Redesigned Website, New Pricing, Tokens, and Merchant Models for B2BinPay

An innovative upgrade of commissions, a brand new website, Enterprise and Merchant Models, and much more have been introduced by B2BinPay.

An innovative upgrade of commissions, a brand new website, Enterprise and Merchant Models, and much more have been introduced by B2BinPay. B2BinPay is a major and respected provider of cryptocurrency payment processing, together with other products. B2BinPay has also decided to revise its pricing policy and considerably reduce fees as well as simplify the sign-up process to attract even more businesses to use the company’s services.

The website has undergone a comprehensive update to improve user convenience. Numerous improvements have also been made to the B2BinPay platform.

What Are The Changes To Pricing Plans?

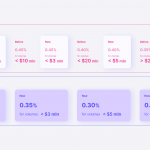

To provide clients with more benefits, the B2BinPay team updated the price structures. The following changes have been made to the Merchant Models’ percentage categories and volume limits:

Next, the onboarding price for Enterprise clients has been reduced by B2BinPay. Now, instead of 1,500 USD, new clients will be required to pay only 1,000 USD! The team has also changed the percentage tier barrier for Enterprise users, which has resulted in considerable savings. The variants are described in the following illustration:

All outbound transactions are completely free! These are some of the lowest pricing in the market and provide excellent value for B2BinPay clients.

Robust UI And Features Are Now Ready

The B2BinPay team has totally modernized the website to give users useful content in an approachable way. The completely redesigned website has several sections that have been revised to describe each item or service that B2BinPay provides.

Newly created pages simplify navigation and provide instant access to the most important information.

The business has provided an in-depth explanation of both on-chain and off-chain transactions. On-chain transactions take place on the blockchain, which necessitates network participants’ confirmation. For an On-chain transaction, B2BinPay does not charge a commission, but the consumer is still responsible for paying the blockchain commission. The proprietary technology of B2BinPay is used to perform off-chain transactions. Outside of the blockchain, these transactions are carried out amongst B2BinPay customers. Users of B2BinPay avoid blockchain costs and processing times since Of-Chain transactions are fast and free of charge. Should you have any questions, all the details about on- and off-chain transactions involving different users, all use cases are now fully described on the website.

Customers may now browse the constantly expanding list of currencies thanks to the addition of the “Available Currencies” tab, which offers more than 80 different coins.

FAQs section has also been enriched by queries about services, functioning, security measures, and other topics.

Last but not least, all businesses will be able to swiftly and simply integrate blockchain technology into their own payment systems, with more ease and security than ever before, thanks to B2BinPay’s API. If you want to check all the information, visit the website. The B2BinPay software was also upgraded to enable Merchant Invoice Limits, Delta Amount, and Cardano (ADA), in addition to a number of user-friendly improvements.

There Are New Crypto Assets Too

The range of currencies and tokens available through B2BinPay’s Merchant and Enterprise models has increased. Including WBTC, ANKR, GALA, IMX, and others, there are now nearly 100 new tokens.

Advanced Merchant Models

B2BinPay has restructured its models in a significant effort to help its clients. There are presently three versions available from the firm, including Enterprise, Merchant (Fiat Settlement), and Merchant (Crypto Settlement). Users that choose Merchant with a crypto settlement have the option to open digital wallets that accept prominent stablecoins, such as USDT or USDC, as well as cryptos, such as Bitcoin.

Bottom Line

As you can see, the B2BinPay team has made considerable steps to improve the product’s usability and business-friendly pricing policy. B2BinPay is a fantastic option for businesses wishing to include bitcoin payments into their operations. Customers will likely get the perfect plan that suits their unique demands thanks to competitive costs and pricing methods. The quick, safe, and dependable payment processing options from B2BinPay are available to companies of all sizes.