B2Broker Presents White Label cTrader Out-of-The-Box Solution

It gives us great pleasure to announce the debut of our cTrader White Label product on behalf of B2Broker, an industry leader in the supply of technology and financial services for the fintech industry.

It gives us great pleasure to announce the debut of our cTrader White Label product on behalf of B2Broker, an industry leader in the supply of technology and financial services for the fintech industry. A prominent multi-asset trading platform on the market is now accessible to brokers thanks to the new solution. A popular option for seasoned traders, the cTrader platform is renowned for its advanced features and trading tools. A comprehensive trading experience with the cTrader platform is now possible for brokers to provide to their clients, thanks to the new White Label package.

About cTrader White Label

Through our sleek user interface that can be branded into any style imaginable, institutional businesses and retail firms have the ability to create customized brokerage experiences that reflect their individual taste or preference with the aid of fully-featured brokerage infrastructure!

The White Label cTrader game-changing platform offers you the ability to run your own broker business, providing Forex, cryptocurrency, and multi-asset trading.

White Label cTrader provides all the resources and tools you need. This intuitive and powerful trading platform has a functional and clear system consisting of a large variety of trading instruments that will help you in the trading process. To succeed with cTrader, you don’t have to make additional investments such as purchasing a cTrader server license, adjusting settings and configurations, or finding and integrating a reliable liquidity provider. Additionally, you don’t need to concern yourself with integrating with CRM and back-office systems, setting up a complete infrastructure, or implementing crypto processing. Additionally, a support desk is available at all times to assist with any questions or issues. Using White Label cTrader, your brokerage receives a fully featured, tested solution.

cBroker – Powerful Tool for White Label cTrader

cBroker is a program of the back office that keeps track of customer accounts and handles trading inquiries. It is an essential tool for administration and settings since it combines and tracks all the information passing through the system. With cBroker, you have complete control over the trading environment within a highly user-friendly interface. All the processes and operations will be accessible to you at all times, giving you full control.

cTrader Copy

Using cTrader Copy’s highly customizable investing platform, traders can easily copy other traders’ strategies or offer their own strategies for copying. Moreover, with The cTrader Copy tool, it will not only be possible to attract more clients and grow your audience but also furnish an extra income stream.

The cTrader Copy offers traders access to a wide range of options within a highly user-friendly platform. Also, traders can select which assets they want to trade, how much to invest, and at what risk level.

cTrader Open API

You can quickly and easily build our own platform on top of cTrader, utilizing the cTrader Open API in order to design your unique trading applications.

Among all the variety of the platforms now available on the market, there are few that do allow you to build your own trading interface or mobile trading applications, not to mention they allow you to customize your trading interface. White Label cTrader, however, will enable you to customize the platform interface to reflect your company’s look and feel, as well as the needs of your traders. With cTrader White Label, you can customize platform labels, graphics such as banners and symbols, user interface preferences, indicators, and technical analysis programs. Due to its adaptability, you can do so comparatively easily with cTrader White Label. You can seamlessly integrate this solution into your trader’s room, where you can continue utilizing all of your crucial trading capabilities, along with any of your other applications. If you’re yet unsure what your customer interface will look like, you can create your own or use an existing one, such as TradingView or another popular one.

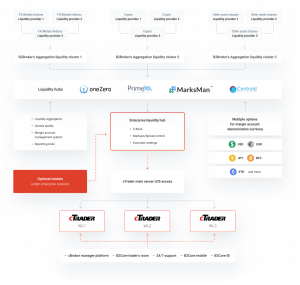

Prime of Prime Liquidity Pool

As part of the cTrader White Label solution, at your service will be a Prime of Prime Liquidity Pool, which opens you direct access to the best prices from the world’s leading prime brokerage firms and prime of prime companies. With Tier 1 Liquidity, you are free to select among a thousand trading instruments in seven different asset classes: FX, Metals, Commodities, Indices, Cryptocurrencies, Equities, and ETFs. In particular, we provide access to 110 FX symbols and 150 cryptocurrency CFDs, considered the market’s best trading products.

B2Broker and cTrader

If you are looking to start a trading business in the FX, crypto, or multi-asset markets or to expand the offering of your current brokerage, the cTrader White Label platform from B2Broker is what you need.

“cTrader is a well-known platform with a proven track record of success, and it is used by all the market’s top brokers. A quick search on the Appstore for cTrader will reveal all the major companies that use this platform.

We believe that in today’s ultra competitive markets, every broker must offer a wide variety of trading platforms to its clients. Otherwise, the broker would lose clients who wish to trade on the cTrader platform. In addition to the traditional trading capabilities provided by the MT platform, cTrader will almost certainly attract a new category of traders and investors.

When it comes to managing your crypto brokerage, and its algo capabilities, cTrader is one of the top solutions on the market.

Since 2021, we have been seeing a growing demand for cTrader among cryptocurrency brokers. Since many cTrader brokers use our liquidity offering, we decided to open a whole new world for brokers that want to grow more sophisticated and cater to traders’ needs, rather than requiring them to use a single platform,” B2Broker CEO Arthur Azizov.

cTrader White Label is a flexible platform that can be customized according to your business branding requirements and specific needs, regardless of your size or industry.

With B2Broker’s cTrader White Label platform, you can enjoy even more features and benefits. Keep an eye out for updates, and do not hesitate to contact us if you need more information.