Lead Generation in the UTIP CRM

The UTIP specialists present a new tool for lead generation in the UTIP CRM, which allows brokers to maximize the efficiency of their work with lead generators.

In order to improve the lead generation service, a new functionality has been added to the UTIP CRM that optimizes API requests and speeds up the integration process. It allows brokers to independently configure the settings of their work with lead generators.

Types of interaction between a lead generator and the UTIP CRM

Prior to the integration process, a broker and a lead generator define a set of data from the client card that will be available for the lead generator when interacting with the UTIP CRM.

Depending on the technical capabilities of a lead generator, the interaction process can be implemented through “Requests” and/or Postback.

Requests is a type of interaction between a lead generator and the UTIP CRM, when the lead generator can make an API request at any time to get information on its clients, and only by the fields allowed by the broker.

While working, a lead generator can get information on all of its clients, as well as selectively for each specific one.

Postback is a type of interaction during which the information selected by the broker is automatically sent to a lead generator when the selected event occurs: for example, when the first deposit is made.

There are several types of events that can be selected for a lead generator: sending information when a customer type changes and sending a message on deposit events.

So, by using Requests and Postback, a lead generator is always able to get information about the conversion of leads supplied.

It’s worth noting that Postback is an automated and secure way to interact with a lead generator, and its use is preferable.

Functionality adjustment

The implemented functionality enhances a broker’s ability to work with lead generators.

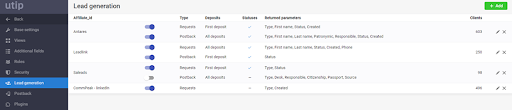

A broker can:

– add a lead generator on their own;

– choose a type of interaction;

– configure a set of fields that appears in requests and in Postback.

And if needed, a broker can also disable a lead generator with one click in the settings.

Functionality benefits

Interaction with each lead generator is customized separately and in compliance with data protection. A lead generator no longer needs access to an account in the UTIP CRM to get client data. This allows greater security of sensitive information.

The process is based on the principles of transparency for both a broker and a lead generator, thus effectively influencing the joint cooperation.

Find more information about the UTIP CRM on the UTIP Technologies website.