GBP/USD Nears Critical Support Levels – Guest Analysis

Dan Blystone of Scandinavian Capital Markets looks at the GBP/USD pair during these turbulent economic times.

By Dan Blystone, Senior Market Analyst, Scandinavian Capital Markets. With 22 years of experience, Dan gained insight to the markets working at Altea Trading, ABN AMRO and Infinity Futures in Chicago. He is the founder of TradersLog and the Chicago Traders Group. Find out more about Dan by clicking here.

Cable fell to fresh 5-month lows in Monday trading. The pair bounced early in the session, following the Federal Reserve’s emergency decision on Sunday to slash interest rates to near zero. Last week, GBP/USD experienced a devastating series of losing days while global equity markets crashed and investors sought shelter in the greenback, the world’s most liquid currency.

Last Wednesday, the Bank of England (BOE) cut the base rate from 0.75% to 0.25% to address the economic fallout of the coronavirus pandemic. Speculation is rising that the new BOE governor Andrew Bailey will act swiftly to cut interest rates to a record low of 0.01% to protect jobs and growth. Rate cuts typically pressure a currency, due to the fact that that the lower yield makes them less appealing to investors.

On Sunday, the Federal Reserve announced an interest rate cut of 100 basis points to 0.0-0.25% and the launch of a massive $700 billion quantitative easing program. During a press conference, Fed chair Jerome Powell stated: “We will maintain the rate at this level until we’re confident that the economy has weathered recent events and is on track to achieve our maximum employment and price stability goals.”

Despite this news, S&P 500 futures hit their limit down minutes after the open of markets in Asia. The dollar, which would normally be weakened by dovish Fed policy, may remain underpinned by its liquidity and its status as the world’s reserve currency.

Meanwhile the pound fell to a fresh six month low against the euro on Monday, entering a sixth day of losses. Price fell below the key psychological level of 1.10 in early Monday trading, emboldening the bears.

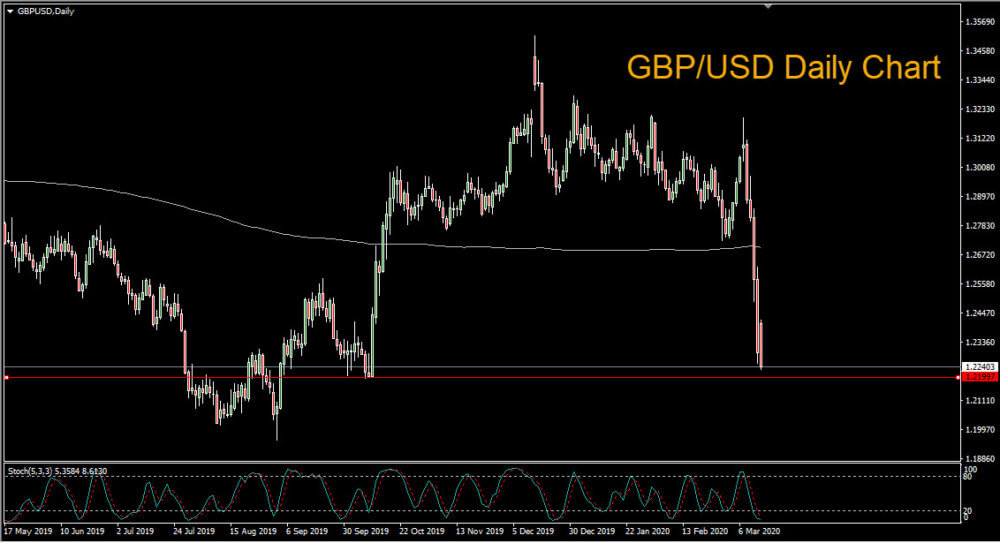

Looking at the GBP/USD daily chart we can see that price has fallen well below the ‘line in the sand’ 200-period moving average, where the bears hold the technical advantage. Potential support lies at the prior lows of 1.2199. A drop below the October 2016 low of 1.1903 would mark multi-decade lows.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.