BOE’s Slashed Rate To Historical Low

BOE cut its interest rate for the first time since March 2009 and revived the long forgotten Asset Purchase Program. Besides slashing 25 basis points off their interest rate to 0.25%, BOE added 60 billion pounds to their government bonds purchase program over 6 months and 10 billion pounds to buy corporate bonds over 18 months.

By Wayne Ko, Head of Research & Education at Fullerton Markets

Bank of England slashed interest rate to 0.25%, Sterling plunged over 150 pips in minutes!

BOE cut its interest rate for the first time since March 2009 and revived the long forgotten Asset Purchase Program. Besides slashing 25 basis points off their interest rate to 0.25%, BOE added 60 billion pounds to their government bonds purchase program over 6 months and 10 billion pounds to buy corporate bonds over 18 months.

Although Mark Carney has expressed readiness for further rate cut, but he also mentioned he is not a fan of negative interest rate. The lower threshold for interest rate is near zero, but will still be a positive number. This sets the floor for interest rate unless he changes his mind. BOE feels the impact of Brexit could come later after 2016.

They maintained growth forecast for 2016, but revised 2017 forecast downwards, from 2.3% to 0.8%. With the help of easing, Sterling is expected to remain weak, which prompted BOE to push forward their 2% inflation target from Q2 2018 to Q4 2017. We expect 1.30 to remain the key support for GBP/USD in near term.

Another big surprise came in last Friday. A whopping 255K jobs were created in July, far exceeded the forecast of 180K. If we put aside the disappointing May figures, the Non-Farm Payroll has been pretty consistent and healthy. Wage growth was slightly better than expected at 0.3% and unemployment remained unchanged at 4.9%. The numbers increase expectation of a rate hike this year.

Although some views point to an open FOMC in September, we foresee less than 50% chance of rate hike next month and possibly a higher chance in December after US Presidential election.

RBA cut its interest rate to 1.50% earlier last week. The AUD/USD dropped briefly but recovered and rallied thereafter. Market saw the cut as a “done deal” for now and price out any further rate cut in upcoming months. RBNZ is expected to follow with a 25 basis point cut this week. Failing to meet this expectation may result in the Kiwi heading back towards 0.7230. The drop after the cut may also be muted if the RBNZ statement displays less dovish tone.

So far, BOJ’s and RBA’s easing effort had resulted in their currency strengthening unexpectedly. Both of them would be in a tight spot if Fed shows dovishness in September’s FOMC, which may strengthen both the Yen and Aussie even further. Having said so, let’s watch out for the string of US data for the next 6 weeks before September’s FOMC.

Our Picks

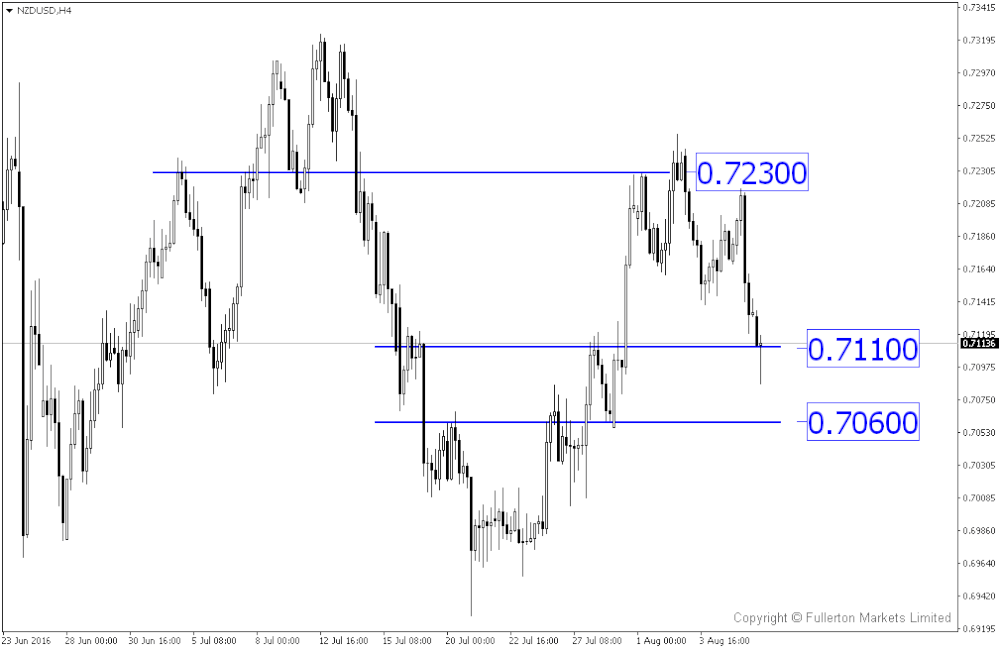

NZD/USD – Slightly bearish. Kiwi weakened on rate cut expectation and strong NFP figure. We expect it to remain weak with the next Support around 0.7060.

