Devexperts’ New Charting Allows Traders to Write Custom Indicators and Signature Studies

Devexperts, a financial software developer for financial companies, has updated DXcharts, a financial charting solution, with an integrated scripting language DXscript.

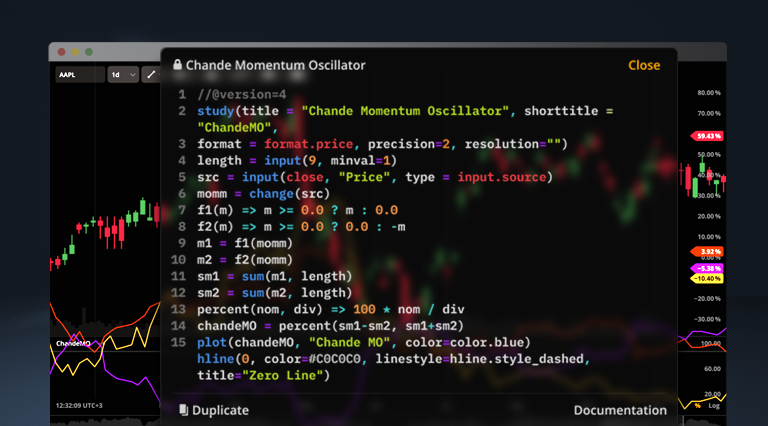

Traders can now write their own custom indicators and apply them to the chart using the DXscript language. DXscript is Devexperts’ proprietary scripting language designed to analyze market data, making it perfect for creating and editing custom chart indicators. Traders can use it with just basic programming experience.

DXcharts allows financial news websites to have their own branded charting app, encouraging readers to remain onsite. The branded charting app also reduces the risk of losing readers as they will no longer be forwarded to third-party charting provider websites. DXcharts is also available as a stand-alone widget for analytical and trading platforms. This is beneficial for brokers with DXcharts becoming a value-added tool for their traders. It offers the unique ability for traders to create, edit, and share their own custom studies.

As a result, broker’s trading platforms will ultimately help brokers expand and develop a loyal client base. Traders can further take advantage of the integrated scripting language by customizing chart studies to their preferences, and later making them open-sourced or sharing them on a fee-basis with other users.

DXcharts owners can offer their clients:

- An unlimited number of studies. No more ‘100+ indicators’.

- Custom studies creator. Introduce new inputs and outputs, change the logic of a study, reveal hidden patterns, etc. Traders can make their studies and share them with fellow colleagues.

Create your own study on DXcharts https://devexperts.com/dxcharts-demo/.

View the knowledge base and playground, publicly available online https://script.dxfeed.com/.