It’s safe to say that the finance industry has faced its share of reputation crises over the years, from the 2008 financial collapse to the many scandals around irresponsible lending, political corruption, and even Ponzi schemes.

Inside View

Exclusive insights, research, and deep dives on a variety of traditional and decentralized finance topics.

The Fintech sector is experiencing significant growth, with fresh opportunities emerging rapidly. Innovations such as machine learning and cryptocurrency are revolutionising finance, leading to a need for trained experts.

To explore what makes Finalto’s white-label solutions stand out in such an incredibly competitive market, Finalto sat down with its Chief Operating Officer, Stanislav Bunimovich, for an interview.

The GBP/USD is one of the highly regarded currency pairs in the world of Forex trading, known for being liquid, volatile, and having narrow spreads. Traders Union’s analysis combines the latest economic data, market news, and technical indicators, giving all the insights needed to make informed decisions about trading pounds and dollars.

“Regulators in the EU and UK need to take the opportunity presented by the imminent establishment of a Consolidated Tape for shares and ETFs to update relevant post-trade transparency rules, so that they capture the full scope of share trading activity in Europe. Without this, Europe risks being left behind.”

As the Bitcoin community counts down to the upcoming Bitcoin halving, Mark Zalan, CEO of GoMining, shared exclusive insights into how the company is gearing up for this pivotal event in the cryptocurrency world.

Celebrating its 14th anniversary, Tools for Brokers (TFB), hosted a private networking event in Cyprus, gathering industry professionals to discuss future trends and innovations.

For access to the full interview and to explore more about Finalto’s contributions to the FX industry, you can visit the March 2024 edition of e-Forex magazine.

From using computer programs in the 1980s to High-Frequency Trading (HFT) in the 2000s and now using generative AI tools to execute trades at lightning-fast speed, we have come a long way. The new emphasis in stock and forex trading has come through generative AI tools mostly powered by OpenAI’s easily accessible (API) technology. Like other trading segments, investors and analysts in forex trading are excited and concerned at the same time with the increasing role of AI.

“This breakthrough is as much due to the wealth management industry, which has set itself up to offer accessible and innovative products, as it is to savers who are now familiar and seduced by these products.”

Saxo Bank published its Quarterly Outlook for Q2 2024, offering an analysis from the bank’s Strategy team, focusing on the impact of elections in key market countries and their potential to divert attention from critical economic indicators.

As the Forex market in Singapore continues to attract an increasing number of investors and traders, selecting a reliable and trustworthy Forex broker becomes crucial for individuals navigating the dynamic world of currency trading.

FinanceFeeds spoke with Andrew Saks of TraderEvolution Global, Iouri Saroukhanov from Cboe Europe, Remonda Kirketerp-Møller of Muinmos, and Quinn Perrott of TRAction, to ascertain their perspectives on the evolving regulatory environment in Europe, specifically how it’s shaping the transition from CFDs to listed derivatives and what it means for the future of trading and brokerage services in the region.

In this article, the industry leaders delve into the transformative role of AI in trading.

In the ever-evolving landscape of digital communication, the intersection between social media and the financial market represents a dynamic and complex domain that significantly influences public perception, corporate reputations, and the valuation of assets.

“DDoS attackers use a variety of techniques to annoy, harass, and extort companies. These attacks cost little to launch and can do serious damage to a company’s brand.”

The research incorporated viewpoints from 210 individuals, including professionals from clearing firms, brokers, asset managers, hedge funds, exchanges, and other market infrastructure operators, with a balanced geographic representation from North America, Europe, and Asia-Pacific.

Discover how AltimaCRM enhances KYC and data verification processes for forex brokers, streamlining operations and ensuring compliance.

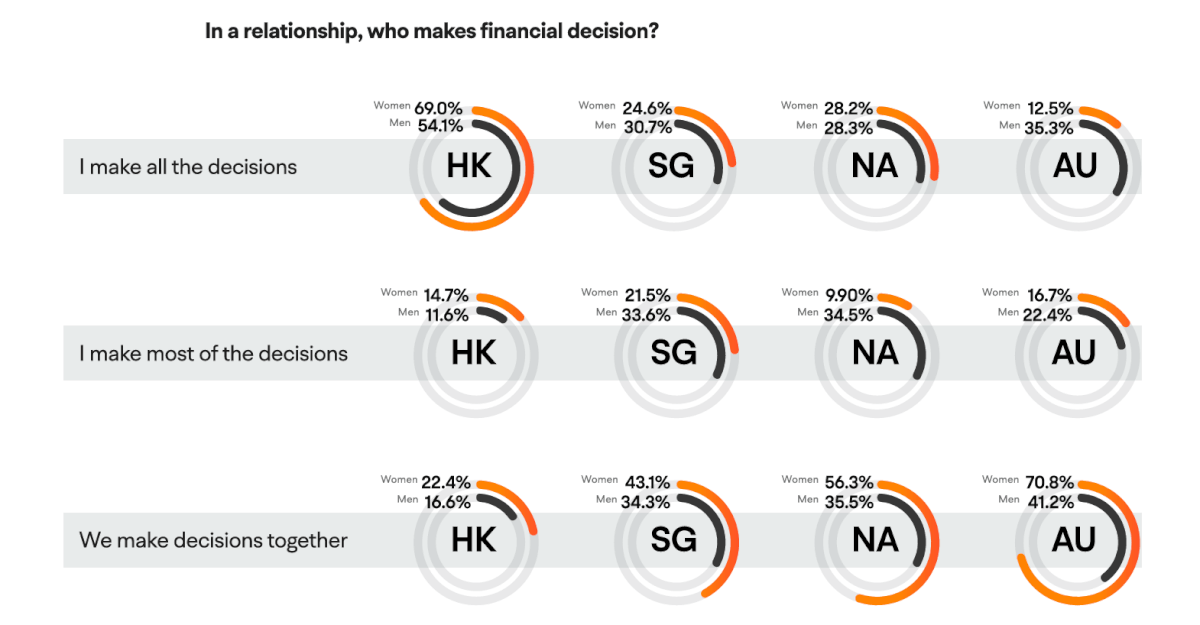

“Perceived self-biases may limit women from realizing their full potential in investing. With the right support and resources, investment can become a powerful tool that can redefine a woman’s financial resilience.”