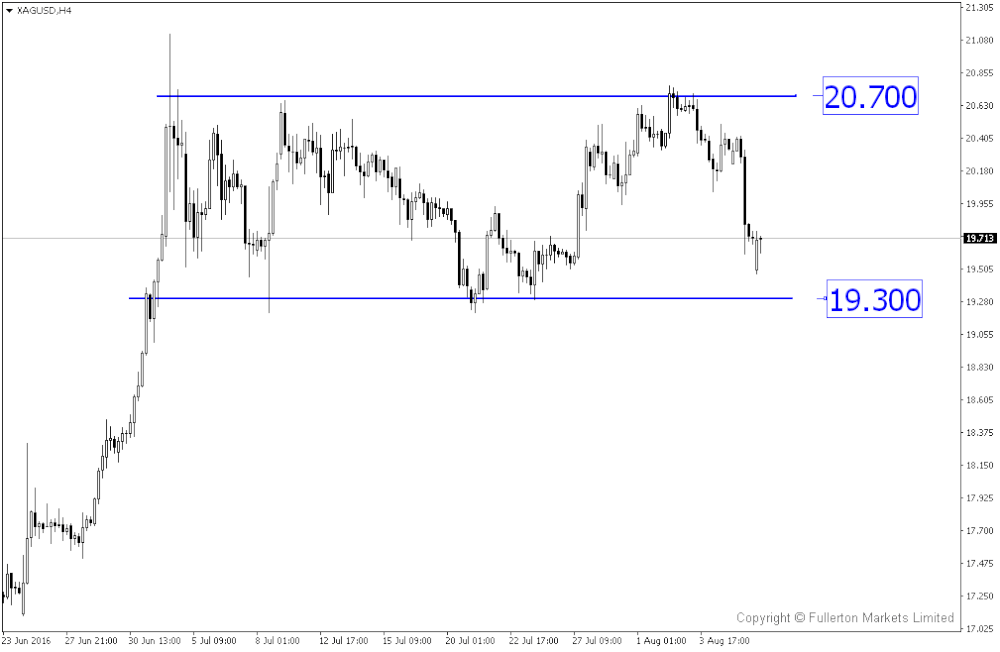

XAG/USD (Silver) – Slightly bullish. Silver is consolidating in a range. Price is heading towards the Support around 19.30 and we expect it to hold.

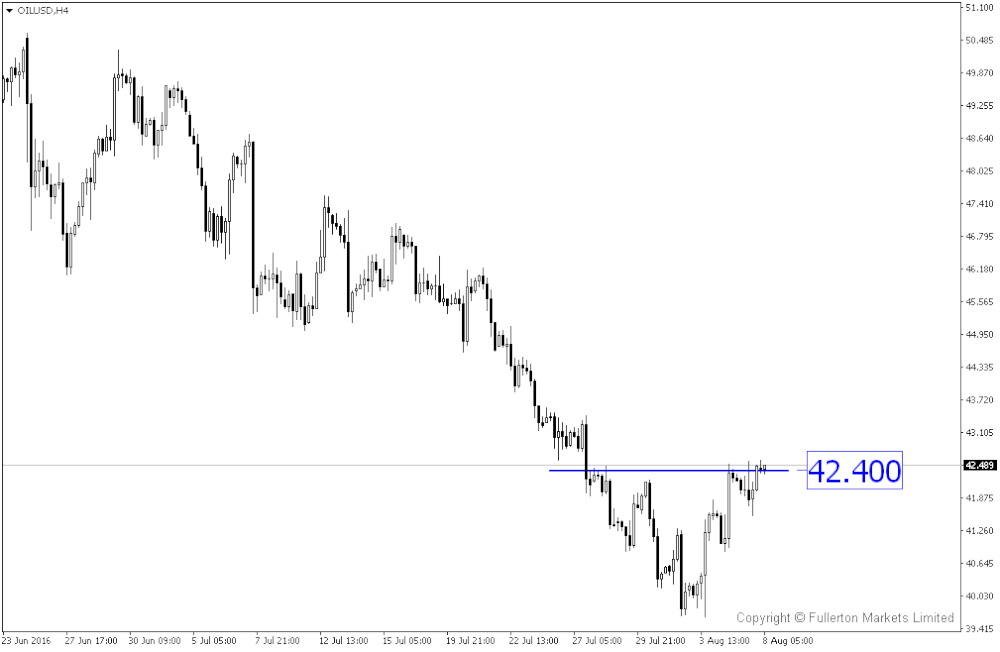

OIL/USD (WTI Oil) – Slightly bullish. Technically, prices have rebounded more than 20% from the fall since mid June. This could possibly be the signal of a reversal.

Top News This Week (GMT+8 time zone)

New Zealand: Official Cash Rate. Thursday 11th August, 5am.

We expect figures to come in at 2.00% (previous figure was 2.25%).

Europe: German Prelim GDP. Friday 12th August, 2pm.

We expect figures to come in at 0.4% (previous figure was 0.7%).

US: Core Retail Sales. Friday 12th August, 8.30pm.

We expect figures to come in at 0.4% (previous figure was 0.7%).