AAX ranked among top crypto exchanges by CoinGecko and CryptoCompare

CoinGecko, one of the earliest crypto data aggregators, has ranked Atom Asset Exchange (AAX) as one of the most trusted cryptocurrency trading platforms. This milestone comes hot on the heels of AAX being recognized as the world’s second largest crypto exchange by spot trading volumes.

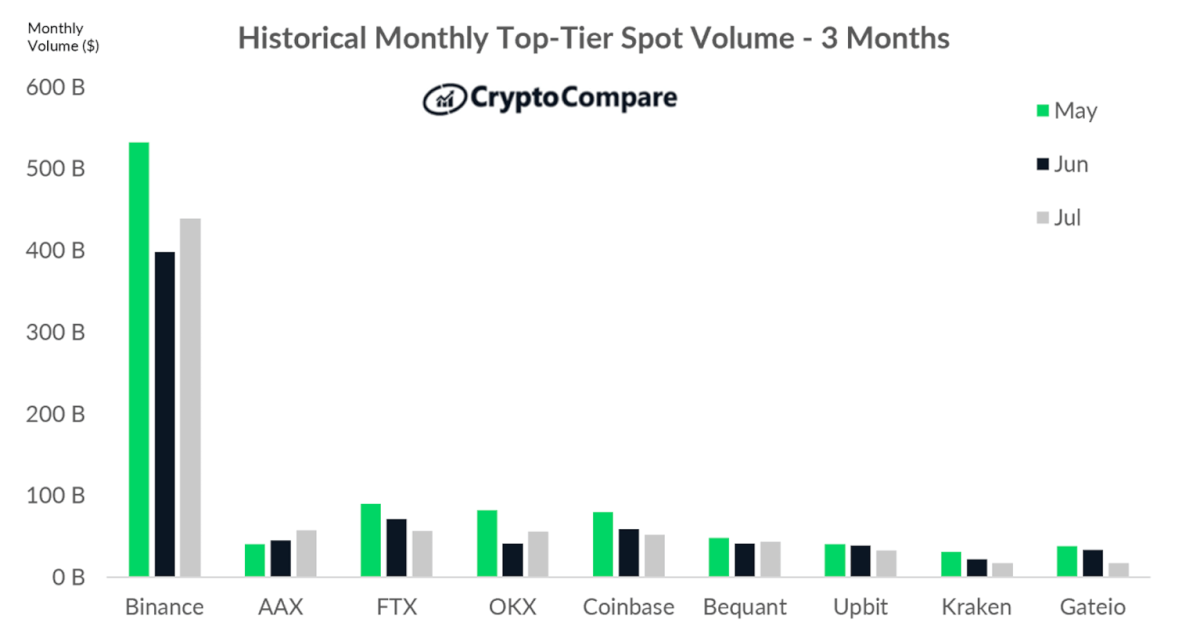

Per CryptoCompare’s recent industry survey, spot trading volume on AAX rose 26.5 percent to $57.2 billion, making it the largest exchange by volume after Binance for the first time in its history. The monthly exchange review offers widely quoted insights into the cryptocurrency industry as well as changes to exchanges’ metrics that make up the data provider’s price indices.

The surge in AAX’s turnover came despite the decline of spot trading volumes across all centralized crypto exchanges. In July, crypto spot volumes took another step back, falling by 1.3 percent to $1.39 trillion, the lowest turnover recorded since December 2020.

AAX, powered by the London Stock Exchange Group’s LSEG Technology, has seen a spike in trading volume since the start of the year, rising 285 percent from $14.9 billion during the period.

