Enabling sustainable growth in a volatile and uncertain environment – Guest Editorial

The 2% strategy enables traders to calculate the maximum amount they should invest in a single trade, says Autochartist CEO Ilan Azbel

By Ilan Azbel, CEO, Autochartist

The unprecedented pandemic has left the markets, as well as businesses, trying to guess what the future will bring as the markets are becoming increasingly volatile and global economic stability becomes more uncertain.

Forex though, as an industry, has over the past years come across its fair share of struggles with a lot of fluctuations (e.g. 2008 financial crisis) causing instability in the industry. With instability come problems which can be translated to difficulties in generating leads, but most importantly converting leads into trading clients.

But has the recent pandemic had the same effect?

It seems that the pandemic has awakened the markets from both the perspective of fx brokerages as well as traders. Afterall, Sun Tzu in the Art of War, said “In the midst of Chaos, there is Opportunity.”

The broker’s perspective

Being a natural disaster with devastating effects on global economies, the covid-19 pandemic has revived the markets creating unprecedented volatility which evidently has generated a vast amount of trading opportunities. Over the past years, markets were experiencing very low volatility rates and as such opportunities were limited, directly affecting portfolio sizes and trading volumes.

The trader’s perspective:

As the new reality sinks in and people spend more time at home away from their offices and in many cases even left without a job; they try to create alternative opportunities for income. And so consumers are turning to fx trading which given the market volatility, creates various opportunities to generate income and keep their mind occupied.

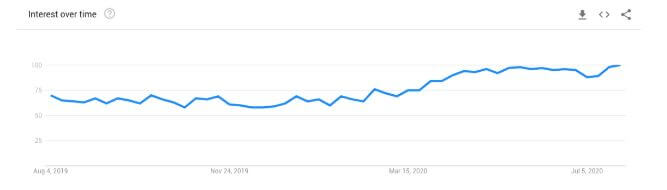

Looking at a chart below from Google trends, which represent the search trends of the term “forex trading” we can see that the worldwide search interest over time is showing a steady upward increase. Particularly the upward trend seems to be forming around the same time as the european pandemic.

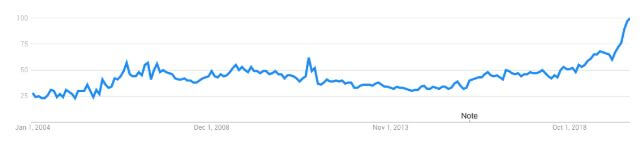

Additionally, if we look at the overall interest over the long term we see an impressive upward trend forming over the last six months.

The opportunity

The market volatility, combined with the increased interest to trade, create a massive opportunity for fx brokers that with the proper tools and guidance can prove lucrative for the industry, allowing for sustainable growth.

How do brokers achieve that sustainable growth?

Empowering your traders and providing them with the right tools and information is key to their, and therefore your, success.

Research provided by Autochartist shows that when a trader has a relatively large loss when compared to their deposit, the psychological impact that will have is debilitating and therefore it is rather likely that the trader will stop trading.

Focusing on risk management is critical if you are to avoid falling into this trap. Providing traders with the ability to take advantage of market conditions smartly in times of volatility will go a long way in increasing the traders Lifetime Value (LTV) and therefore total deposits over the lifetime of the trader. Let’s take a look at some general rules and tools that can help increase your trader lifetime value and retention rate.

Generally, as a rule, it’s massively important to help traders understand how much they are prepared to risk in a single trade. Many resources speak of the 2% rule which should be implemented as a trading strategy by all day traders.

The 2% rule

The 2% strategy enables traders to calculate the maximum amount they should invest in a single trade. The calculation is simple:

Available trading capital x 2% = Maximum investment amount.

Following the 2% rule allows traders to control their exposure to risk. The brokerage fees and charges (both buying and selling) should be accounted for in the calculation. Additionally the trader should also use the stop-loss order to limit the risk exposure.

Alternatively, fx brokers often offer risk calculation tools such as the Autochartist Risk Calculator which prevents traders from risking more capital than they should. Being a valuable tool, the risk calculator allows the trader to set the amount of money they are willing to invest in a single trade, along with their entry and exit levels. Given this information, the risk calculator assists traders understand the correct trading volume to use in order to stay within their risk tolerance. This ensures a longer LTV for the trader, keeping them happy and in-turn benefitting the broker.

Monitoring historical performance

As the forex market has matured, brokers have come to realize that a simple churn-and-burn environment doesn’t help in growing a sustainable business. Brokers are learning from their more experienced gaming-industry peers who understand that keeping the player at the table for longer is where true, sustainable value is built. Casinos understand the importance of allowing a trader to win in order to get more money on the table.

In light of this, more sophisticated brokers are starting to once again see the value in quality market research. . Even though historical performance is not indicative of the future performance, quite often it proves to be a useful and powerful tool in assisting traders in making more informed decisions.

Autochartist’s past performance analysis shows that some of their research strategies provide between 70% and 80% success rate – providing brokers with the assurance that their traders will have a positive experience and come back for more.

The forex market has proven to be a tough nut to crack when it comes to dealing with situations related to global crisis, with the industry coming out stronger in each and every event so far. The markets seem to have woken-up, and both traders and brokerages should work together to capitalise on the market opportunities presented to them.

The consequences of the global virus outbreak should in no way be undermined, but looking at the bright side using the right tools, support, strategy and psychology, the forex industry will keep shining for now.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.