Soft-FX launches stock events module to TickTrader platform

FXOpen, the renowned FX and CFD broker is a longtime partner of Soft-FX, but the software firm has also developed projects for other big names within the industry, including GKFX Prime, FXPrimus, and Libertex.

The trading industry is undoubtedly going multi asset and software development firms have been making the necessary updates to their trading platforms in order to address the demands from brokers.

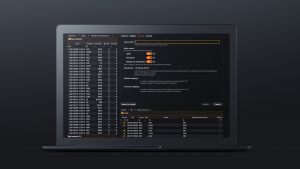

As part of the ongoing changes in the trading industry landscape, Soft-FX has introduced a Stock Events Module to its flasgship product, the TickTrader trading platform.

Designed to manage data during corporate actions, the stock events module eliminat gaps arising from events such as splits, dividends, and mergers and acquisitions.

One more step towards multi asset brokerage

Soft-FX is a fintech development firm founded in 2005 which has since established a multitude of long-term partnerships with forex and cryptocurrency brokers, cryptocurrency exchanges, dealers, banks and funds.

FXOpen, the renowned FX and CFD broker is a longtime partner of Soft-FX, but the software firm has also developed projects for other big names within the industry, including GKFX Prime, FXPrimus, and Libertex.

The addition of the stock events module to TickTrader allows brokers to configure stock operations on the trading platform depending on corporate actions that occur at a particular point in time.

Corporate action refers to any activity that brings material change to a stock-issuing organization and impacts its stakeholders. Dividends, stock splits, mergers, acquisitions, and spinoffs are examples of corporate actions, all of which can require significant resources to process in the absence of automation.

Soft-FX explained how it works: “Consider such corporate events as stock splits. Stock splits may create large gaps on the chart, leading to a false impression of a sharp drop in the price. Based on the chart, technical indicators would give misleading sell signals. TickTrader Stock Events module helps to counteract such occurrences.”

“The module also allows you to adjust data by eliminating gaps arising from events such as dividends, and mergers and acquisitions, enabling your platform to accept adjustments as seamlessly as possible.”

FinanceFeeds webinar: Expert panel to discuss market data for multi-asset brokerages

Soft-FX launched white label solution for crypto exchanges

In November 2021, Soft-FX introduced an enhanced version of their quick-launch crypto exchange solution which provides the means to generate high-quality liquidity from the start, the most up-to-date security protocols, a virtually unlimited number of trading instruments, and the ability to schedule the launch in just two weeks.

The upgraded iteration of the White Label Crypto Exchange solution includes a package of three seamlessly integrated products – TickTrader Liquidity Aggregator, TickTrader Trader’s Room, and TickTrader Trading Platform.

The liquidity aggregator establishes an independent liquidity aggregation process and connects an unlimited number of crypto liquidity providers.

The trading platform features spot exchange and margin operations, mobile, desktop, and web terminals, flexible API integrations, and algorithmic trading options. The trader’s room boasts 20 off-the-shelf blockchain and 50+ fiat payment systems integrations.

The white label solution includes additional services such as compliance operations to handle every step of AML/KYC policy procedures for onboarding clients and a trading desk outsource function.