Innovations in Technology and the User Experience — A MarksMan Update

MarksMan Liquidity Hub, the go-to platform for crypto spot liquidity solutions, has just unveiled an exciting update with new UI/UX features.

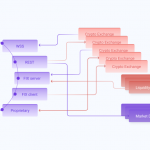

MarksMan Liquidity Hub, the go-to platform for crypto spot liquidity solutions, has just unveiled an exciting update with new UI/UX features. These upgrades open up a world of opportunities for bridge technology by giving clients greater choice and flexibility when it comes to liquidity options, market selection, and risk hedging. As a result, the world of crypto just got better: the leading crypto liquidity technology platform is now faster, more intuitive, and easier to use than ever before.

New Platforms

The Liquidity Hub has just become even better! MarksMan’s price discovery engine now supports the Huobi Spot and Huobi Futures platforms as new main sources of Level 2 quotations. This means that customers now have access to a world of trading opportunities, opening liquidity streams across all trading instruments offered on these global trading venues.

Price Construction

MarksMan has announced a significant upgrade, including support for contract lot sizes in derivatives as well as markups and volume modifiers depending on order book depth. Because of this, clients may ensure that their transactions are performed with the optimal level of liquidity depending on their specific requirements.

Risk Hedging

The MarksMan hedging engine is now available on the Huobi Spot and Huobi Futures platforms. Furthermore, the team fine-tuned the derivative asset order placements by taking contract variables such as contract size and face value into consideration.

Lightning-Fast Price Updates

Introducing lightning-fast price updates! MarksMan Level 2 quotes now provide a refresh rate of up to 100 ms, allowing your traders and investors to get the clearest possible view of the market.

Data Analysis

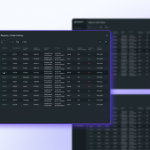

The new Reports Section from MarksMan Web UI offers a comprehensive view of all trading activity inside your account, allowing you to quickly identify and analyze orders for accurate and informed decision-making.

More Information = More Safety

MarksMan’s User Guide’s Hedging Configuration page has been updated with all the latest information on how to set up hedging and manage your positions, so you will know how to protect yourself and make sure your investments ride out any turbulence.

Verdict

The team at MarksMan Liquidity Hub is raising the bar for technology and user experience in the industry. With their latest update, clients now have access to innovative features that can help them stay ahead of the competition. Don’t miss out – try MarksMan Liquidity Hub today.