy Description

- Share Your Strategy on Different Sources

- Create a Website with Your Strategy

Not only does your cTrader Copy strategy profile allow for a lot of supporting information, granting your investors the full picture, but it also allows you to showcase and promote your strategy on any external website by means of an embeddable code.

For Followers: How to stay in control & take informed decisions in Copy Trading?

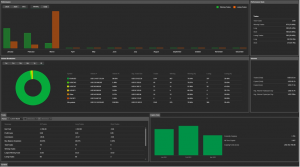

- An Equity-to-Equity ratio model is built for precision and advanced risk management

- Every followed strategy is placed in a separate copying account, ensuring a clear vision of each strategy’s performance for superior analysis and risk management

- An Equity Stop Loss can be applied per strategy and increasing or decreasing funds can be allocated to any strategy of your choosing

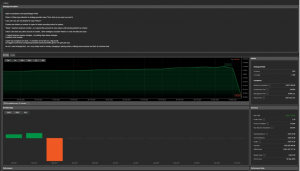

- Charts can be adjusted to specific time periods, all important information on Time Weighted ROI, Balance vs. Equity, Breakdown of Traded Symbols and History of Followers has a convenient visual representation, and your favourite strategies can be bookmarked for easier access

- The newly-redesigned dashboard displays all your copying accounts with followed strategies and allows you to modify settings or analyze strategies in a matter of a click, saving time and bringing you one step closer to expert trading

Final Note

As a final note, it’s worth reiterating that it’s fast and easy to get started as a strategy provider in cTrader Copy. Investors can start following you in a matter of seconds, there is no complicated power of attorney form, no need for you to become a licensed financial advisor, or really any other technically complicated procedures. It really is that simple – all because cTrader Copy provides an extreme level of transparency to investors, offering them enough information to make well-informed decisions as to whether a strategy is worth investing in. Stay Safe & Happy Trading!