FX derivatives volumes explode in 2015, says World Federation of Exchanges

The World Federation of Exchanges, representing more than 200 market infrastructure providers including exchanges and CCPs, released its IOMA 2015 Derivatives Market Survey, based on enquiry responses supplied by exchanges and clearinghouses as well as data collected from exchange websites, containing extensive information broken down by product lines (single stock options and futures; commodity options […]

The World Federation of Exchanges, representing more than 200 market infrastructure providers including exchanges and CCPs, released its IOMA 2015 Derivatives Market Survey, based on enquiry responses supplied by exchanges and clearinghouses as well as data collected from exchange websites, containing extensive information broken down by product lines (single stock options and futures; commodity options and futures, etc)

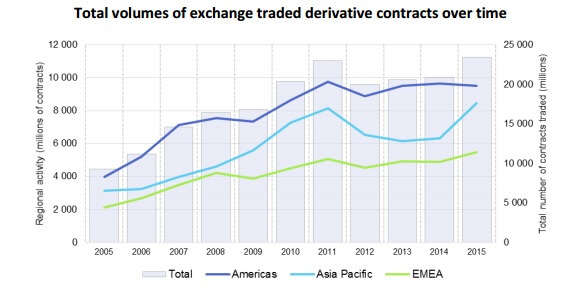

The report found that derivatives volumes grew by 12% in 2015, exceeding 2011 levels for the first time. Much of this growth is owed to the Asia Pacific region, up by 36%.

Source: WFE

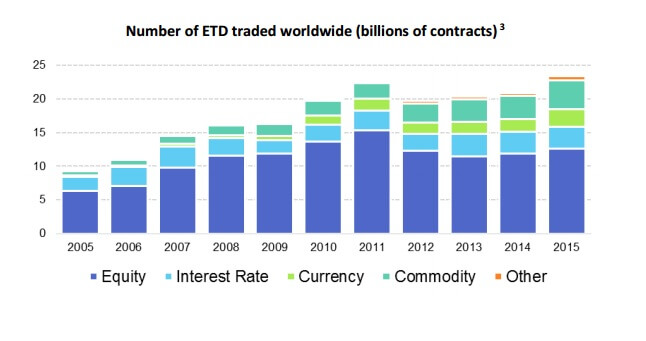

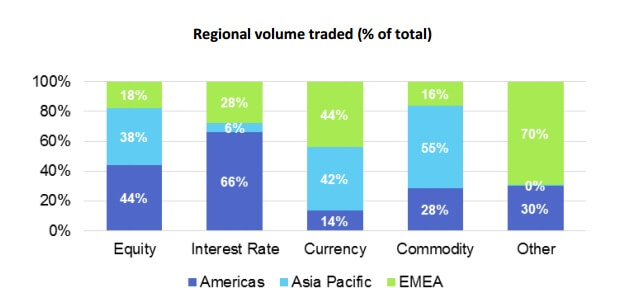

While equity derivatives continue to be the most traded asset class, currency and commodity derivatives have seen its largest volume growth in 2015, up by 37% and 26% respectively. “Currency derivatives experienced the most dramatic increase in 2015 (up 37%), dominated by the EMEA and Asia Pacific regions (representing 44% and 42% of all trading activity respectively). All regions experienced growth in the volumes of currency derivatives”, said the report.

Source: WFE

Source: WFE

Single stock options, the most actively traded contract to date, were surpassed by commodity futures as the most traded contracts in 2015. More “exotic” derivatives’ volume were also up by 51%, but from a much lower base.

Nandini Sukumar, CEO at the World Federation of Exchanges, said: “Exchange traded derivatives showed solid growth in 2015 and volumes rose above 2011 levels for the first time. As the underlying trend in the use of financial markets continues to rise, these numbers are milestones on that road. The trend in commodity futures comes during a volatile year for commodity markets and is a tangible use of financial markets for investors seeking to mitigate risk and find transparent prices. Exchanges and markets serve the real economy every day and that will only increase.”

Commenting on the publication was also Siobhan Cleary, Head of Research and Public Policy at WFE: “The growth in exchange traded currency derivatives is particularly interesting inasmuch as it represents a potential shift in volumes from the over-the-counter markets. Similarly, the growth in the Asia Pacific region may suggest the start of a longer-term trend.”

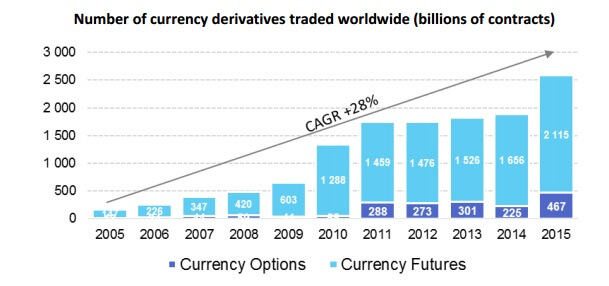

In regard to Currency Derivatives, the WFE found a breakout in volume in 2015, compared to the previous four years. The compound annual growth rate (CAGR) since 2005 is of 28% for currency futures and 108% for currency options, with the American and EMEA regions losing its market share to 14% (from 19%) and 44% (from 45%), respectively, while the Asia Pacific region’s volumes in currency futures and options is set to dethrone the EMEA region, up to 42% (from 36%).

Source: WFE

31.2% of all currency futures and options trading volume went through the Moscow Exchange as the USD/RUB was the most traded futures contract in the world in 2015. Following the Moscow Exchange were the NSE of India (19.2%) and the Indian BSE Limited (13.6%). USD/INR futures, USD/INR options, US Dollar futures and Euro futures completed the top 5 currency contracts by volume in 2015.

The document can be read here.

Image used on social media compliments of Perpetual Tourist