China restricts foreign investment

China restricts foreign investment after the government presented a list of subsectors, not permitted for foreign investors in the latest commercial areas in the country. The list of 122 subsectors, ranging from livestock to bank deposits, has been published today on the government website. Entirely prohibit foreign investment in the mining sector for non ferrous […]

China restricts foreign investment after the government presented a list of subsectors, not permitted for foreign investors in the latest commercial areas in the country. The list of 122 subsectors, ranging from livestock to bank deposits, has been published today on the government website. Entirely prohibit foreign investment in the mining sector for non ferrous metals systems for air traffic management, postal companies, content on the Internet, radio and television programs and other agency Xinhua informed.

China restricts foreign investment after the government presented a list of subsectors, not permitted for foreign investors in the latest commercial areas in the country. The list of 122 subsectors, ranging from livestock to bank deposits, has been published today on the government website. Entirely prohibit foreign investment in the mining sector for non ferrous metals systems for air traffic management, postal companies, content on the Internet, radio and television programs and other agency Xinhua informed.

In other sectors, foreigners can invest only through joint ventures with Chinese companies. Among them were exploring for oil and natural gas, design, production and maintenance of aircraft generic melting of rare earth metals. The air cargo operations should be controlled by the Chinese side, as a single foreign participation may not exceed 25%, according to the list. The aim of the “negative list” is clearly to encourage domestic and foreign investment in any sector.

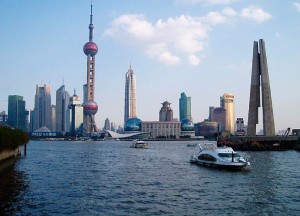

Three new free trade areas will be opened tomorrow in China on the model of the Shanghai Free Trade Zone, established for less than two years, but that failed to meet expectations, AFP, citing state media. These new areas will be located in the southern province of Guangdong, Fujian in the southeast and in the port metropolis Tianjin, near Beijing. Each of them has an area of about 120 square kilometers. The attempts of China restricts foreign investment is a new move of the government, which wants to stimulate the internal economy growth.