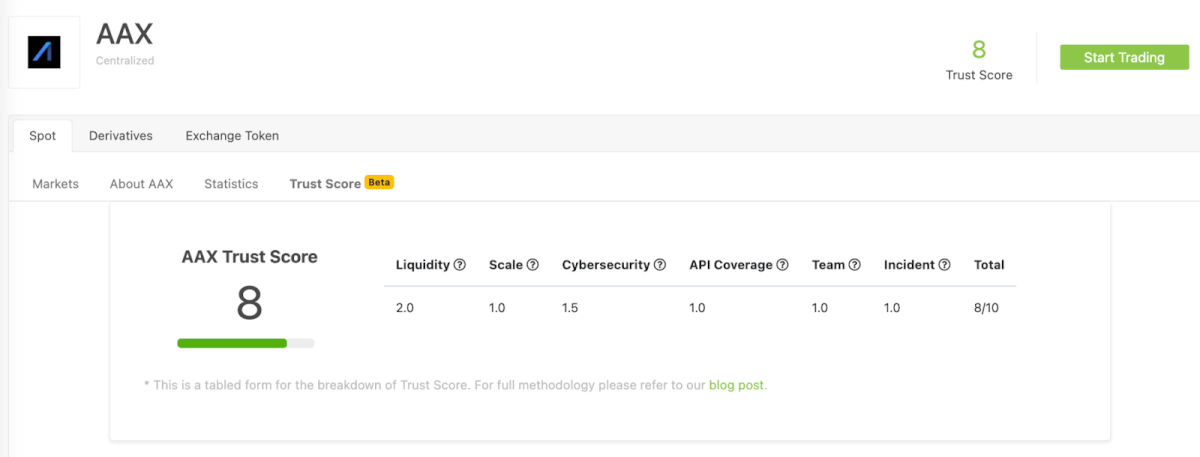

Meanwhile, CoinGecko has awarded AAX a Trust Score of 8, which indicates that the institutionally focused platform is now ranked as a 3-star Certified Ethereum Professional (CEP) Exchange.

CoinGecko provides fundamental analysis of cryptocurrency markets through intricate valuation methodologies revolving around market capitalization, volume and price. The industry data aggregator also tracks community growth, open-source code development, major events and on-chain metrics.

Based on an adjusted average of +12 indicators, CoinGecko has already evaluated the security of 1,500 cryptocurrencies and 290+ crypto exchanges. It is the first security rating covering such a big number of digital assets and platforms.

To combat fake exchange volume data, CoinGecko has developed a unique rating algorithm called “Trust Score.” On CoinGecko, exchanges are no longer ranked as they are reported, but rather ranked more holistically based on various related metrics and the firm packaged it all as Trust Score to make it actionable at one glance.

Trust Score measures many facets of what an actively cryptocurrency exchange should have – namely liquidity, trading activity, scale, technical expertise, cybersecurity and more.

Among the ranking criteria, AAX scored favorably in terms of liquidity, scale, cybersecurity, API coverage, and the availability of a senior leadership team. AAX was also recognized as a digital asset exchange that has not yet experienced security/functional issues that can potentially affect a user’s fund safety.

“Trust has alway been one of AAX’s core principles, along with security, integrity, and performance. Fully delivering on these principles takes time and constant improvement. It is great to see our achievements reflected in CoinGecko’s ranking as we continue to enhance our technological capability and services for our users,” said Ben Caselin, VP of Global Marketing and Head of Research & Strategy at AAX.

The recognitions mark a fresh iteration of AAX’s efforts to measure grassroots cryptocurrency adoption around the globe and offer unique insights after a year of increased attention for the industry.

AAX said last month it was expanding hiring right now, a sharp contrast to a slew of job cuts and a hiring freeze at multiple companies operating in the crypto space.

The prominent platform has “hundreds of roles” available across many functions as it doubles staff size this year to support its global expansion plans. AAX will open additional offices to support new markets and add staff to expand expertise and product lines.

The good news comes amid a downturn in crypto markets that triggered a wave of high-profile firings, layoffs, and staff reductions at leading players. On top of those pieces of news was Coinbase, which cut about 1,100 jobs or 18% of its workforce and Gemini which let 10% of its staff go.