The other face of trading – Guest Editorial

Market Analyst Ramy Abouzaid looks at how the daily economic conditions that face two people, one in Argentina and one in Turkey, can affect the FX market’s exotic currency pairs

By Ramy Abouzaid, Head of Research, ATFX, UAE

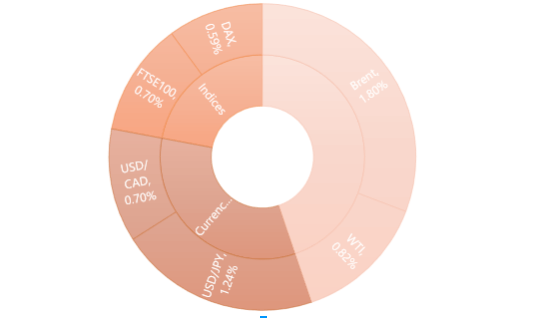

While you are sitting in front of the trading screens and prices are moving fast and fluctuating, looking at the US Dollar Index, the reflection of movements of yield rates on US bonds at the time (chart added below), your focus as a trader is on making the largest amount of money from these signals and analysis. However, take a brief moment to digest the following:

Federico, a 10-year-old boy, lives with his mother in Buenos Aires and while he wakes up in the morning to get ready to go to school, his mother tells him he will not go today as she can no longer afford to attend school. At the same time, 30-year-old Malika lives in Istanbul. She has just received a letter from her company telling her that she has been made redundant and has just become unemployed. The company justified this because of rising business costs and lower profits margins.

Do you imagine that the numbers moving in front of you on the trading screen can impact the lives of other people, be they near you or thousands of miles away?

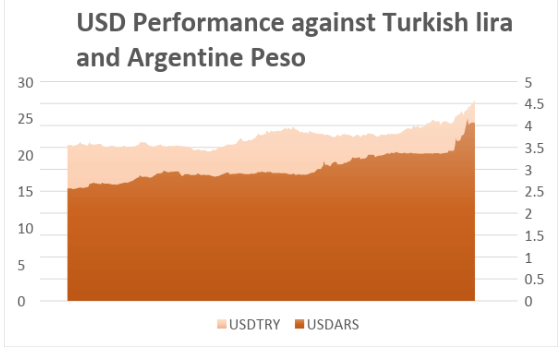

The rise in the US dollar – especially with rising yields on US bonds – has affected financing costs in emerging economies. These economies are clearly suffering. Let’s take two obvious examples: Argentina, whose currency has lost about 25% of its value over the past few weeks, with the central bank raising interest rates to 40% to stop this bleeding.

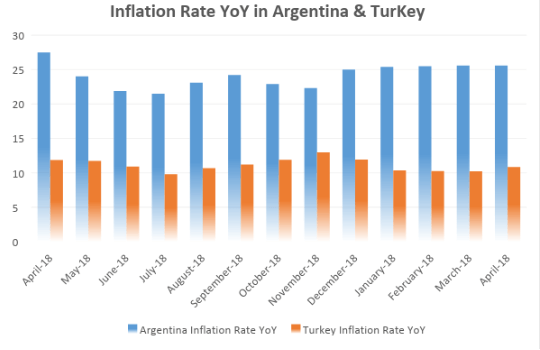

This led to massive inflation in Argentina, reaching more than 25% on an annualized basis, which is devastating for limited and fixed income. If we look at Turkey, which is also suffering from a continuous decline in the price of its currency against the dollar, the dollar has reached a new historical high against the Turkish lira. Inflation has also risen and approached 11% on an annualized basis. With these successive rises in the US dollar and with the continued rise in US bond yields, this is reflected in the daily lives of people, which rarely get our attention. Only as numbers and with all this, we still have the opportunity as traders to translate those stories into profitable results.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.