The B2Broker Platform Now Supports 150 Cryptocurrency CFD Pairs

With new symbols to choose from, B2Broker is delighted to announce that its cryptocurrency offerings have expanded

With new symbols to choose from, B2Broker is delighted to announce that its cryptocurrency offerings have expanded. As a result, the group of companies now supports 150 cryptocurrency CFD pairs. A number of new coins have been introduced, including FTT, MANA, AAVE, COMP, SNX, APE, QTUM, THETA, KSM, YFI. The new coins are all paired with USD, which makes them accessible to a wider range of traders. This continued commitment to offering a variety of assets and pairs is what sets B2Broker apart in the industry. We are proud to be able to offer our clients such a comprehensive service.

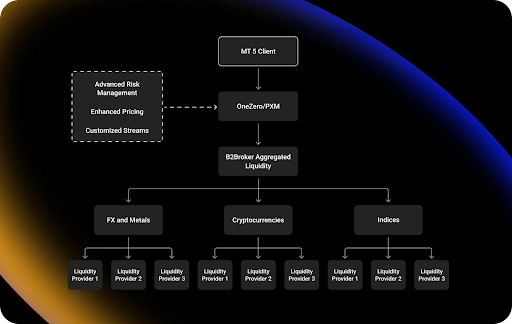

With our new crypto CFD products, our clients can expect the same level of liquidity and tight spreads that we have long been known for. Additionally, they also provide a rich depth of order book, which makes them highly suitable for trading. We are confident that these new trading pairs will be an excellent addition to our portfolio, therefore providing our clients with a greater selection of market opportunities.

We’ve made great strides in the past few months, and we’re proud to announce that we now offer 150 crypto CFD pairs with some of the best liquidity in the market. This is a huge accomplishment, and we couldn’t have done it without the support of our clients. We’re committed to providing the best service possible and always exceeding expectations. Thank you for your continued support!

Providing technology and liquidity solutions for the Forex and crypto industries, B2Broker is the industry leader. We’re proud to have been in business for almost eight years, during which time we’ve built up a large market share among brokers/dealers and institutional players. Our liquidity solutions are considered some of the most sophisticated currently available on the market, enabling us to offer the best service to our clients. You can rely on us for the most efficient and effective access to liquidity. Having state-of-the-art technology and excellent customer service will help your business thrive.

The cryptocurrency market operates around the clock, and our company recognizes this. Due to this, we try to provide our clientele with 24-hour liquidity and support. We want our clients to be able to trade whenever they want, without having to worry about whether there will be someone available to help them. This commitment to customer service is just one of the many ways we strive to be the best in the business. By offering round-the-clock support and always being innovators in the space, we provide our clients with the best possible experience. When it comes to 24/7 support, we are your best option. Please feel free to reach out to us whenever needed.

If you’re interested in learning more about what we do, make sure to check out the video featuring B2Broker CEO Arthur Azizov and Head of the Dealing Division John Murillo. Our video gives you an inside look at what it’s like to work with B2Broker and how we’re able to provide industry-leading services to our clients.