CoinGecko and 21Shares publish The Global Crypto Classification Standard

“Crypto is still in the early days – but it is key to have a standard way to classify the asset class so investors can understand both the commonalities and differences between the various assets.”

21Shares, the world’s largest issuer of cryptocurrency exchange-traded products (ETPs) has released The Global Crypto Classification Standard report in partnership with popular crypto data aggregator CoinGecko.

The report aims to create a uniform way to categorize cryptoassets, so investors and regulators can better understand the nuances within the asset class.

Crypto varies drastically from one asset to another, which creates a need for a standard way to summarize and understand the different assets. For that reason, the report introduced a methodology composed of three levels of categorization, with each cryptoasset falling into one option within each level.

Level 1: Crypto Stack (i.e. cryptocurrencies, smart contract platforms, decentralized applications (dApps))

Level 2: Market Mapping by Sectors (i.e. infrastructure, metaverse, decentralized finance) and Industries (i.e. developer tooling, payment platform, credit/lending)

Level 3: Taxonomy of Cryptoassets (i.e. cryptocurrency, staked currency, governance token and more)

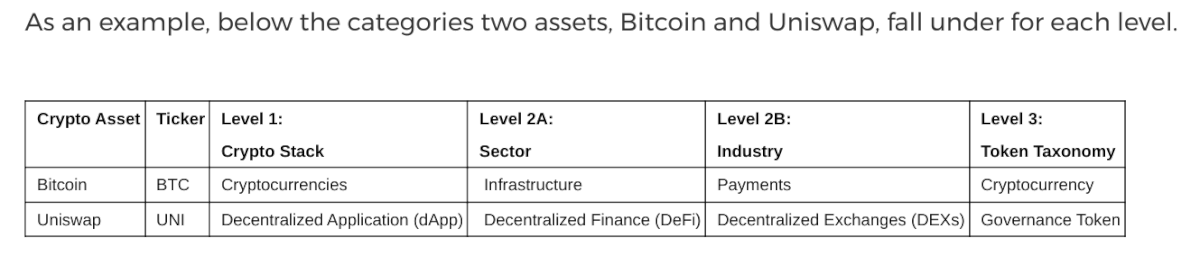

As an example, below the categories two assets, Bitcoin and Uniswap, fall under for each level.

Eliézer Ndinga, Director of Research at 21.co, parent company of 21Shares, said: “Crypto is still in the early days – but it is key to have a standard way to classify the asset class so investors can understand both the commonalities and differences between the various assets. Upon meeting with CoinGecko, we knew the company’s independent nature and reputation as a one-stop-shop to learn about new projects in the crypto space made them the right partner for this type of initiative.”

Bobby Ong, COO and co-founder of CoinGecko, commented: “Being able to systematically rank and classify cryptoassets, based on a research-driven approach, aligns well with our mission as an independent cryptocurrency data aggregator. We’re thrilled to team up with 21Shares to provide consumers worldwide with a framework to anchor on, as the space evolves.”

21Shares and CoinGecko also used the methodology proposed to evaluate the Top 100 crypto assets by market capitalization. The classification will be available on the CoinGecko website by summer of 2023.