Context Analytics partners with Autochartist

Context Analytics (CA), a global leader in Unstructured Financial Data processing has partnered with Autochartist to distribute its social media sentiment analysis tool into Europe, the United Kingdom, and APAC.

Context Analytics (CA), a global leader in Unstructured Financial Data processing has partnered with Autochartist to distribute its social media sentiment analysis tool into Europe, the United Kingdom, and APAC. By leveraging Autochartist’s vast broker network and multi-language expertise, this partnership provides CA with expansion opportunities outside of North America.

With recent market movements around stocks like GameStop and AMC, traders are becoming increasingly aware of social sentiment; looking to take advantage of any emerging trends.

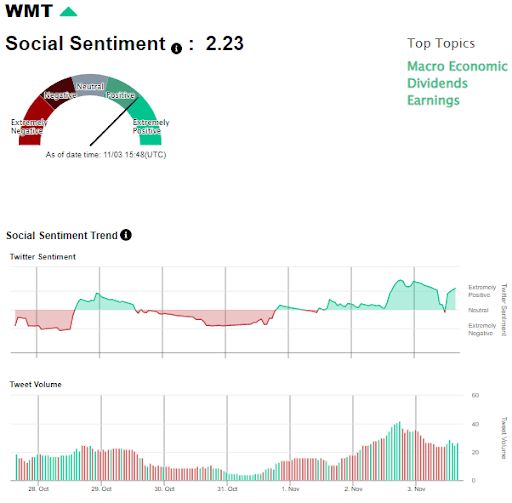

CA’s tools distill social conversations into easily understood metrics, providing traders with a view on what social media channels think about specific financial instruments.

Ilan Azbel, CEO at Autochartist remarks “Historically speaking, we (Autochartist) have always performed our own analytics. But in the case of sentiment, we decided to partner with the global leaders. By doing this we ensure we bring to market the best possible tool for traders, putting out sentiment data to the retail marketspace that hedge funds have used for years”

“We are proud to be partnering with Autochartist. Not only that, but with this partnership, we get to take our market leading sentiment data to the European trading community!,” said Context Analytics’ CEO, Joe Gits.

About Context Analytics: Is a financial data analytics company that sources, cleans, structures, and analyzes textual data for investable insights and business intelligence. Founded in 2011, CA has built Intellectual Property in four Major FinTech Areas: Sentiment Natural Language Processing, Source Agnostic Textual Parsing, Complex Topic Modeling, and Source Accuracy. CA provides the financial and marketing communities with new data sources to evaluate financial data sets, enhance returns, and reduce risk.

About Autochartist: Since 2004 Autochartist has partnered with many of the world’s leading online brokers across the globe. Autochartist services millions of traders in over 100 countries through its vast broker partnerships. Autochartist distributes thousands of trade setups, articles, and social media posts daily in more than 30 languages. The company prides itself on its core commitment to service excellence and ongoing market leadership through developing innovative new products.