IG overtakes Interactive Brokers as US 4th largest retail FX broker

Data from the US derivatives regulator for May 2022 shows that IG US has moved past Interactive Brokers in the rankings of the US retail FX brokers.

The US business of Europe’s largest spread better overtook IBKR as the fourth largest holder of retail FX funds —something that only happened a number of times with Charles Schwab as both companies duke it out for dominance.

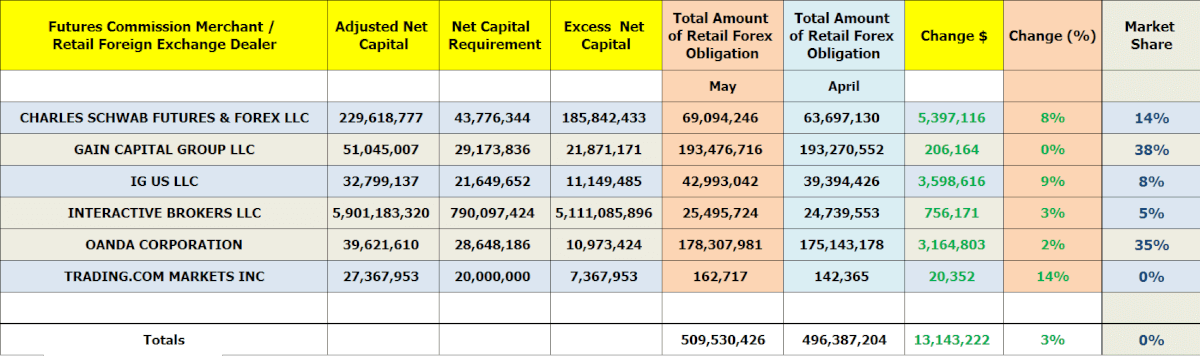

Charles Schwab was the best performer for the month after it registered an overall rise of $5.4 million to $69 million, compared to only $63 million at the end of April, or an increase by 8 percent month-over-month.

IG US reported a $3.6 million increase in its clients’ assets for May, up 9 percent on a monthly basis. Total retail obligations now stand at $39.3 million, which reflect an 8 percent market share, up one percent over last month.

Further, retail deposits at OANDA Corporation grew $3.1 million in May 2022. The leader in corporate FX solutions also maintained its stance as the second largest in the US with 35.0 percent market share.

Interactive Brokers also added nearly $756,000, or 3 percent on a monthly basis, in retail forex deposits.

Overall, the CFTC’s monthly report shows that the balances of US retail traders have been largely skewed higher in the month of May. According to the agency, the FX funds held at registered brokerages operating in the United States, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, came in at $509 million, which is three percent lower month-over-month compared with the $496 million reported in April.

Meanwhile, GAIN Capital’s clients’ funds were virtually unchanged from a month earlier. However, the largest FX broker in the United States remained the leader in terms of market share, commanding a 38 percent share, unchanged from the April ranking.

The newest comer to the US FX industry, Trading.com Markets, continues to take a bigger chunk of the overall retail funds, but at a very limited scale. The broker has boosted its customer deposits to $162,000 in May, up 14 percent from $142,000 a month earlier.

The chart listed below outlines the full list of all US brokers that held Retail Forex Obligations in the month ending on May 31, 2022 – for purposes of comparison, the figures have been included against their April counterparts to illustrate disparities.