thinkorswim enhances trading platform amid Schwab integration

TD Ameritrade has announced enhancements to the thinkorswim trading product suite with a host of new features and services.

The thinkorswim upgrades are part of the integration with Schwab following the latter’s acquisition of TD Ameritrade in a $26 billion all-cash deal.

In November 2021, Charles Schwab announced it would rebrand TD Ameritrade’s retail FX business and integrate the former rival’s thinkorswim and thinkpipes trading platforms. At the time, the company anticipated the integration between the two largest publicly traded discount brokers to take up to three years following the close of Ameritrade takeover.

The merger creates an online brokerage behemoth with nearly $7 trillion in client assets and more than 30 million brokerage accounts. The process will also include the educational offerings and tools accompanying them, as well as TD Ameritrade’s institutional portfolio rebalancing solution iRebal.

thinkorswim upgrades charting, news, programming, offering

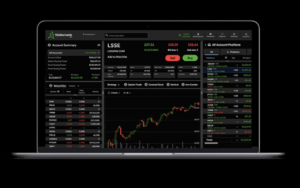

The enhancements of thinkorswim have provided greater customization for traders who also now more informed and empowered with new charting and programming capabilities, integrated news features to contextualize market moves on mobile, and a more robust and streamlined trading offering on web.

Barry Metzger, Head of Trading and Education, Charles Schwab, said: “We know how important thinkorswim and the consistent innovation at the platforms’ core are to clients. These recently released feature enhancements are an excellent example of how we are continuing to innovate and improve upon the experience while the integration moves forward.”

New thinkorswim enhancements include:

thinkorswim Desktop: Charting and scripting capabilities take center stage, with the addition of 11 new charting studies and the release of the thinkscript® Integrated Development Environment (IDE), an advanced code editor that allows users to create, edit and manage their own studies and strategies or build on existing studies (both predefined and user-defined) within the thinkorswim platform for a tremendously expanded customizable experience.

thinkorswim Mobile: “Portfolio Digest” has been added to its overview page, allowing users to see what in the news may be affecting their holdings without logging in to a computer, in addition to improving on its display behavior while in Privacy mode and updating the look and feel of its watchlists.

thinkorswim Web: The platform’s charting system now offers a fuller trading offering with seamless drag-and-drop order editing and one-click cancellations alongside a display of historical and upcoming earnings projections. Also recently added is an Active Trader ladder interface with integrated order entry, volume display and Bid/Ask size at various price levels, and integrated Profit/Loss display – all fully accessible and mobile responsive.

TD Ameritrade launched a virtual Active Trader Branch in April. Consultants focus on trader “coaching” and wealth management to help meet the unique needs of their self-directed traders. The new Active Trader Branch builds on the success of a similar service already available to Schwab trader clients.

TD Ameritrade is a leader in U.S. retail trading and provides investing services and education to self-directed investors and registered investment advisors.