Forex weekly recap: Expect the unexpected

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA There is no mystery that you can enjoy an infinite amount of perks as a trader (besides the lovely long hours and stress accumulation) traveling makes the top of the list. However, as brilliant as it may sound, all that perceived liberty comes […]

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

There is no mystery that you can enjoy an infinite amount of perks as a trader (besides the lovely long hours and stress accumulation) traveling makes the top of the list.

However, as brilliant as it may sound, all that perceived liberty comes with a tag price. Yes, the responsibility to educate and communicate to others to improve their lives and experiences.

While we recover from this jet lag, let’s translate the week’s charts from the vast and complex universe of Forex Trading. After all, that’s why you are going over this recap.

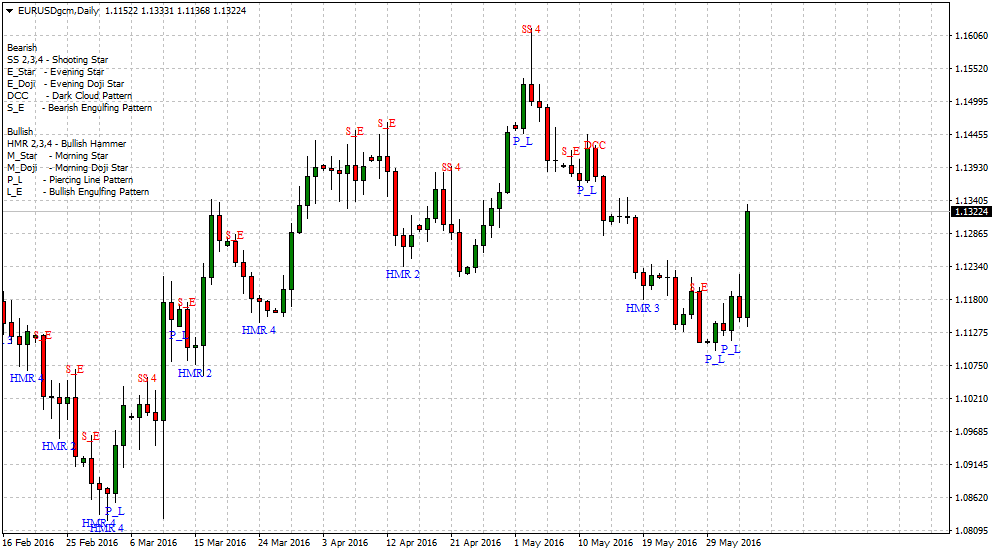

EURUSD

First off, one thing that caught our attention as soon as we landed at Heathrow was the multiple messages indicating the efforts made to add more security in the UK Borders.

Thought the Eurozone core value was to be more welcoming? Do not hold your breath; we will come back to this idea in a moment.

Reviewing the EURUSD, you may notice that we are trading in the direction of the trend since late February 2016. That’s a fact no matter how many times the Bears and “Nostradam us” analysts keep talking and publishing ten reasons why the Euro should or will trade below parity.

It is imperative to follow strategies in the spectacular now, and as long as the price does not break this week’s low which is around 1.1097, there is little evidence to think a massive sell-off will take place towards the trading range back in December 2015.

NFP should provide more guidance as far as what is the Fed going to do or not with interest rates (not that we should care because madness just creates more opportunities). If data delivered is not above expectations; then we are all in for a quick shift to add risk, and no doubts everyone will be selling dollars.

Resistance: 1.1450 – Support: 1.1097

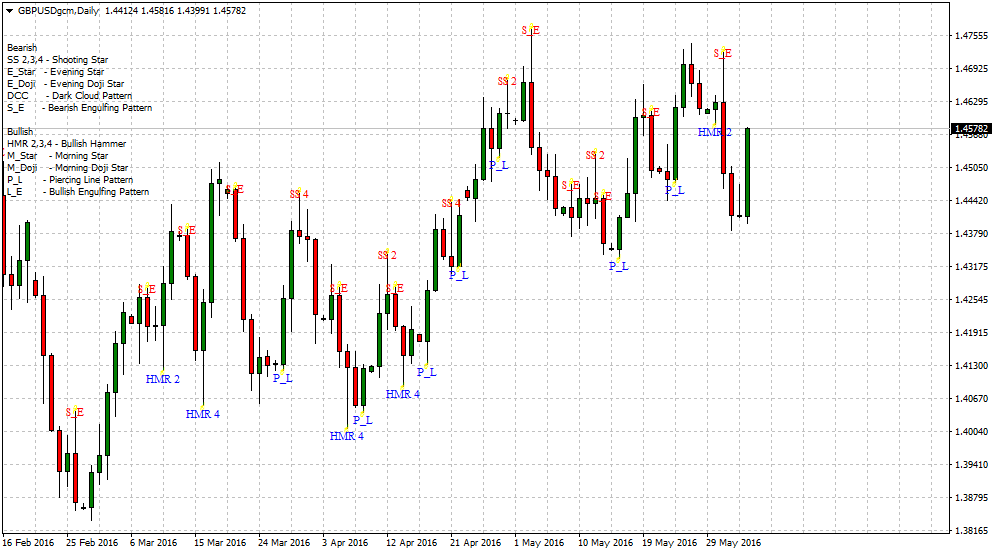

GBPUSD

Week after week, we cannot deny this trading pattern reminds the Scottish vote from 2014. However, rumors indicate our brave Hedge Funds are not willing to participate in the bloodbath.

Is the Hedge Fund industry growing a risk-off leg? And, we think you needed to be brilliant to run one of those. To charge the 2% management fee or perform as expected; that’s the question.

Believe it or not selling resistance and buying support has been enough to provide a positive pip accumulation. Short above 1.4700s and Long positions below 1.4 450s in a wide range; close to +250 pips from high to low.

In the coming weeks, weak fundamental data and Brexit ghosts may increase volatility for the pair. Technically, let’s focus on the bullish candlestick pattern; piercing line pattern.

Resistance: 1.4741 – Support: 1.4382

USDJPY

555 pips.

That’s the distance from the year’s low to 100.00 and think it twice because it may still happen without any difficulties.

Insert Image

Bank of Japan is not going to waste its last ammo (or just the last bullet) to save the day, especially not for traders and large speculators.

The Japanese formula to live with an ongoing deficit it’s gone and done. Take a look at the US Dollar/Japanese Yen chart, what do you see? Yes, most recoveries are around 300 pips, before another +650 short debacle initiates. Please, knock on wood, so analysts at Goldman Sachs keep providing buying alerts to all those large corporations and hedge funds; a lot more liquidity will make the retail market shorts more profitable.

Resistance: 111.45 – Support: 105.53

USDCAD

Let’s picture the following scenario:

- China fights a battle to adjust its economic model.

2. Oil production has been steady and consumption in decline.

Now, can anyone explain why crude oil is trading above $35.00 a barrel?

Wait! Not only that, the high yield bond market (terminology used for riskier bonds) however, we do