Satisfy Your Trading Needs With B2Core, MarksMan, & B2Trader’s Brand-New Pricing Plans!

Satisfy Your Trading Needs With B2Core, MarksMan, & B2Trader’s Brand-New Pricing Plans!

B2Broker is pleased to introduce new prices for its key products, B2Core, MarksMan, and B2Trader. Our company has reduced the cost of its programs for all three components in order to make them more affordable to even more individuals as well as firms. This step demonstrates B2Broker’s dedication to offering top-quality software that fulfills the demands of brokers and traders throughout the world. On the behalf of the B2Brokers team, we would like to thank you for your support and cooperation.

How Have The Fees Improved?

Every single client of our B2Trader, MarksMan, and B2Core no longer pays setup fees. None of the three products require a setup cost. Whose, who would have previously had to pay a setup fee of $25,000 for B2Trader and $2,000 for MarksMan now enjoy huge discounts. The removal of setup costs will simplify the onboarding process for consumers and result in long-term financial savings. Additionally, by eliminating setup fees, clients will find it simpler to scale their usage of these products as their needs change. Users and the businesses that make these services gain from that too.

B2Broker has modified the business contract in order to deal with setup costs and provide our customers with such outstanding benefits. For new customers of B2Trader, Marksman Liquidity Hub, or B2Core, a three-month upfront payment has become a requirement. This adjustment will help our billing procedure run more smoothly while also bringing our clients considerable savings and creative alternatives.

Besides that, the AWS invoice is no longer a separate payment for B2Trader clients. B2Broker will keep offering this first-rate service at no cost – we will take care of it. Our clients simply have to make the monthly payment. We anticipate that this adjustment will help our clients save more money and make it simpler for them to control their finances.

What Has Changed in the Products?

We recently revised our package for B2Trader to simplify it and make it more straightforward in order to give our clients the greatest trading unique experience. Now that all packages provide complete capability, it is extremely easy to distinguish them based on the quantity of trading instruments and order book depth. If you only need a certain number of pairings and a straightforward order book, you can choose the Standard package. However, the Enterprise version with 100 pairings and a 100×100 order book is a better option for you if you want to offer several currencies and tokens.

Additionally, we have lifted the maximum limit on recognized external liquidity providers in the MarksMan Liquidity Hub’s Advanced version. Every client will now find it easier thanks to this modification, which gives them more freedom and possibilities. All clients may now join an infinite number of external liquidity providers thanks to this upgrade, giving them the freedom to securely supply trading services, understanding they have access to the best pricing available.

Moreover, Customer Support Queues are also introduced by the B2Core team! We focus on providing our clients with the best service possible, which is why we have a standard Customer Queue available for the Standard and Advanced subscriptions and a separate Queue for the Enterprise plan. We have already notified everyone, and we are presently reviewing requests. However, after approval, all work for the Enterprise package will take precedence. We are confident that this new method will greatly improve our capacity to provide for our clients.

In order to be more thorough and precise about what we provide and what we do not, we have also eliminated any “coming soon” subscription additions. It implies that any new feature will not be accessible if it is not part of a package until a later update makes it public. For our clients to choose the best plan, we want to be as open and honest with them as possible.

To properly reflect the goods, we have refreshed all connections and included more contemporary functionalities. We are confident that these improvements will enhance and enrich your using experience.

What Are The Prices?

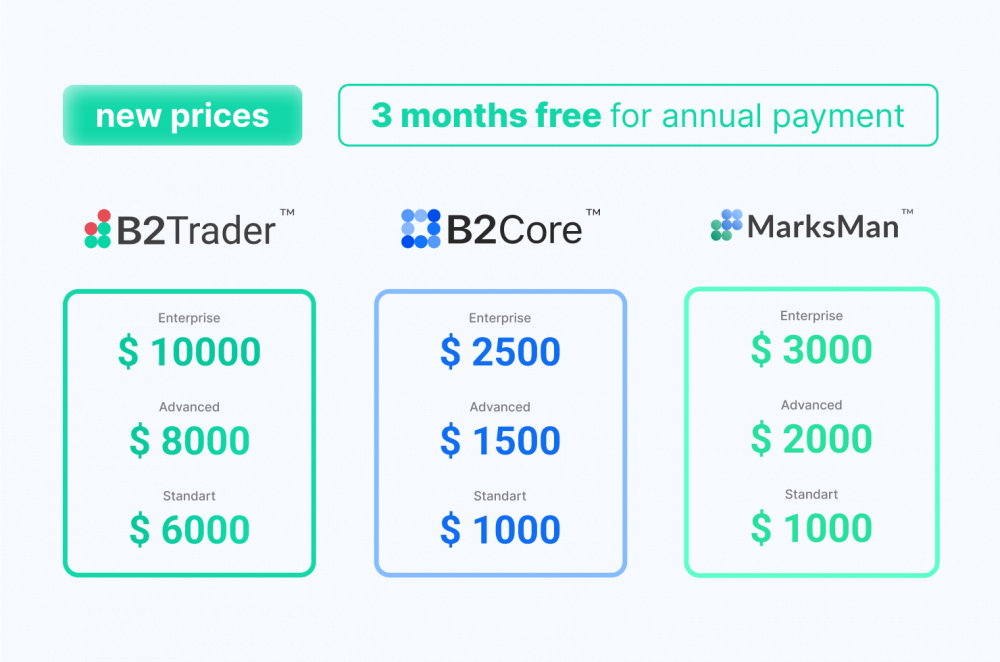

Important to mention is our pricing structure, which has been modified to be more transparent and open for our users. Our three major offerings are B2Trader, MarksMan, and B2Core. The pricing for them is as follows:

1) The monthly prices for B2Core’s Standard, Advanced, and Enterprise packages are $1,000, $1,500, and $2,500, accordingly.

2) The Standard plan for B2Trader costs $6,000 per month, the Advanced package costs $8,000 per month, and the Enterprise package costs $10,000 per month.

3) The monthly costs for MarksMan’s Standard, Advanced, and Enterprise packages are $1,000, $2,000, and $3,000, respectively, including Hedging Trade Volume.

Are you thinking about purchasing a yearly subscription? Then there is something you ought to be familiar with. By committing to a full year, you will save money by obtaining three free months. You will only be required to pay for nine months instead of twelve.

Conclusion

Our team at B2Broker is more than happy to offer its clients even more benefits with the updated rates. The updated price choices for B2Core, MarksMan, and B2Trader make the solutions more affordable to various enterprises. B2Broker’s dedication to providing the best possible services to its clients is reinforced by these developments. Sign up today to take advantage of these fantastic goods at an even better price! Also, don’t forget to watch out for future upgrades and additions. We will also appreciate your comments; hence contact us should you have any questions or recommendations.