Meet Christina Barbash: Bringing Point Nine’s RegTech to the world of Forex

As the financial services industry spearheads the adoption of diversity as a key ESG topic, Finance Feeds has doubled down on its focus on women leadership within the FX space.

In the latest iFX EXPO Dubai 2022 event in February, which held a Female Industry Leaders panel, we spoke to Christina Barbash, Business Development Manager at Point Nine.

Point Nine is a regulatory reporting firm providing trade and transaction reporting services to legal entities across the globe, helping them to remain compliant with EMIR, MiFID II, SFTR, and other requirements.

Ms. Barbash was at the conference exchanging views about the Forex industry trends and discussing the needs of regulatory reporting for Forex Brokers.

We spoke about how brokers can’t do without a RegTech partner in the FX industry today, Point Nine’s solution, expansion plans, and the recent partnership with FIS.

Point Nine offers a cloud-based reporting solution that is compliant with EMIR, MiFIR, ASIC, and FinFraG. Is RegTech here to stay?

Compliance is here to stay! There are numerous strict regulations already enforced and they become stricter over time. Regulators rely on the data reported by market participants to monitor both the participants and the overall market. The data is dispersed in legacy systems across many sources and does not contain all the data required for reporting purposes. RegTech firms are here to simplify this onerous process in a cost-effective and professional way.

Compliance is here to stay! There are numerous strict regulations already enforced and they become stricter over time. Regulators rely on the data reported by market participants to monitor both the participants and the overall market. The data is dispersed in legacy systems across many sources and does not contain all the data required for reporting purposes. RegTech firms are here to simplify this onerous process in a cost-effective and professional way.

Your list of 165 customers includes high-profile names such as FxPro, Broctagon, and ED&F Man Capital Markets. What types of firms do you cater to?

Our clientele includes regional banks, big corporates, high-frequency trading firms, fund managers, retail FX brokers, and investment firms.

Point Nine says it has processed and reported more than 7 billion transactions across all asset classes since 2015, with a proven track record of 99.95% submissions success in EU/UK transaction reporting. Is the remaining 0.05% an issue?

Our solution includes more than 5,000 validations, including those specific to our clients’ needs. This exceeds the requirements of the relevant regulations. Approximately 15% of the trade data we receive from clients for reporting purposes contains various errors. My colleagues from the Implementation Department solve these errors prior to submission, thus achieving the 99.95% success rate.

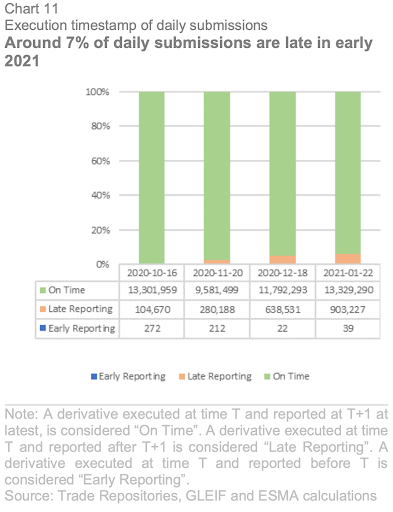

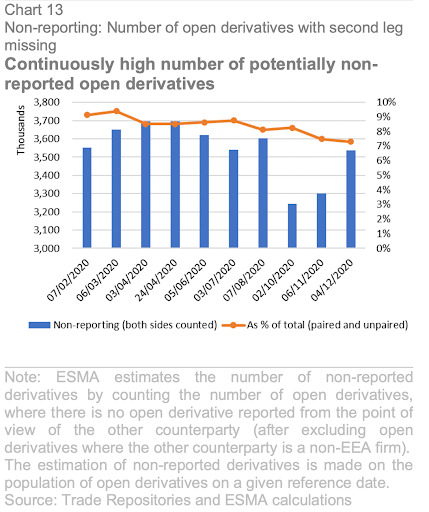

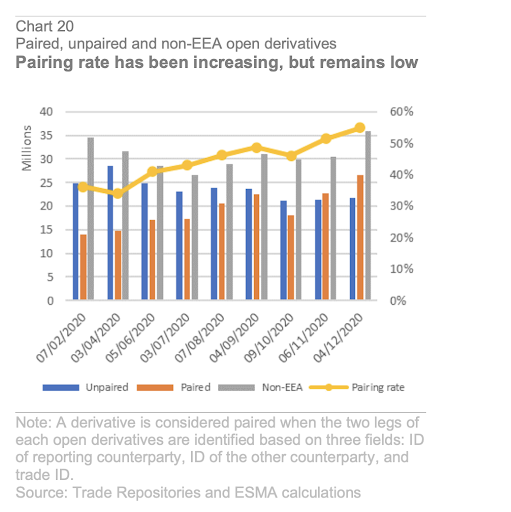

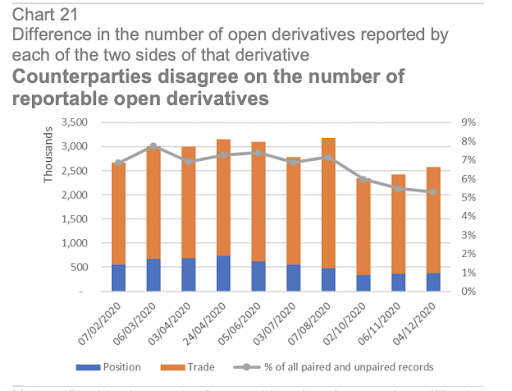

As per the “EMIR and SFTR data quality report 2020” published by ESMA, numerous problems continue to exist, despite the fact that EMIR reporting was originally introduced in 2014. Reporting entities continue to submit reports after the deadline (see Chart 11 below), a large number of open trades are not reported at all (see Chart 13 below), performing basic tasks such as UTI management remain a huge problem for half of the trades submitted (see Chart 20 below), and counterparties report without agreeing on the content of the reports, as mandated by Article 9 of EMIR, and therefore, disagree on the number of open trades between them (see Chart 21 below).

I am very proud to say that Point Nine has the necessary knowledge and abilities to solve these challenges for our 100+ live clients.

Chart 11:

Chart 13:

Chart 20:

Chart 21:

Your firm is headquartered in Cyprus. Does that give you a competitive advantage given the FX and CFD industry?

We are a global provider (EU, UK, Australia, Canada, US). At P9, our primary advantage is our talented team who makes our technology and service a global success. Our physical proximity to retail FX in Cyprus allows us to provide personalized experiences to customers and partners. We also plan to open offices in the UK, USA, and central EU to further expand our physical presence to customers and partners.

You have recently partnered with FIS for its Trade and Transaction Reporting Manager solution. How can customers benefit from that?

“FIS recently selected Point Nine to bring Trade and Transaction Reporting together, which will strengthen our abilities” Christina Barbash of Point Nine exclaims. “We are proud of our partnership with an S&P 500 firm, and we are excited about the opportunities ahead of us to achieve common goals.”

Christina adds, “Firms are expected to follow very specific and strict data and submission requirements. However, these requirements and data are disconnected and siloed across various systems, data formats, and third parties. By combining the vast amount of FIS trade data and the unique capabilities of Point Nine, we are thrilled with the opportunity to improve the timeliness of reporting submissions as well as improve reporting accuracy. The results of these combined efforts will be reduced costs and risks.